Vauld’s fiasco, $GARI Dumping & Huddle | 10th July ‘22 | #2

GM folks!

Welcome to Litmosis, where we lose our sleep every weekend to give you digestible insights and alpha about Web3 and early-stage projects.

We are glad that you guys loved the first issue, that’s why we are back again with what’s going on in India🇮🇳.

This week on Litmosis, we have got (some bearish news!):

Vauld going down: What exactly happened and the impact💀

Investor dumps $GARI, the price fell by 90% in a day!🌧

The project that caught our eye ft. Huddle01 👀

Decoding Web3 Fundraises ft. KoinX🇮🇳

Tweet of the Week🐣

Estimated reading time: 4 mins 43 seconds

Shield to survive? The Vauld fiasco & its impact.

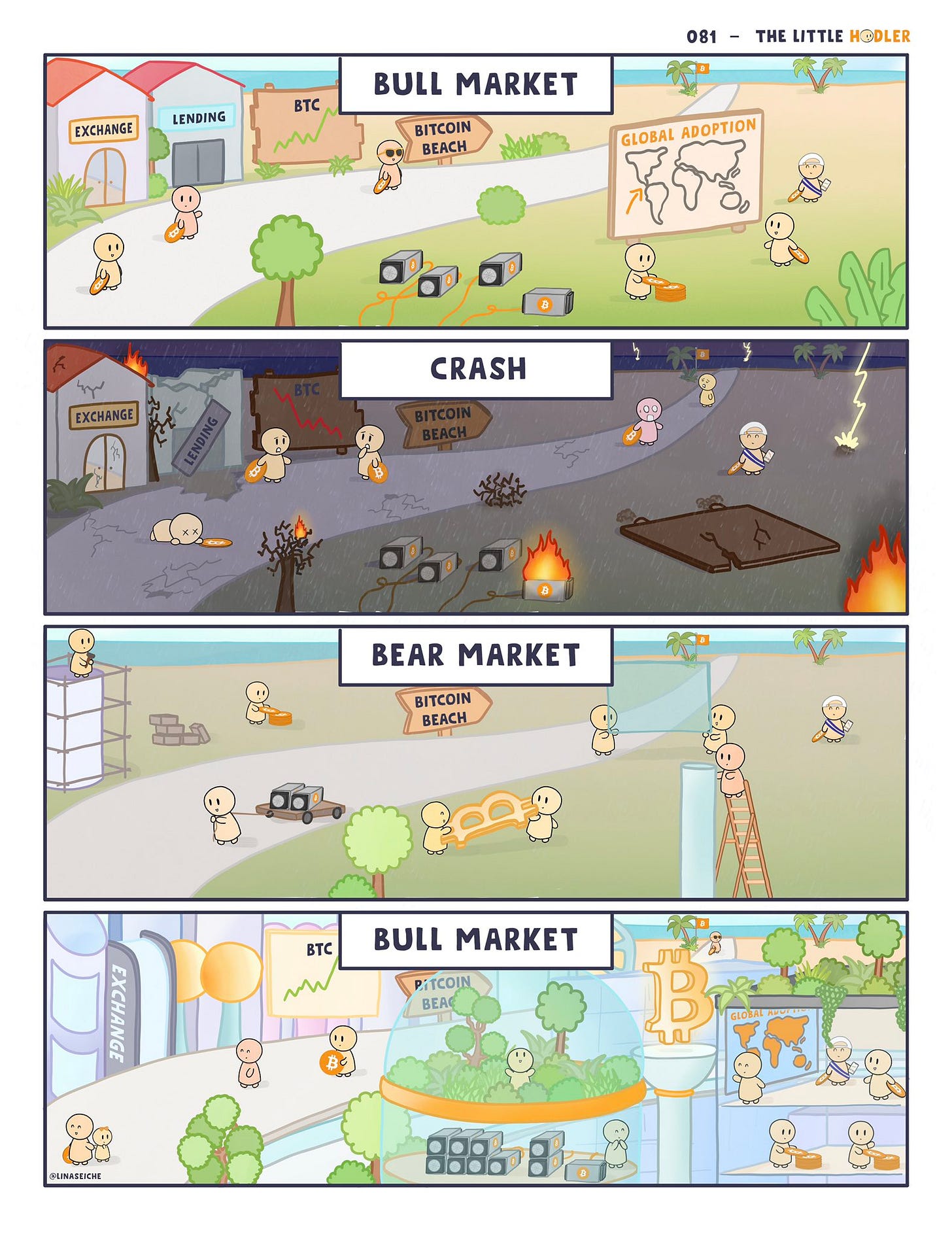

Crypto is having a bad day indeed. It’s that day that has many years in it just like a movie, many plot twists and meltdowns just like a movie... and hopefully, we have a happy ending. (anyone? maybe? okay!)🥲

Yes, we are talking about another domino on the crypto earthquake, this time Vauld. What was Vauld?

A centralized crypto lending platform or you can say, another CeDeFi platform. The best part, they understood Indians love two investing products: FD (Fixed Deposit) and SIP (Systematic Investment Plan). Vauld exactly copied them but for crypto with extra juicy yields ~ 12%!

In July 2021, the company raised $25 million on a Series A round from top-notch investors and afterward grew itself to having $10-15 million of transactions daily. India’s top finance influencers promoted them and everyone was going well.

Until…

Recently, Vauld put out a statement saying, they are facing financial issues, that lead Vauld to stop deposits, withdrawals, and trading on the platform.

Few saw it coming: Earlier in June, Vauld has also laid off 30 percent of its staff before, just like many other companies during the downturn.

What escalated this move?🧐

Vauld operated just like a Bank: Take money from customers via FD products and lend it to crypto projects (i.e yield farming)

When the downturn started to happen, with Luna, celsius, and 3AC going down. This led to panic among investors and a huge selloff.

More Selloff → Less arbitrage opportunity || Less arbitrage opportunity → More Selloff.

Adding to this, the new tax rules on crypto made it even worse with Vauld seeing a liquidation of more than $200 million within a month's time (also called bank run). 🤯

Vauld is not the only one in this drama, recently another crypto lending platform, Voyager has also filed for bankruptcy.

What next? (another bailout?)

Nexo, a crypto lending firm based in London, is in talks to potentially take up a 100% stake in the company. Though these processes tend to take time, this acquisition will act as a relief to the investors, as Nexo may compensate some of their investors.

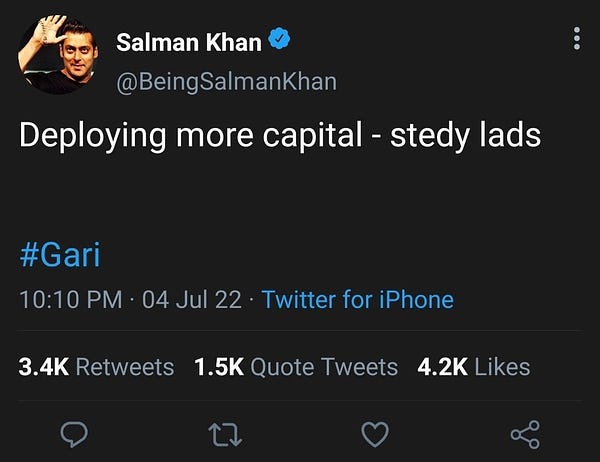

$GARI fell from Rs. 57 to Rs. 7!

It was July 4th, this Monday, and $GARI the official token of Chingari fell down almost 80% of its value. Within some hours on that night, it went from $0.73(~₹57) to almost $0.1 (₹7), and now it’s at $0.12 (₹9.3). (damn!)

With recent meltdowns and hacks, this event gathered many rumors and panics across the community and token holders. Obviously, it’s a no joke to lose 80% of the value of the token you are holding, and It becomes more concerning when the big celebrities promote them to a wider audience.

So, this is how it happened-

It first got affected in KuCoin. A big whale placed a sell order of $2 million (~₹16 crores) worth of gari tokens.

The market maker didn’t provide much liquidity to the huge order, so the price tanked.

So it is a market-based incident, caused by that investor. GARI then came up with an official statement about what had happened and confirmed, that it wasn’t any hack, rather the price action was a purely market-based event.

Panic in the bushes, investor in losses (on repeat). (Damn! this hits hard)

The Litmosis take:

Whale attacks or Investors dumping are a serious concern for projects who have launched their public tokens, in the early stages.

--

haha

Decoding India’s Web3 fundraise (a dry week😪)

“KoinX raises $1.5M to build unified crypto tax platform for Web3 transactions”

The Litmosis Take: Crypto Taxation is definitely a problem to solve for, but how big is the market? Won’t other tax platforms just integrate crypto taxation as a small feature? Can they build a suite of products around crypto taxation?

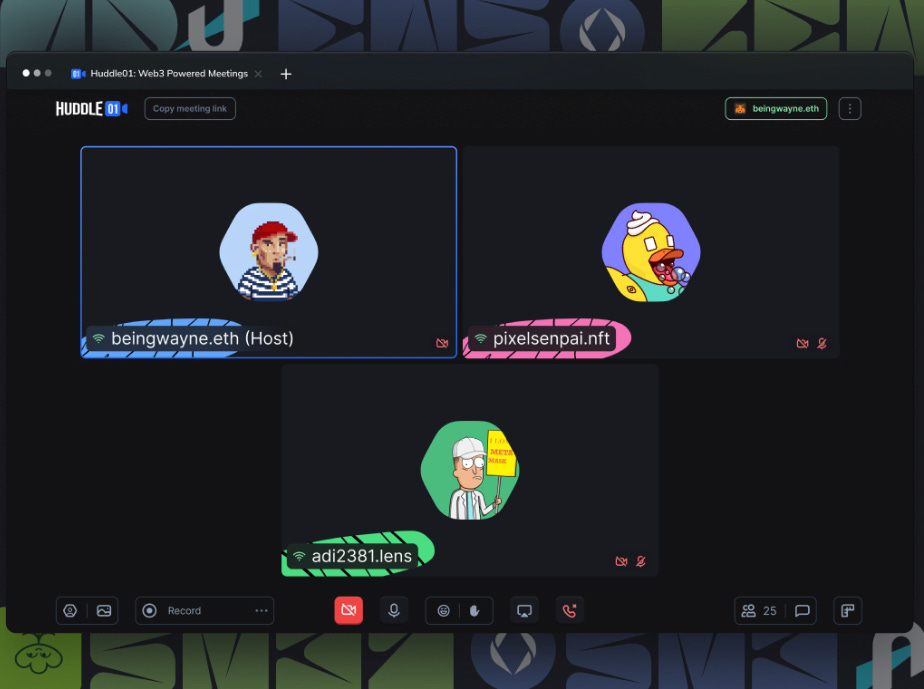

A project that caught our eye: Huddle01 👀

Web3 in communication, what’s that?

Well by now, you might have already heard about the narrative around decentralization, owning your data on the centralized internet, etc.

But, why it is important?

because of the control! yes, control.

The control big organizations have over your activity, your data, and your identity on the internet.

Huddle is just like google meet but without google.

It means you can do video calling from anywhere in the world, in a space where you own your identity, thoughts, and data.

It’s very easy to set up, with just one click, you can log in with your wallet, and your meeting is live. Apart from three are some cool and useful features like putting your NFT avatar as your pfp, using IPFS to store your recordings, and letting you steam your meeting natively from the app.

This goes without saying that you can make the calls token gated as well, allowing your community to participate in them.

How cool is that!

Till now there have been more than 10k calls on Huddle01. And recently they came up with the announcement, that they are now live on both web browsers & mobile apps.🔥

Love to see them coming!

Weekend Reads📖 - A design special

A quite detailed and long post about Web3 design principles (35min read)

Explore AI doing wonders | DALL·E 2 and The Origin of Vibe Shifts

Tweet of the Week:

We loved this marketing campaign by the Social Crypto Exchange, DEFY, one of the most trending stuff on Crypto India Twitter, this week! An Excellent ROI, Indeed.

Oh btw, we also help projects with research & strategy and have previously helped 5+ projects, if you need help with any of these, do let us know at @Litmosis.

That’s all lovely folks from your friends: Yash and Sitesh. See ya, next week! 🥂

If you found this post helpful, It’d mean the world to us if you could share this with your friends. (Thanks!)

DISCLAIMER: This newsletter is only for educational purposes and should not be considered investment advice or any recommendation to buy or sell any assets. Do your own research. None of this is financial advice and you can possibly get rekt.