The Yield Aggregator for Solana: Meteora Dynamic Vaults’ Deep Dive

Discover how Meteora revolutionizes yield aggregation on the Solana blockchain, providing users with optimized returns and automated risk monitoring for a seamless DeFi experience.

While Decentralised Finance (DeFi) is preferred by most users due to self-custody, it has its own challenges such as hacks or rug-pulls, when these funds are deposited into different protocols. It can be daunting for an average user to do constant monitoring and rebalancing of their funds. They lack the following:

Not enough time and resources to monitor and manage their portfolio 24/7 to stay ahead of yield changes. In times of black swan events like FTX crash, which are quite frequent in DeFi, they cannot act fast enough to withdraw funds, especially when they are offline.

Infrastructure to deploy algorithms and automated strategies to multiple lending protocols with appropriate risk management principles.

Meteora Dynamic Vaults were built to solve precisely this. In this essay, we will have a deeper look at a protocol, that is solving the problem of yield management on one of the most performant chains — Solana! We will delve into the significance of liquidity, explore the workings of Meteora's Dynamic Vaults, and analyze real-life case studies to represent their effectiveness.

Why Liquidity is critical for Solana?

Spot liquidity for swapping plays a crucial role, not only in Solana DeFi but also in other sectors such as NFTs, Gaming, DePIN, Payments, and more. Specifically in DeFi, liquidity is essential for the following reasons:

Lending and Borrowing: In the event of liquidations, where crypto assets are sold to cover debts, having deep liquidity for assets like SOL ensures smooth liquidation processes. This helps minimize the risks associated with bad debts within the ecosystem, promoting stability and trust among users.

Cross-chain User Acquisitions: Users migrating from EVM ecosystems need to bridge their assets and work with wrapped versions of assets such as BTC, ETH, etc. These wrapped assets must be swapped for native assets. Increased liquidity for such tokens enables EVM users to bridge effectively and attracts users from other ecosystems.

Boosting Trading Activity: When new tokens like BONK are launched, they require initial liquidity to enhance the trading experience and increase activity. This kickstarts a liquidity flywheel for the broader Solana DeFi ecosystem.

Deep liquidity refers to a market or trading environment that has a significant volume of buy and sell orders, with a large number of buyers and sellers actively participating in trading activities. It signifies a market with ample availability of assets for trading, characterized by a high level of liquidity.

Meteora: The Liquidity Backbone of Solana

Meteora serves as the liquidity backbone for Solana by enabling stablecoin liquidity, lending protocol capital, and deep capital efficient AMM pools.

Just a year back Mercurial Finance was a popular decentralized exchange (DEX) in the Solana ecosystem. The collapse of FTX and Alameda Research led to a crisis for Mercurial, as its liquidity dried up and users lost confidence. The team behind Mercurial embarked on the Meteora Plan, which involved launching a brand-new technology platform and resetting the existing tokenomics of Mercurial. The Meteora Plan was a success, as Meteora quickly emerged as a powerful force in the DeFi landscape.

Meteora is one of the strongest Solana DeFi teams and is also behind Jupiter, the #1 DEX aggregator on Solana, processing over 5.3 million transactions and $32 billion+ in swap volumes till now!

How Meteora Is Solving for Liquidity?

To enhance liquidity on the Solana network, Meteora has launched a suite of products:

Meteora Vaults: These vaults optimize the use of capital by distributing assets to lending pools, generating profits for liquidity providers (LPs).

Dynamic AMM Pools: LPs have the opportunity to earn additional profits by utilizing lending sources in addition to traditional swap fees, thereby maximizing their returns.

Multitoken Stable Pools: These pools effectively combine liquidity from multiple assets into a single pool, allowing LPs to diversify their holdings and make efficient use of capital.

Non-Pegged Stable Pools: Specifically designed for non-pegged assets, these pools ensure that the value of assets within the pool remains stable, promoting optimal capital efficiency.

Meteora Dynamic Vaults: Jupiter, But for Lending

Just as Jupiter fetches the best swap rates from different DEXs, Dynamic Vaults fetch the best lending rates.

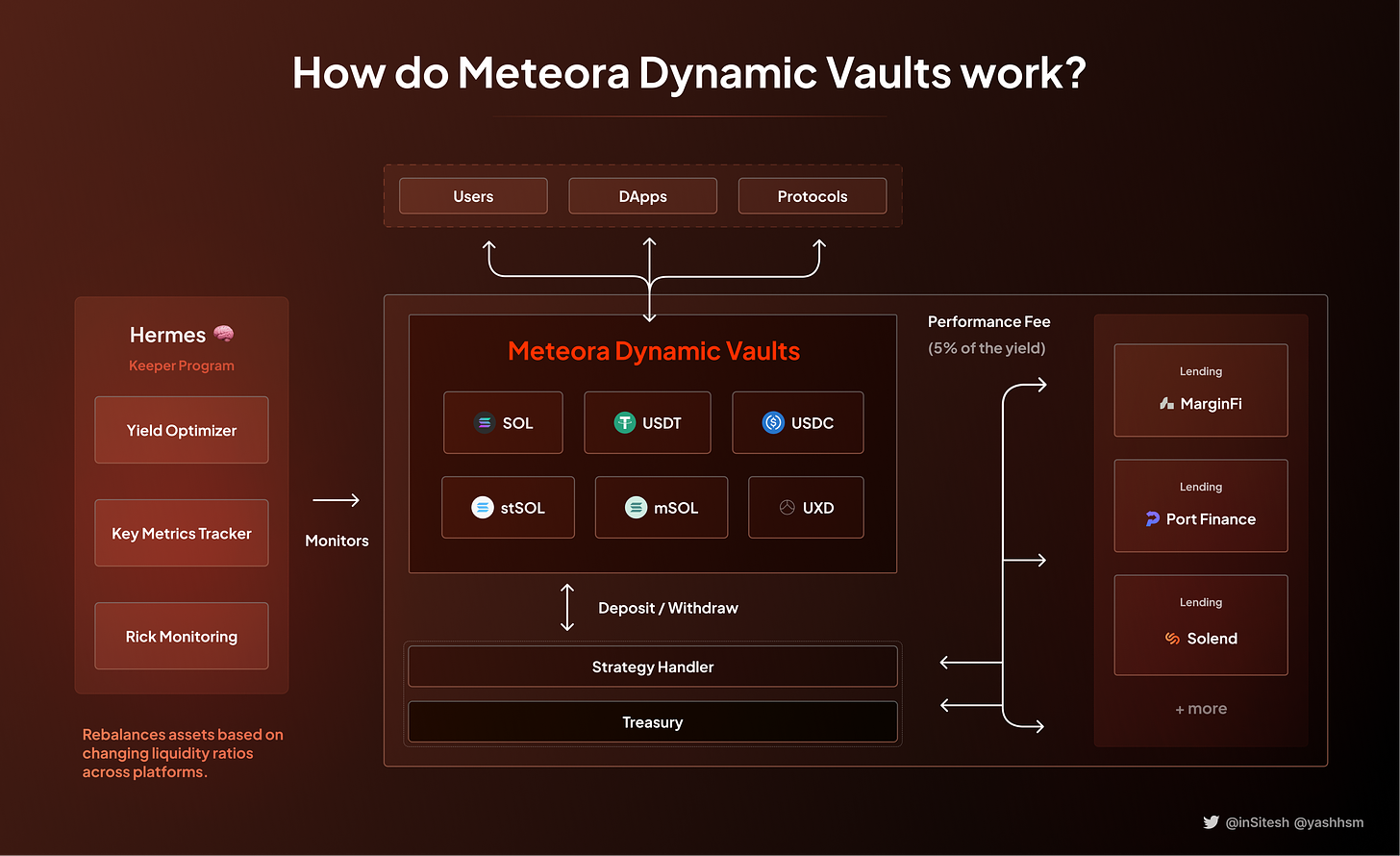

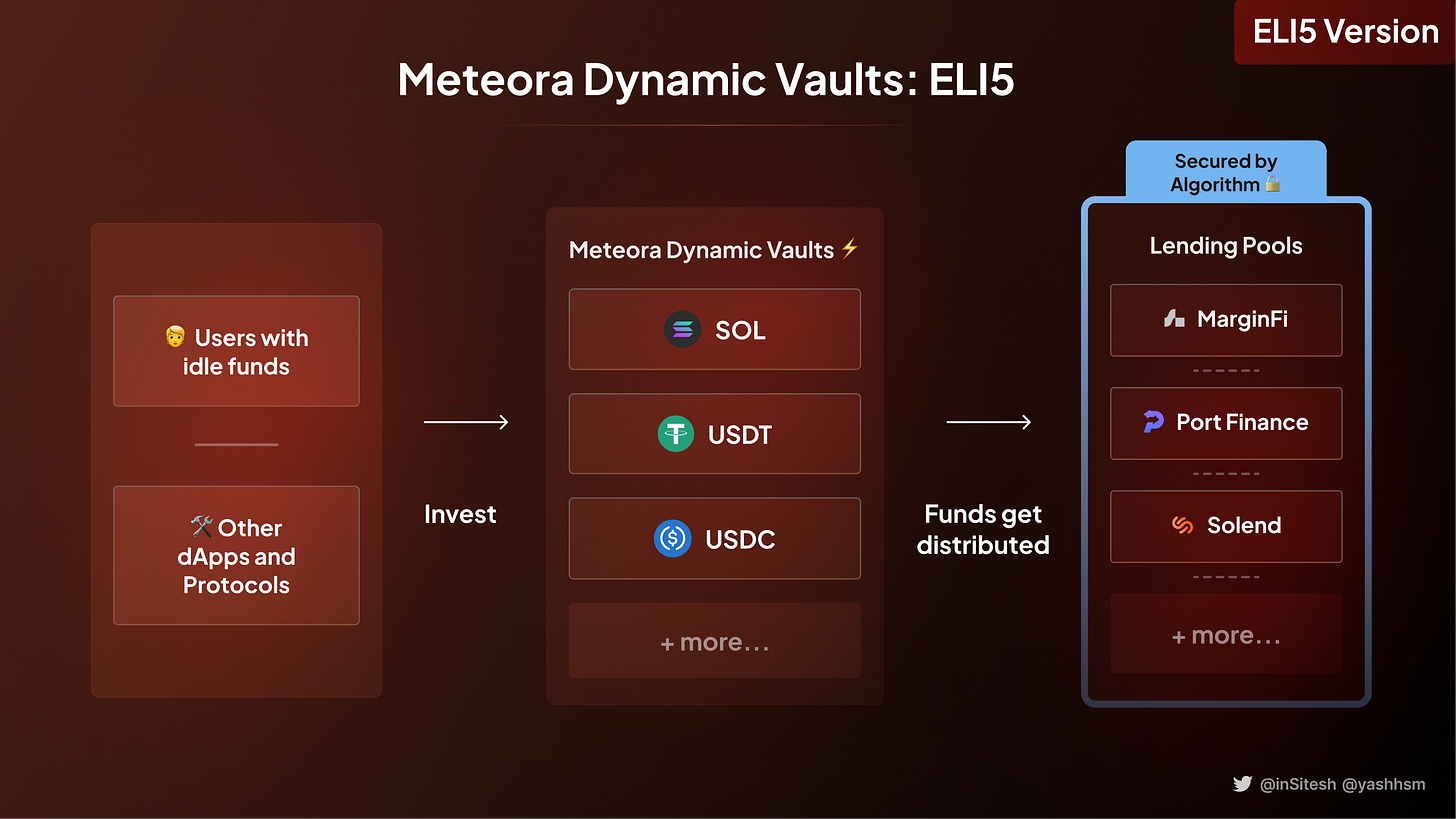

The way Dynamic Vaults work is simple: Users and integrated Protocols → deposit their capital to → Dynamic Vaults Pool → which is then distributed to lending protocols → It gets monitored and rebalanced.

Now you may wonder: why not directly lend with the lending and borrowing projects?

The reason is the same as why users prefer DEX aggregators like Jupiter over directly swapping with DEXs like Orca or Lifinity, as aggregators ensure the best possible rates. We will understand in greater depth the advantages of Meteora Dynamic Vaults throughout the essay.

How Dynamic Vaults work:

Meteora Dynamic Vaults allow users and integrated protocols to deposit and/or withdraw assets from the vault program at any time. Deposited assets are distributed to various lending protocols like Solend and Marginfi, with maximum allocation based on a combination of yield percentages and risk mitigation strategies around protocol audit, insurance coverage, and open source status. The design was made possible due to: Solana’s speed, composability, and low transaction fees as it requires constant event monitoring.

The following are the key features:

Security and safety of principals

24/7 liquidity available to be withdrawn

Optimized yield returns

Easy to integrate via SDKs

Event monitoring and tracking

The key components are:

1. Vault

Vaults in the infrastructure layer store single-token assets like USDC or SOL. Most of these assets are allocated to various lending protocols to earn yield. Common tokens used in connecting protocols like AMMs or wallets will be pooled together in a single vault. For example, USDC from an AMM and a wallet would be held in the USDC vault. Users and protocols can deposit liquidity to each vault directly through a simple UI.

2. Off-chain Keeper and Rebalancer: Hermes 🧠

Think of the keeper as an autonomous off-chain agent or bot performing automated actions with complex logic (The brain). The keeper monitors the APY of each lending protocol every 1 hour and sends rebalance instructions to re-distribute liquidity amongst these lending protocols.

The three main operations handled by Hermes are:

Yield Optimizer: Hermes calculates the best way to allocate liquidity across lending platforms to maximize APY. The calculation is repeated every few minutes. If there is a change in the allocation, Hermes sends a transaction instruction (also called rebalance crank) to the vault to trigger deposits and withdrawals.

Key Metrics Tracker: The tracker monitors, tracks, and stores key metrics data from lending platforms, such as deposit APY and liquidity in the pool. This data is used for calculations and is also available to integrators. The allocation of liquidity depends on the following factors:

APY (Annual Percentage Yield)

Total deposit

Deposit limit

Pool utilization rates

Pool reserve levels

Risk Monitoring: Hermes monitors utilization rates and reserve levels of lending protocols to safeguard user assets. If a utilization rate is too high (> 80%), Hermes withdraws liquidity from the pool. Deposits are also stopped for 12 hours to give time to investigate and decide whether to continue deposits or stop them completely.

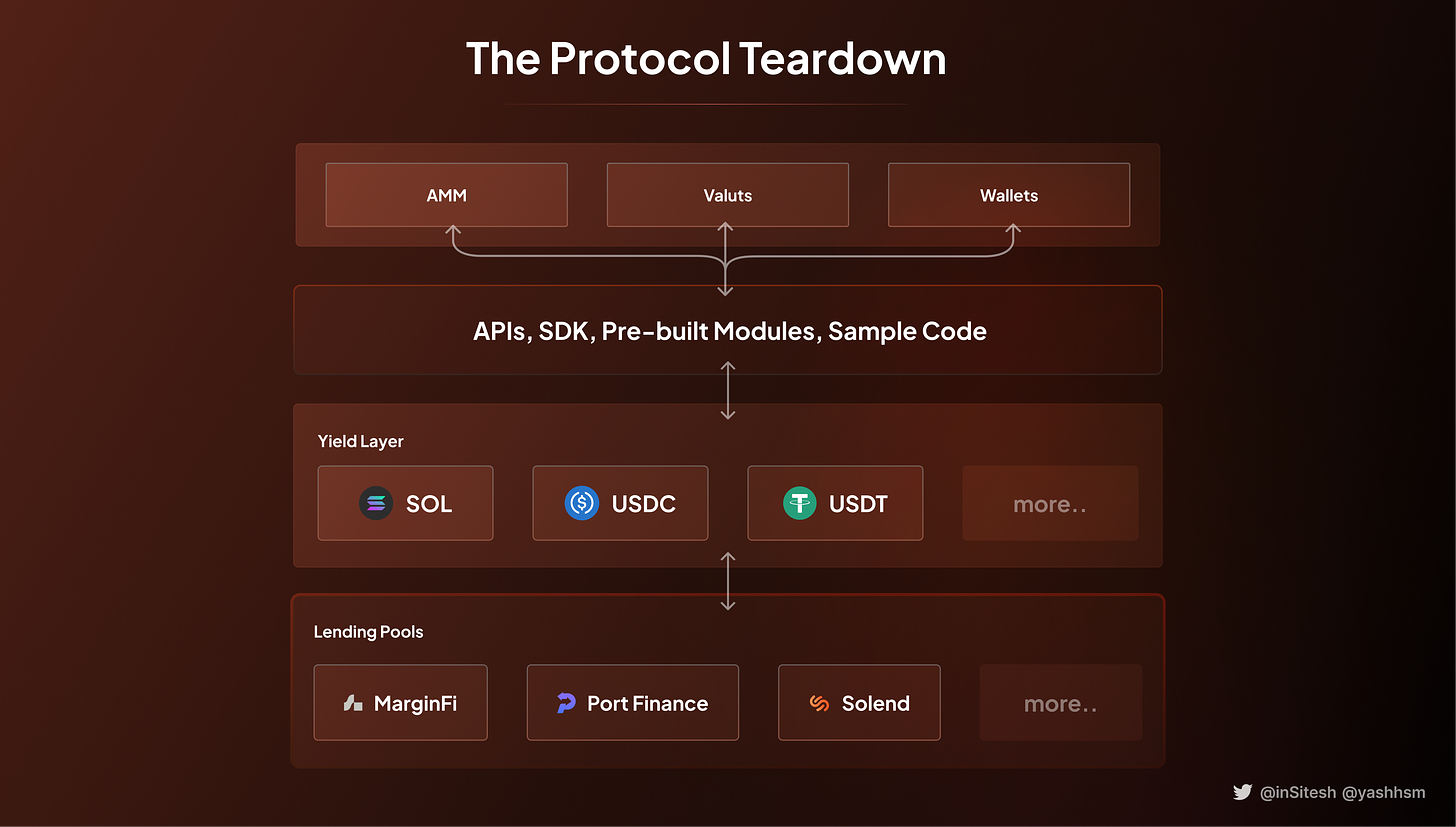

3. Integration SDKs [Developers, Developers, Developers...] 🔌

To enable dApps and protocols like AMMs and wallets to integrate with the Dynamic Yield Layer, Meteora has created a straightforward SDK and is building a library of pre-built modules and reference implementation code examples for rapid app development and plug-and-play. The protocol’s liquidity can be deposited into or withdrawn from the vaults directly via simple API calls. The LPs of the integrated protocols can direct receive the vaults' yield.

Currently, Meteora has two types of clients for providing flexibility to developers: Rust-Client and Typescript-Client. The SDKs are critical for wider adoption in Solana DeFi. For instance, Jupiter is the widely used swapping tool due to easy-to-integrate SDKs, which led to its integration in all popular dApps and wallets of Solana!

If you are a beginner and that was too much to digest here is an ELI5 infographic that we made for you :)

Risk Monitoring and Automated Withdrawals on Meteora

To mitigate risks and protect assets, Meteora has implemented robust risk monitoring mechanisms and automated withdrawal processes.

Meteora's risk monitoring system continuously assesses various risk factors, such as utilization rates, protocol audits, security measures, and overall market conditions. If potential risks or vulnerabilities are identified, Meteora's system reacts swiftly to minimize the impact on user funds.

Off-Chain Keeper

Hermes, the off-chain keeper monitors and tracks the risk factor of the lending pools and makes sure that the funds in the vaults are well-optimized to generate maximum yield while being protected at the same time.

To further enhance the security of user funds, Meteora employs automated withdrawal mechanisms. Meteora sets predefined thresholds to monitor the utilization rates of lending pools and ensure the availability of sufficient liquidity for prompt withdrawals. If the utilization rate exceeds a certain threshold, Meteora's system automatically initiates the withdrawal process to safeguard the funds and maintain liquidity in the vaults.

By automating this process, Meteora aims to provide users with peace of mind, knowing that their funds are protected and readily accessible when needed.

Case Studies on How Vaults Performed Risk Management

During its beta testing phase, Meteora experienced two real-life case studies that provided valuable insights and lessons:

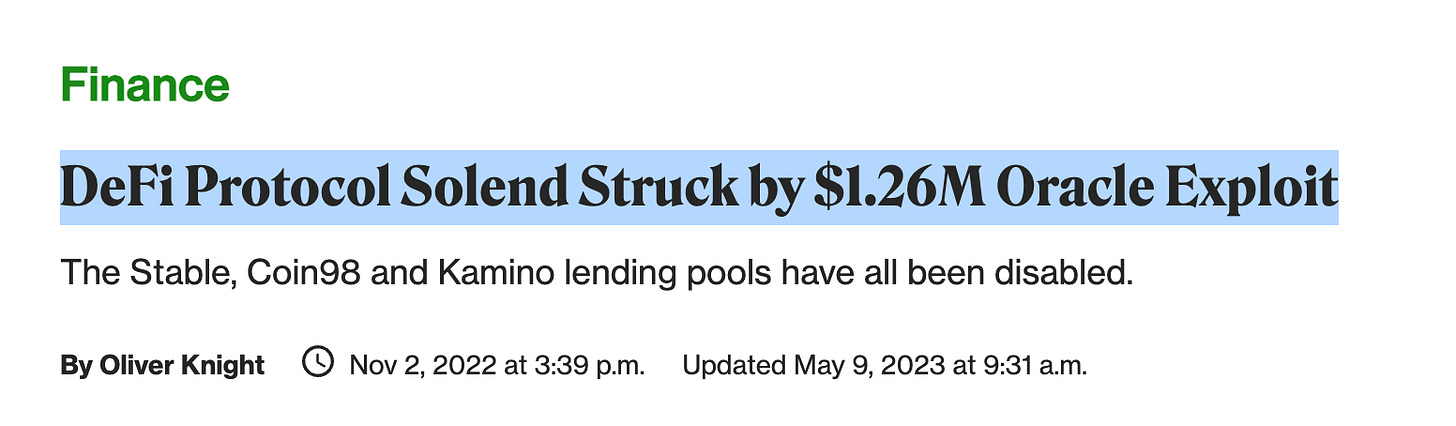

Case Study 1: Solend.fi USDH $1.26 Million Exploit 🚨

Incident: [On November 2nd, 2022] One of the leading lending and borrowing protocols suffered an exploit related to pricing oracles, resulting in $1.26 million in bad debt. The exploiter artificially inflated the price of the USDH stablecoin through an oracle attack on Saber, an AMM protocol. This led to the draining of assets from Solend's three isolated pools (Stable, Coin98, and Kamino), resulting in $1.26 million in bad debt.

Problem: Although the Meteora dynamic vaults didn't support USDH as a deposit asset, the vaults were still exposed to this exploit due to the presence of UXD assets in the Stable and Coin98 pools on Solend.

Solution: As intended, Hermes, the keeper bot, constantly monitored the utilization rates of the pools. It detected an unusually high utilization (>80%) of both the Stable and Coin98 pools, which triggered a withdrawal request. This prompted the withdrawal of all UXD assets to the vaults safely before the pools were drained.

Learning: This embedded safety mechanism helped prevent the lockup of user funds in Solend. By enabling the withdrawal of 100% of UXD liquidity from Solend back to the vaults, it proved its efficacy.

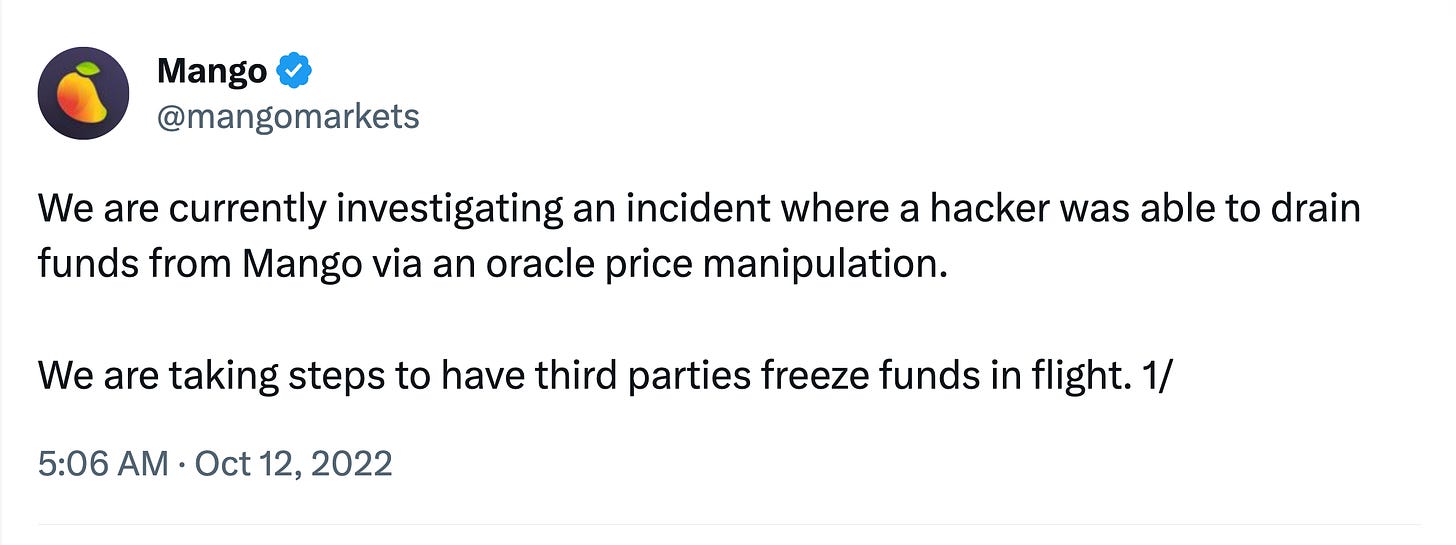

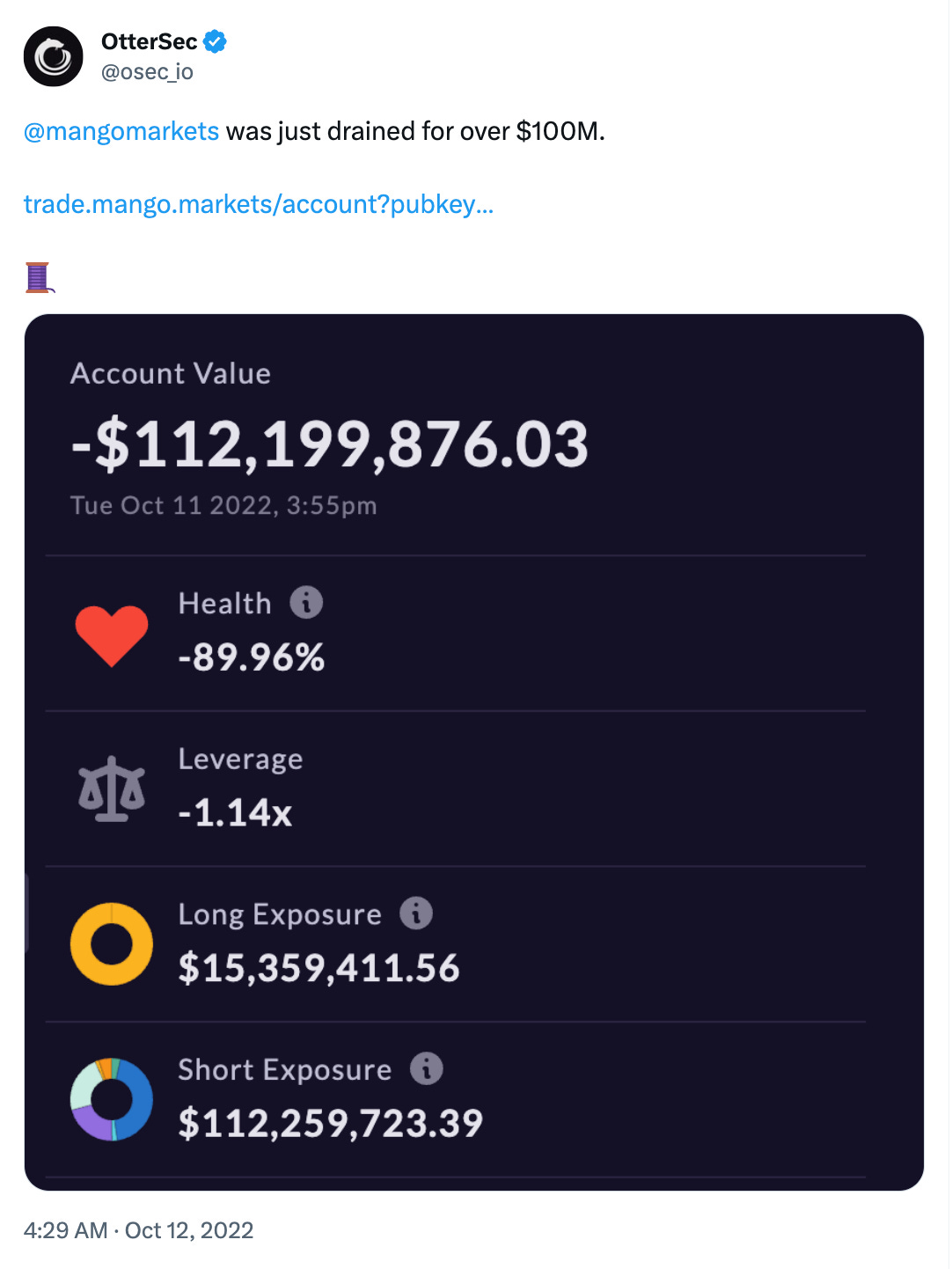

Case Study 2: Mango Markets Exploit ⚠️

Incident: On October 12th, 2022, a malicious crypto trader, using several million dollars, was able to artificially inflate the price of Mango's ($MNGO) tokens on the Mango Market and drain over $116 million from the platform.

Problem: Meteora's dynamic vaults liquidity was also affected by this price manipulation exploit since MANGO was one of the leading lending platforms where assets were allocated. However, the impact was limited as the platform was still in the beta testing phase and had imposed deposit limits for users. Despite $900k USDC being locked up in MANGO, the funds were drained before they could be withdrawn in time.

Solution: MANGO paid back the Meteora vaults through their own Mango DAO treasury, successfully recovering the locked funds. The funds were recoverable thanks to the existence of MANGO's insurance funds.

Learning: This incident highlights the importance of insurance funds in DeFi protocols. Furthermore, the exploit also emphasizes the significance of implementing increased safety mechanisms to further mitigate similar risks.

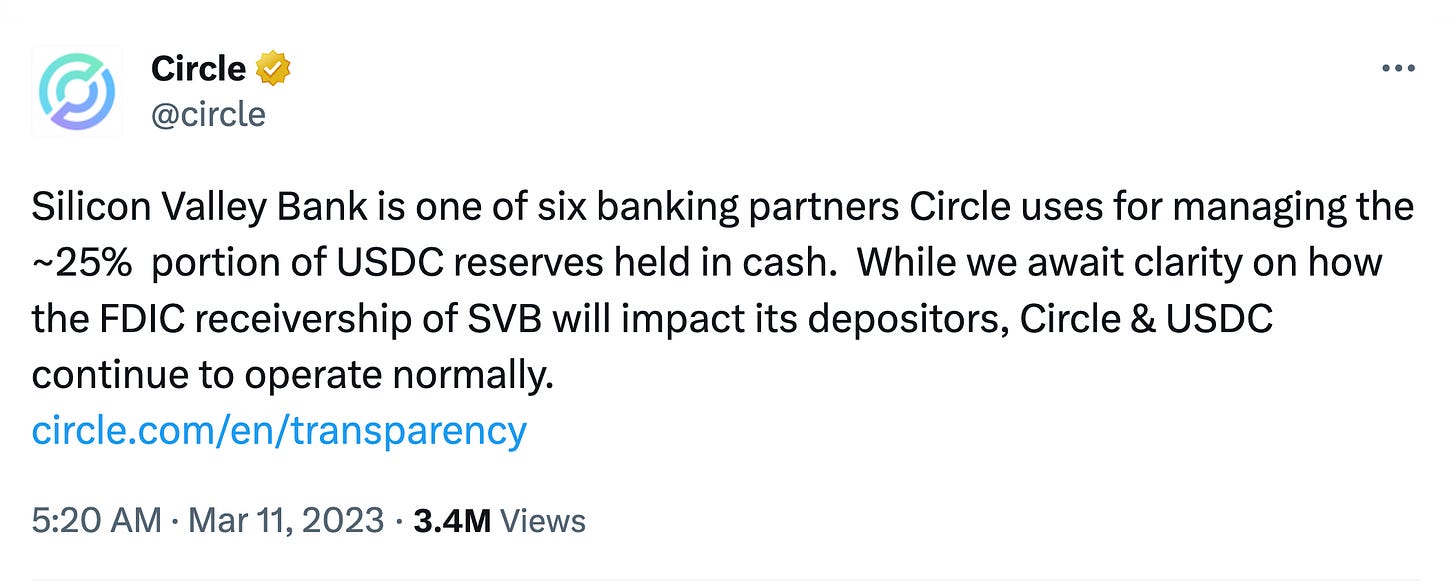

Case Study 3: USDC Depeg 📊

Incident: On March 11, 2023, Circle announced that they had an exposure of $3.3 billion with Silicon Valley Bank (SVB), which led USDC to de-peg to as low as $0.85 before restoring its peg.

Problem: USDC is one of the major deposit assets for vaults. The de-pegging of USDC led to a very high utilization rate (total borrows / total liquidity) as the demand for loans was significantly high for USDC pools. During such situations, the platform may face a liquidity crisis or even a run on the platform, resulting in bad debt (the liquidated collateral is ultimately not able to cover a position’s debt).

Solution: The keeper, Hermes, detected high utilization rates in lending pools and removed liquidity from the pools back to the vaults to keep funds safe. It also reduced the maximum allocation to 10% across the board to be conservative during USDC de-pegging in current market conditions.

Learning: This incident highlighted the strength of Hermes by proving its capital efficiency and protection of user funds. It also displayed the rebalancer's role in saving liquidity provider (LP) capital.

These case studies prove the ability of off-chain keepers to de-risk investments by monitoring risk parameters such as pool utilization and withdrawing automatically when thresholds are being reached.

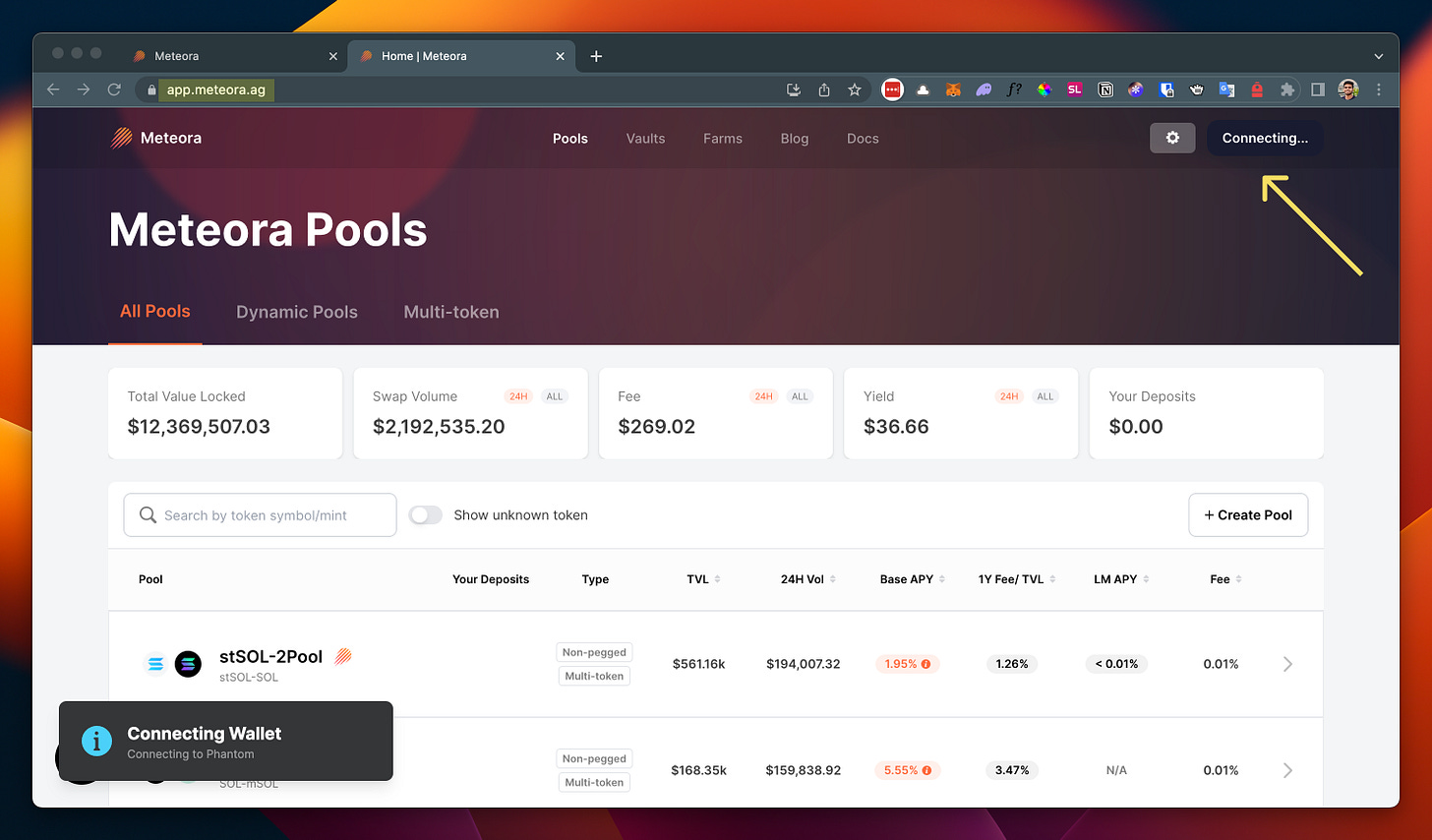

How to deposit into a Meteora vault: a beginners guide

Here's a beginner-friendly guide on how to deposit into a Dynamic Vault:

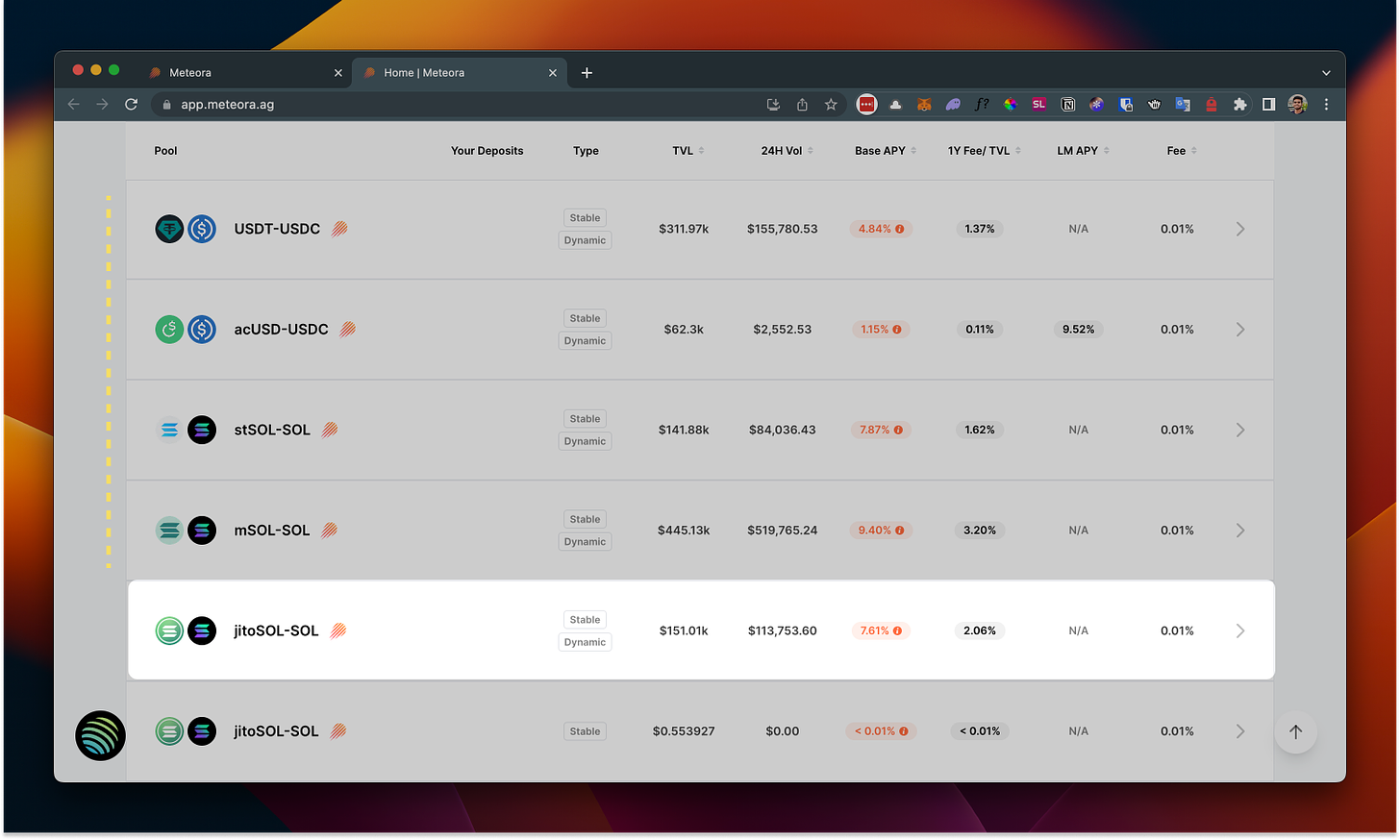

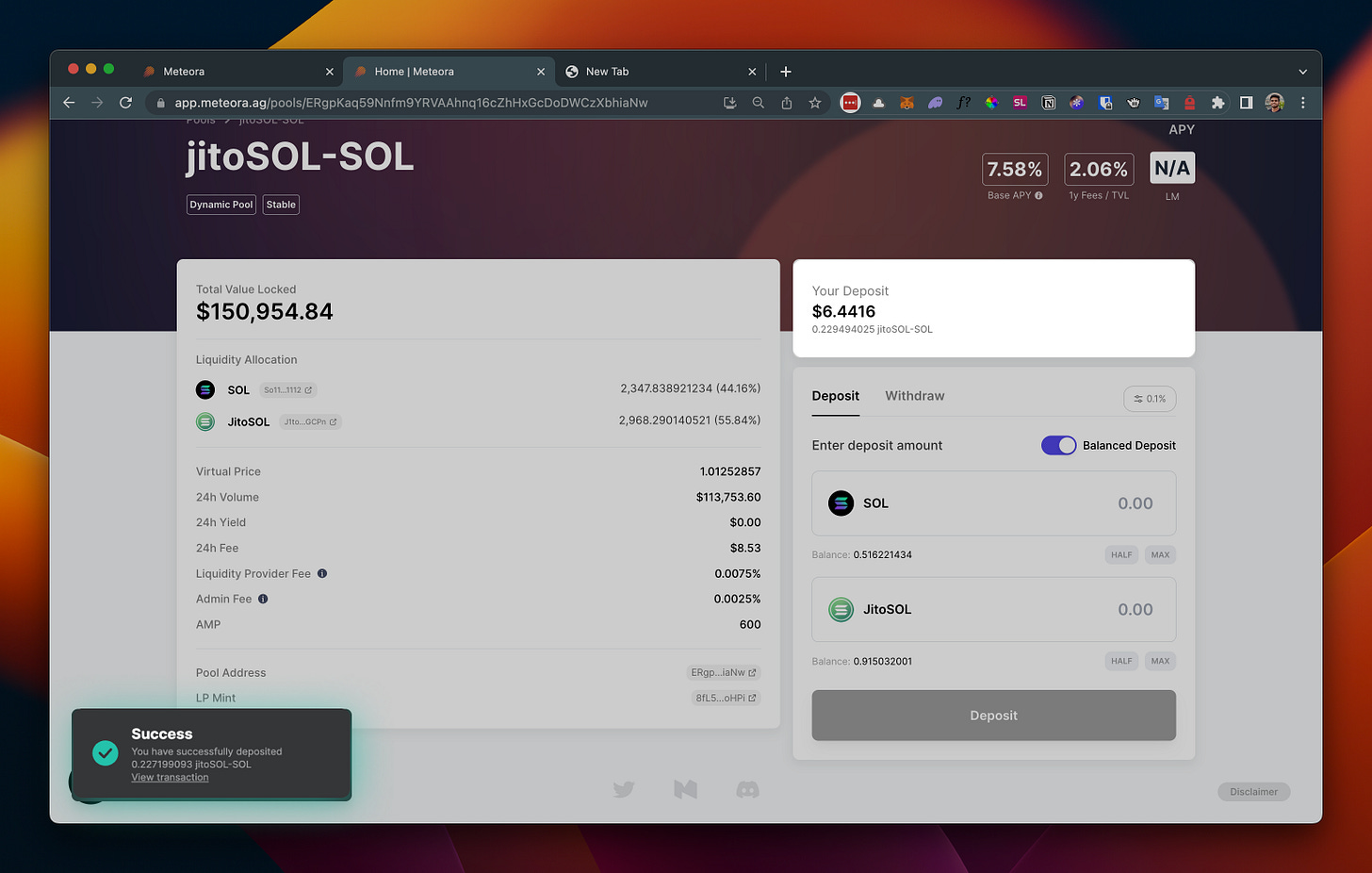

Go to app.meteora.ag and connect your SOL wallet.

You'll see a list of different vault options. Choose one that you're interested in. For this guide, let's say we choose the jitoSOL-SOL vault.

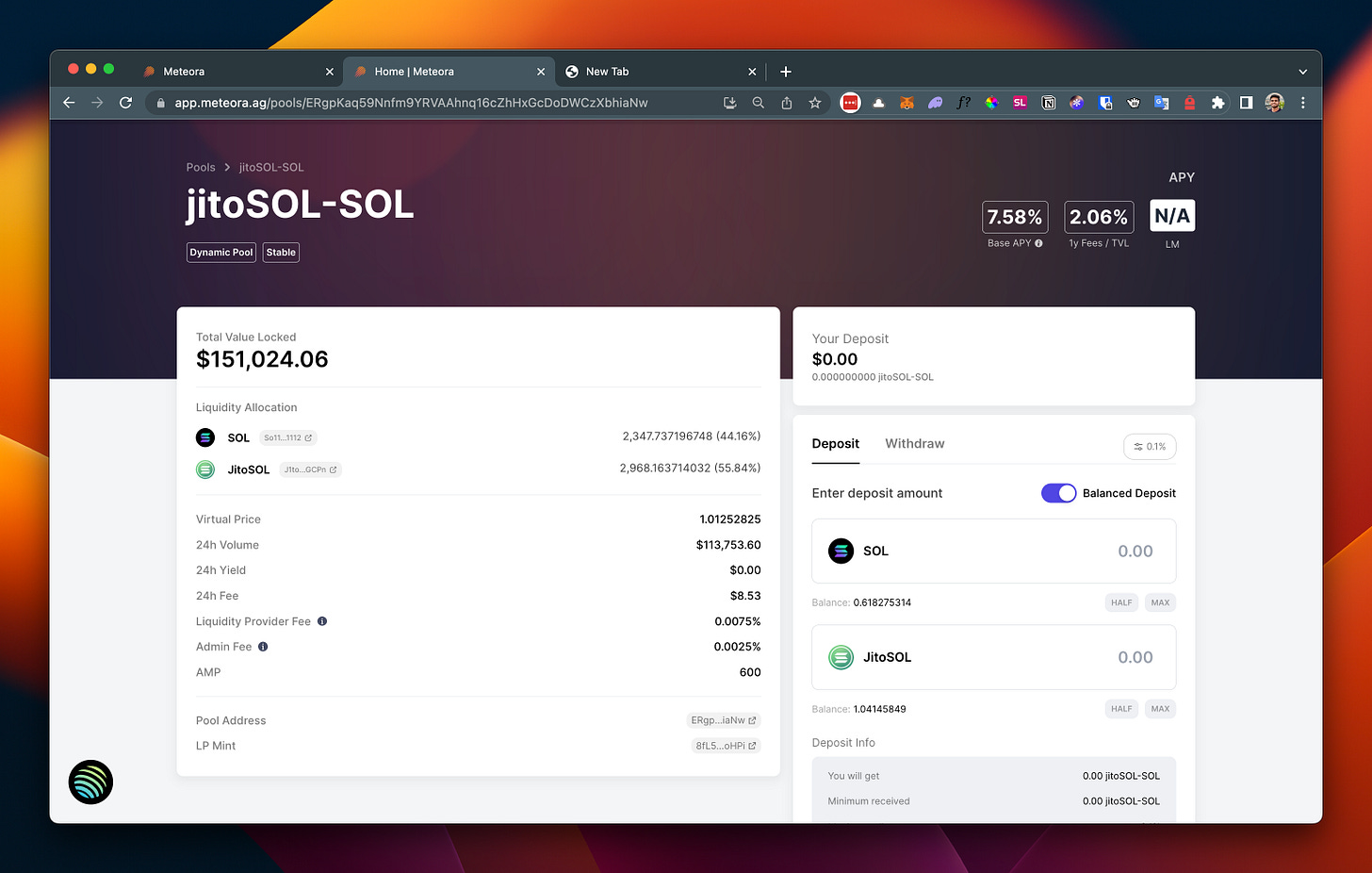

This screen shows all the info about that specific pool and you can take a look the numbers again.

Here we will enable balance deposit (which is recommended) so that we deposit both the token in their equivalent amount to the pool.

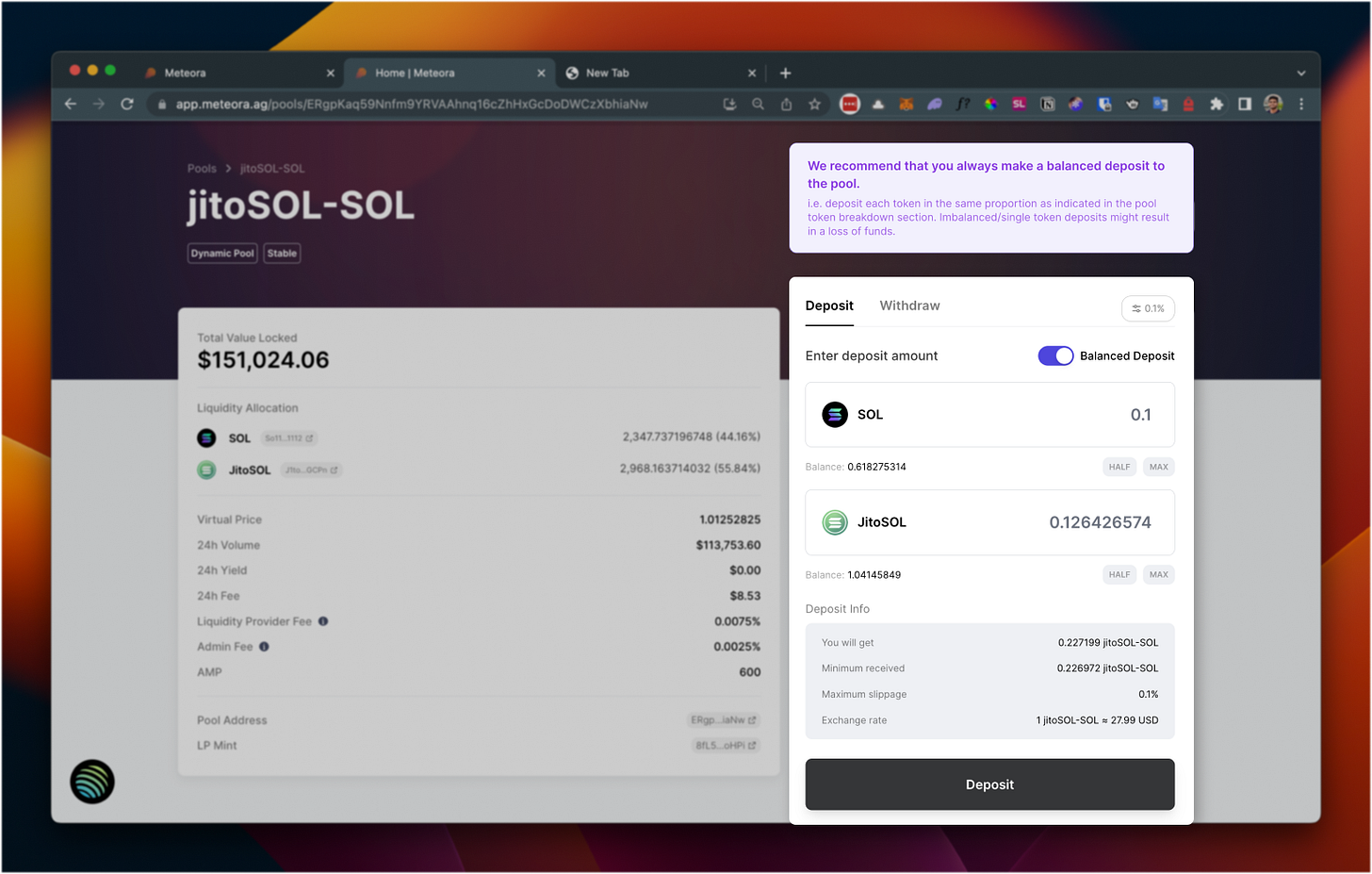

Enter that amount of SOL into the deposit field and the equivalent amount of JitoSOL will be automatically calculated for you. (Note: JitoSOL is a token you receive in return for staking your SOL at the Jito network. This is for educational purposes only and not financial advice.)

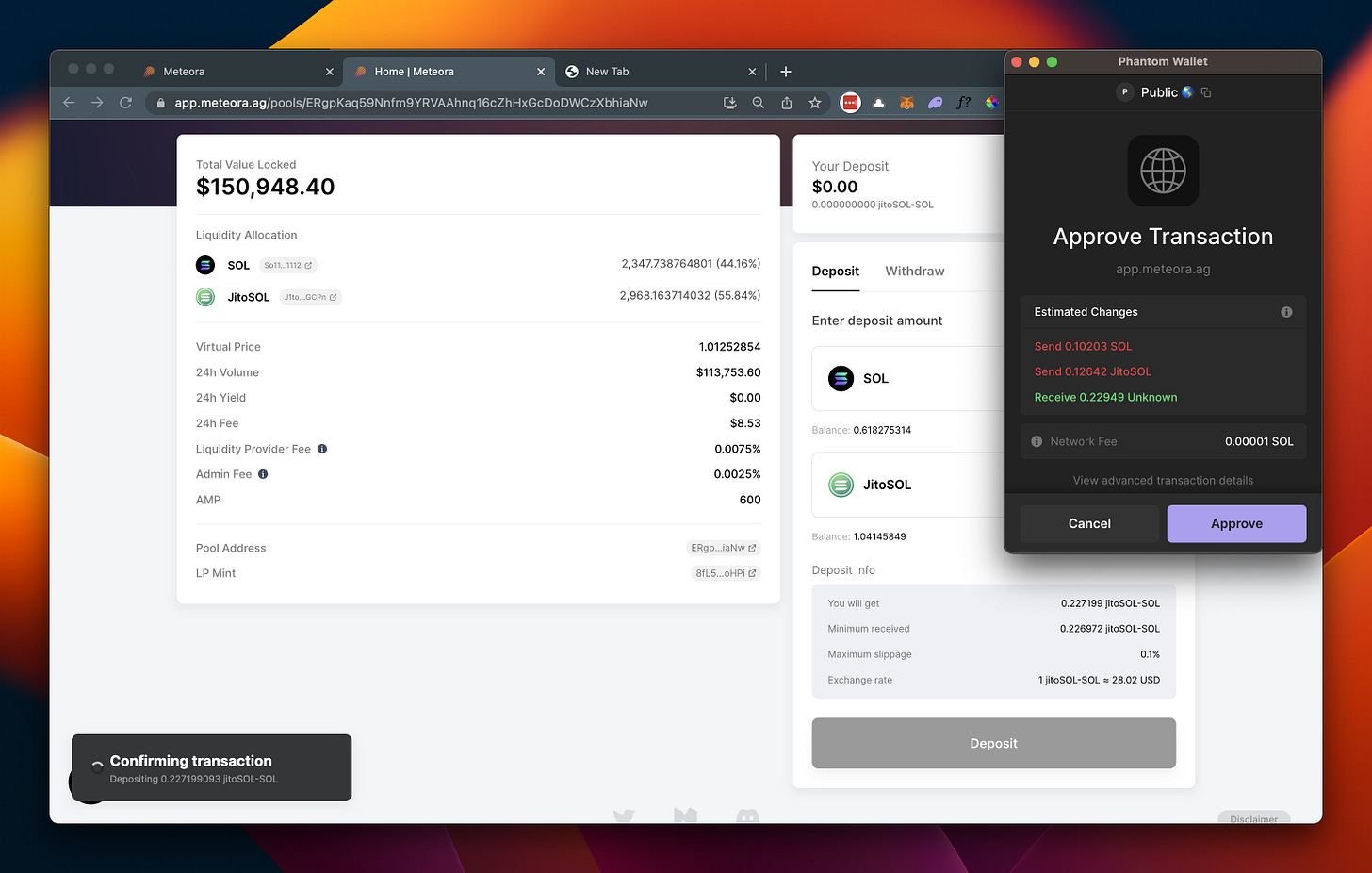

Click on the "Deposit" button. A transaction prompt will appear in your wallet. Follow the instructions to approve the transaction and complete the deposit process.

🎉 Voila! You've successfully deposited into a Dynamic Vault. You can find more information and see the vault's APY (Annual Percentage Yield) in the dashboard and vault description.

Meteora User Acquisition Strategies: Composability

To fully leverage composability, Meteora Dynamic Vaults encourages any protocol, including wallets, treasuries, and AMMs, to easily build on top of them. This allows protocols to generate more returns for their users, overcoming the challenges of optimized yield, safety, and liquidity access with one integration. These protocols can directly deposit and withdraw assets via the SDKs.

Wallets: Wallets are the gateway for crypto users. They contain assets for their users, and the user would want to earn a yield on their idle assets. These wallets can have an easy integration where users can deposit their idle assets in one click and earn yield. Target wallets can be: Phantom, Backpack, Glow, Ottr Finance, Ultimate

DAOs and Project Treasuries: DAOs and projects have sizeable treasuries, which are idle but can’t be invested in risky assets. These treasuries can be deposited in Meteora’s Dynamic Vaults, where they earn yield in an optimized and safe state.

Target DAOs can be: Mango DAO, Monke DAO + any project on Solana

AMMs: AMMs can deposit their unutilized liquidity to Meteora’s Dynamic Vaults, which can increase the overall yield for their Liquidity Providers (LPs). The liquidity of the AMM pools will be deposited in the dynamic vaults. With the added yield, AMMs will be able to make their pools highly capital efficient and reduce the reliance on Liquidity Mining (LM) incentives to sustain or grow the liquidity of the pools.

Target AMMs can be: Orca, Raydium, Lifinity

To incentivize protocols to integrate Meteora Dynamic Vaults, Meteora has an affiliate program, which allows an integrated partner protocol to earn referral fees for the capital deposited to the vaults via its protocol. It tracks the source of liquidity i.e., deposits and withdrawals via the partner wallet address, set up during the creation of the partner account. Once set up and integration is completed, the yield layer will track any deposits or withdrawals into the vaults. The fees generated from the transaction are calculated (on-chain), and transferred periodically the outstanding accumulated fees to the partners (off-chain).

Competitors

Any yield avenues can be essentially considered a competitor to Meteora Dynamic Vaults.

Some of the direct competitors can be:

Direct Lending with protocols: Users can directly opt for lending directly with protocols like Solend or Marginfi instead of coming to Meteora Dynamic Vaults.

Other vault-based projects like Kamino Finance, Hawksight, and Tulip also offer vaults, but they generate yield from trade volume, i.e., fees generated from executing trades on a DEX.

Indirect competitors, which also offer yield on Solana, are:

Staking: Instead of depositing their SOL in lending pools, which yield ~4-5% APY, most would prefer to stake their SOL instead, where they can get 6-7% APY while also getting access to Liquid staked SOL, which provides with an option to use that as leverage in the greater DeFi.

Real-World Assets: With DeFi yields being very low, bringing Real-World Assets (RWA) like Private Credit (Credix Finance on Solana), Real Estate (Parcl and Homebase on Solana), and t-bills on-chain offer a lucrative alternative. They offer a stable yield while giving investors the flexibility to invest directly via USDC.

While the threat of direct competitors is low currently, we believe that indirect competitors can become stronger going forward.

The Path Ahead: The Dynamic Yield Layer for Solana

Meteora Dynamic Vaults is set on the vision to become the middleware that enables any protocol with a treasury (wallets, AMMs, DAOs, etc.) to transform their liquidity into yield-generating assets. All while enabling to give optimized yield for deposited assets in a sustainable, safe, and liquid manner.

Leveraging composability will be key. While Meteora can definitely expand to other chains, for now, we can conclude that much of the success of Meteora’s Dynamic Vaults is hinged on the success of Solana DeFi.

Cheers for staying with us — are you excited about what’s next in the frontier of Solana DeFi?!

Share it with friends if you found it helpful! For any project inquiries or suggestions, connect with — Sitesh Sahoo and Yash Agarwal.

References:

Links and other third-party sources are linked in their respective sections.

Bonus readings: DeFi Vaults Newsletter!

DO YOUR OWN RESEARCH. We make no representation or warranty as to the accuracy or completeness of the information contained in the third-party data sources. This post may contain forward-looking statements or projections based on our current beliefs and information believed to be reasonable at the time. However, such statements necessarily involve risk and uncertainty and should not be used as the basis for investment decisions. The views expressed are as of the publication date and are subject to change at any time. Read the full disclaimer here.