The State of Solana DeFi — Top 10 Themes for 2023

A comprehensive overview of the current DeFi landscape on Solana, highlighting key players, trends and the building opportunities!

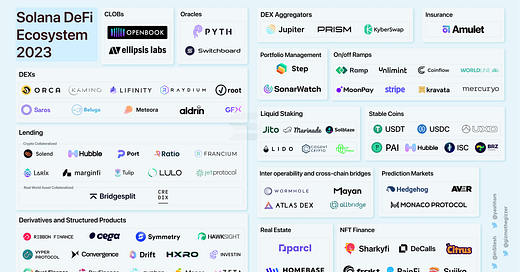

Solana has a thriving DeFi ecosystem thanks to its community of innovative builders: from trading and investing platforms to CLOBs that rival the depth of NASDAQ to derivatives, DEXs, DEX aggregators, and so much more. This essay aims to provide a comprehensive overview of the DeFi landscape on Solana, highlighting key players and trends. By analyzing the strengths and limitations of these projects, we come to appreciate the unique offerings of Solana and how it compares to other ecosystems in the DeFi space.

Overall DeFi Ecosystem

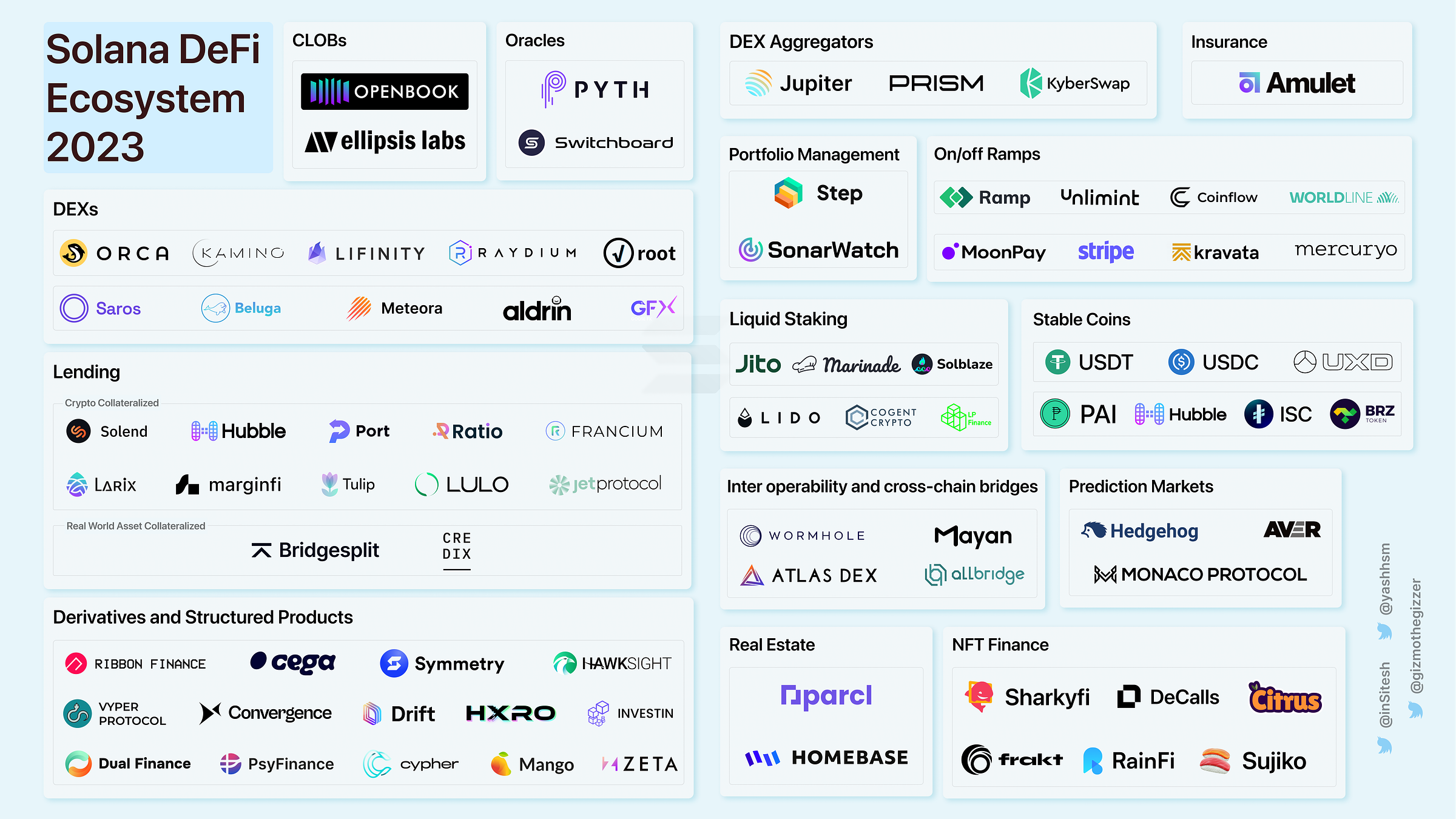

DeFi reached new all-time highs from the DeFi summer of 2020 through the end of 2021. However, 2022 saw the first significant drop in DeFi, compounded by a series of events that shook the ecosystem. This includes primarily centralized entities (BlockFi, 3AC, Celsius, FTX, etc.) that took massive risks with customer deposits. Prices got inflated as a result of these businesses' mutual lending practices and the use of illiquid assets as collateral. The unsustainable nature of their mischiefs ultimately led to their downfall.

If we look at the TVL lost in DeFi after each of these major events, the sheer scale of these losses is staggering. Following the Terra collapse in May, TVL plummeted by $60 billion, with another $25 billion lost due to ongoing liquidation events in June. But the most prominent blow came in November with the collapse of FTX, resulting in losses of around $10 billion that affected the entire ecosystem.

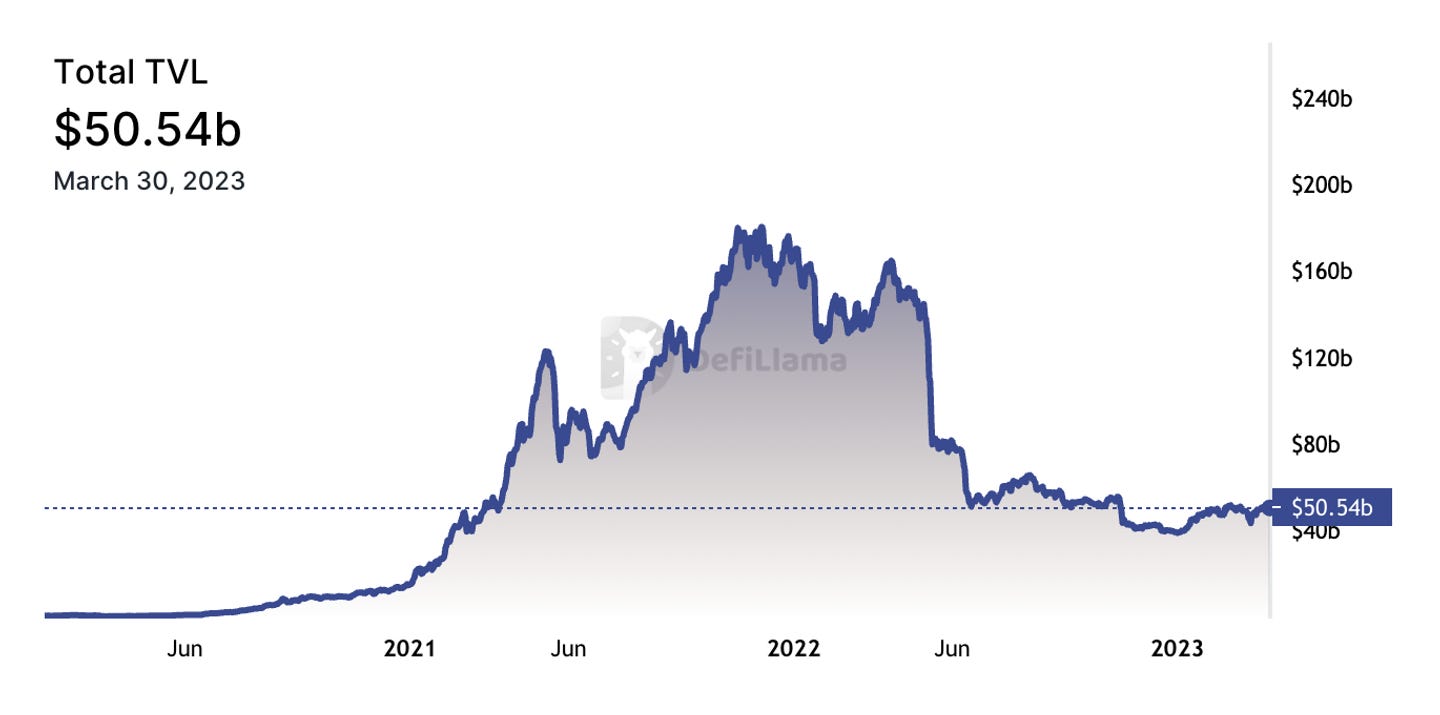

Most DeFi protocol’s native tokens have now fallen 80-90% from their all-time highs. Since TVL is often measured in dollar-value, the price drop exaggerated the impact on DeFi.

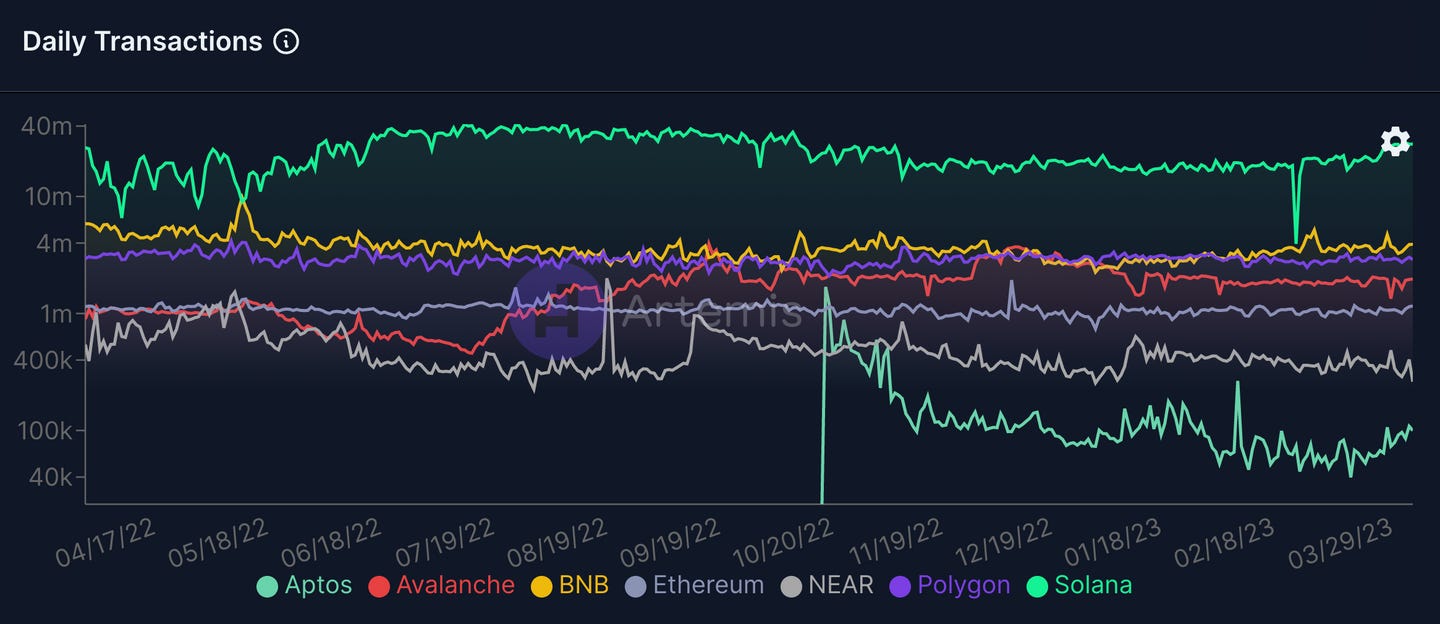

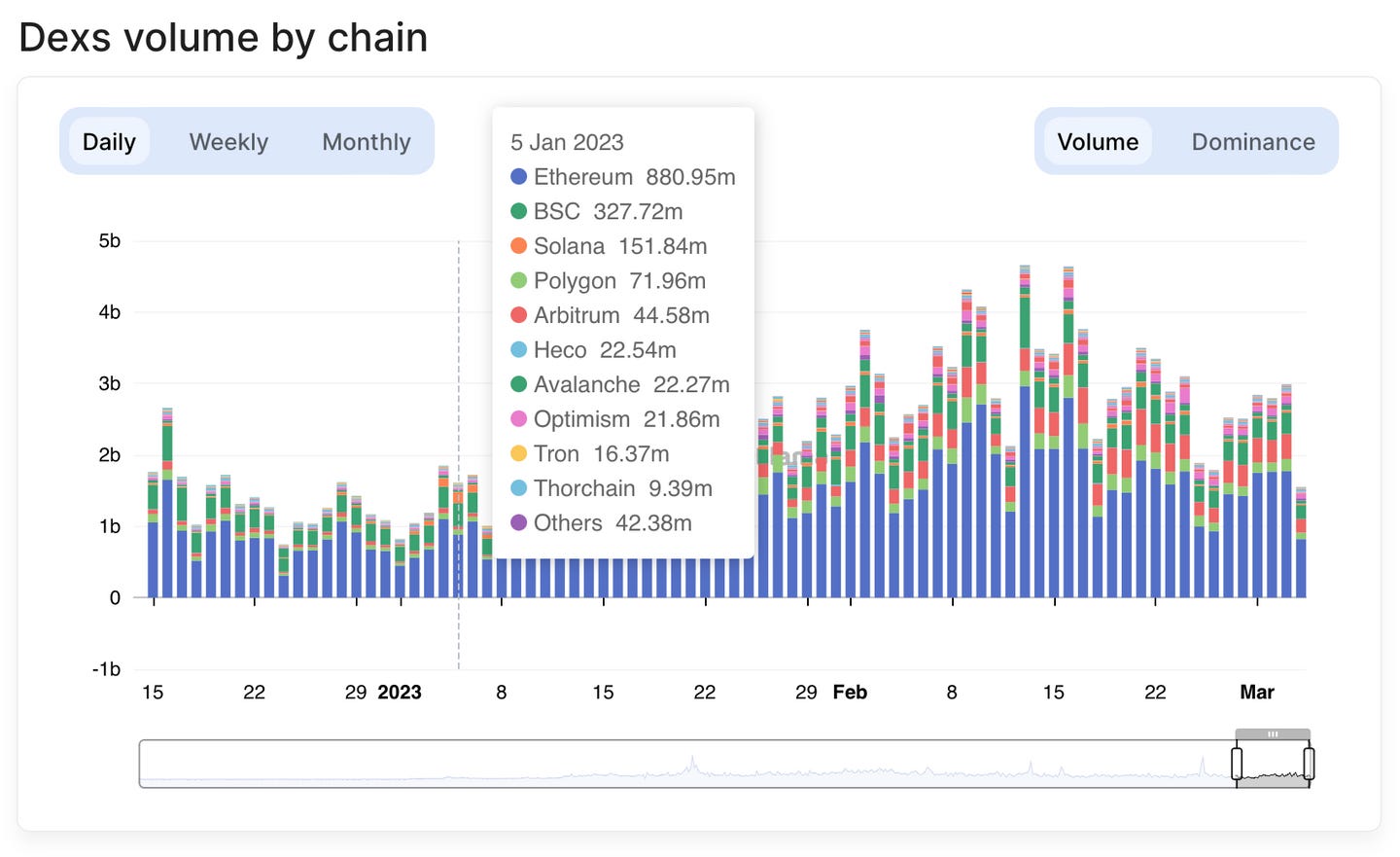

But despite the significant drop in TVL, daily transactions have not been meaningfully impacted. If each chain's number of transactions is a reflection of its daily active users, a clear pattern emerges with Solana as an outlier outperforming all the other chains (to keep things consistent, we did not take into account Solana’s voting transactions). This is not only due to Solana’s high throughput but also the growing number of projects and developer activity in the ecosystem.

An Overview of Solana DeFi

Although younger and smaller than the EVM DeFi ecosystem, Solana DeFi is burgeoning due to the possibility of building products that are fundamentally not buildable on Ethereum. We’d like to think that the raison d’être of Solana DeFi is not to be a lower-cost version of EVM DeFi; rather, the Solana DeFi ecosystem implements new designs that bring more value to stakeholders. For example, order books like CLOBs are needed to bring TradFi-like volume onto DeFi due to superior price discovery and liquidity provision.

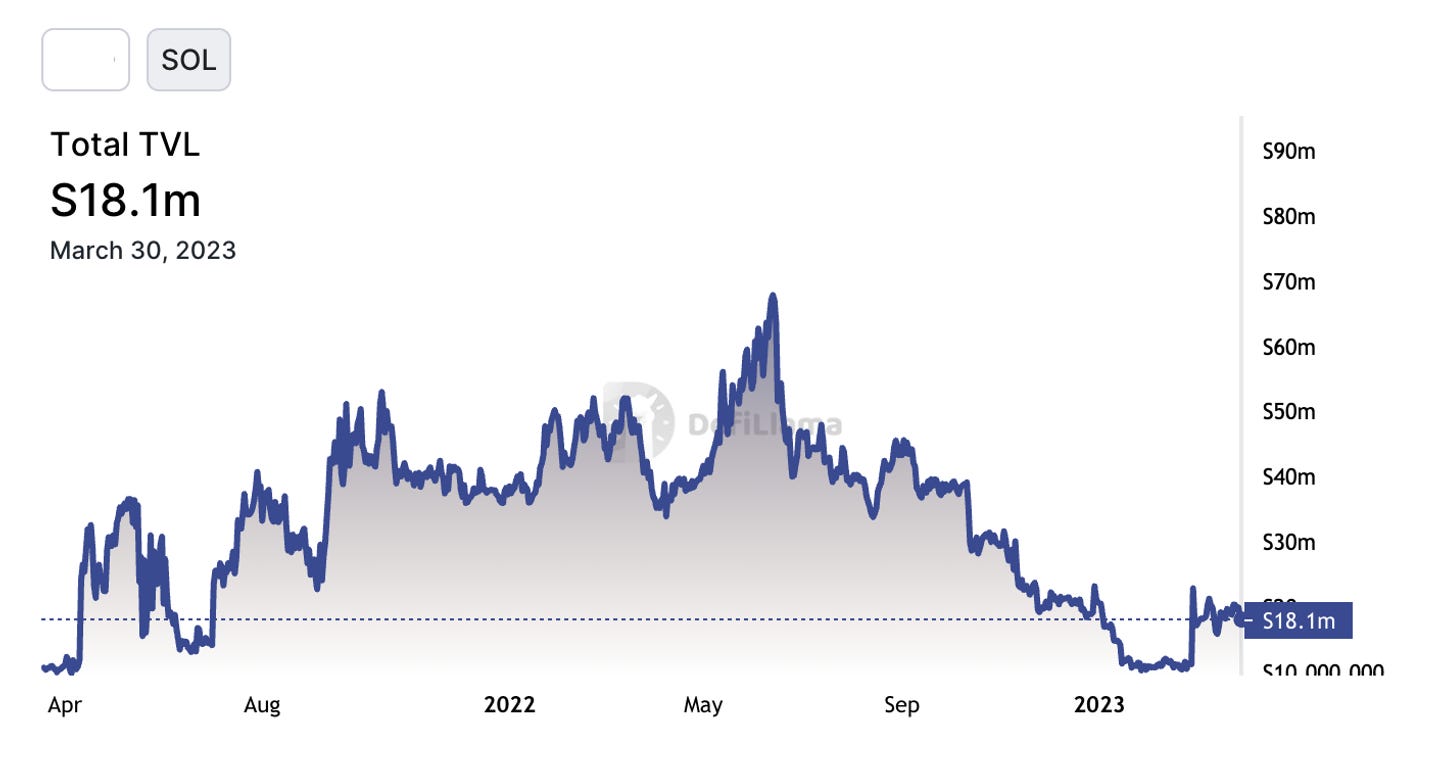

The Solana ecosystem was heavily impacted by the collapse of FTX in November 2022. Many project teams either had funds on the exchange or were backed by FTX and Alameda. Solana DeFi was just recovering from the $100 million exploit on Mango Markets the previous month, but liquidity evaporated post-FTX bankruptcy. TVL went from $1 billion to almost $300 million as the SOL token price dropped by more than half of its value from $35 to less than $14 in a matter of days.

Solana is the Capital-efficient Blockchain

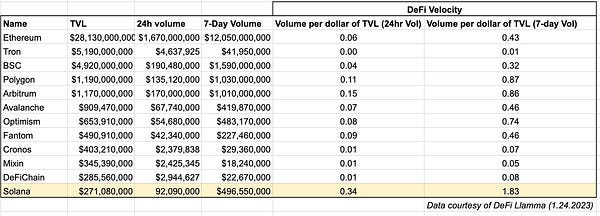

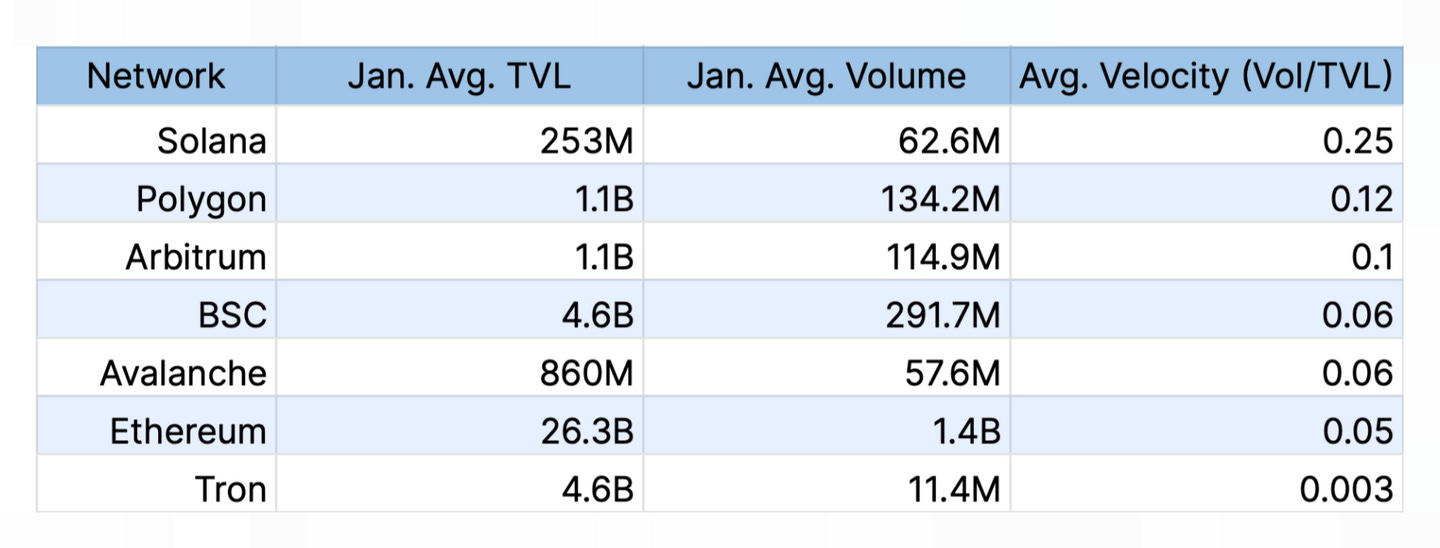

Total value locked (TVL) can be misleading due to double counting that inflates the metric. In comparison, DeFi velocity is a metric used to compare cross-chain activity. DeFi velocity is calculated by taking the ratio of the 24-hour DEX trading volume to the chain’s TVL. The higher the DeFi Velocity, the more active the DeFi ecosystem is.

The concept of velocity is not new. In traditional finance, velocity refers to the speed at which money changes hands in an economy. A high velocity of money is generally seen as a sign of a strong and healthy economy, as it indicates that money is being used to purchase goods and services repeatedly. Another way to view velocity is capital efficiency. A high DeFi velocity suggests that digital assets are actively traded and capital is being put to work.

Solana has a high DeFi velocity compared to other blockchain networks. In January 2022, Solana's DeFi velocity was 0.25, at least twice as high as other networks. This indicates that Solana's DeFi ecosystem is more active (albeit smaller) than its competitors. Even if we exclude the outlier Bonk effect between January 3-8, when Solana recorded the highest DEX volume for the month (reaching over $150 million in volume, which is two-thirds of the TVL), the network still leads the chart with a velocity of 0.21.

Networks such as Binance Smart Chain (BNB), Avalanche, and Ethereum have weaker trading ecosystems than Solana, despite much higher TVLs. This shows that the DeFi velocity metric provides a more accurate picture of a blockchain's economic activity than TVL alone.

Tron’s DeFi velocity of 0.003 indicates that there is a large amount of capital parked. This shows that DeFi velocity provides a more accurate measure (or at least another flavor) of a blockchain's economic activity.

Check out this thread by Kamino Finance which explains DeFi velocity in further detail.

Let’s now dive into each DeFi category or theme and analyze their strengths, limitations, and opportunities that are present.

1. The path forward with DEXs, CLOBs, and AMMs

The collapse of FTX and its aftermath have created a significant loss of trust among users, which has served as a stark reminder of the critical importance of transparent and auditable public ledgers. Unlike centralized exchanges, DeFi platforms are a more transparent option for users as they maintain fund custody. In addition to new decentralized exchange (DEX) contenders, we’re also seeing semi-custodial exchanges and wallets leveraging multi-party computation (MPC) and threshold signing to provably assure users of the safety of their funds while providing them with a familiar CEX user experience.

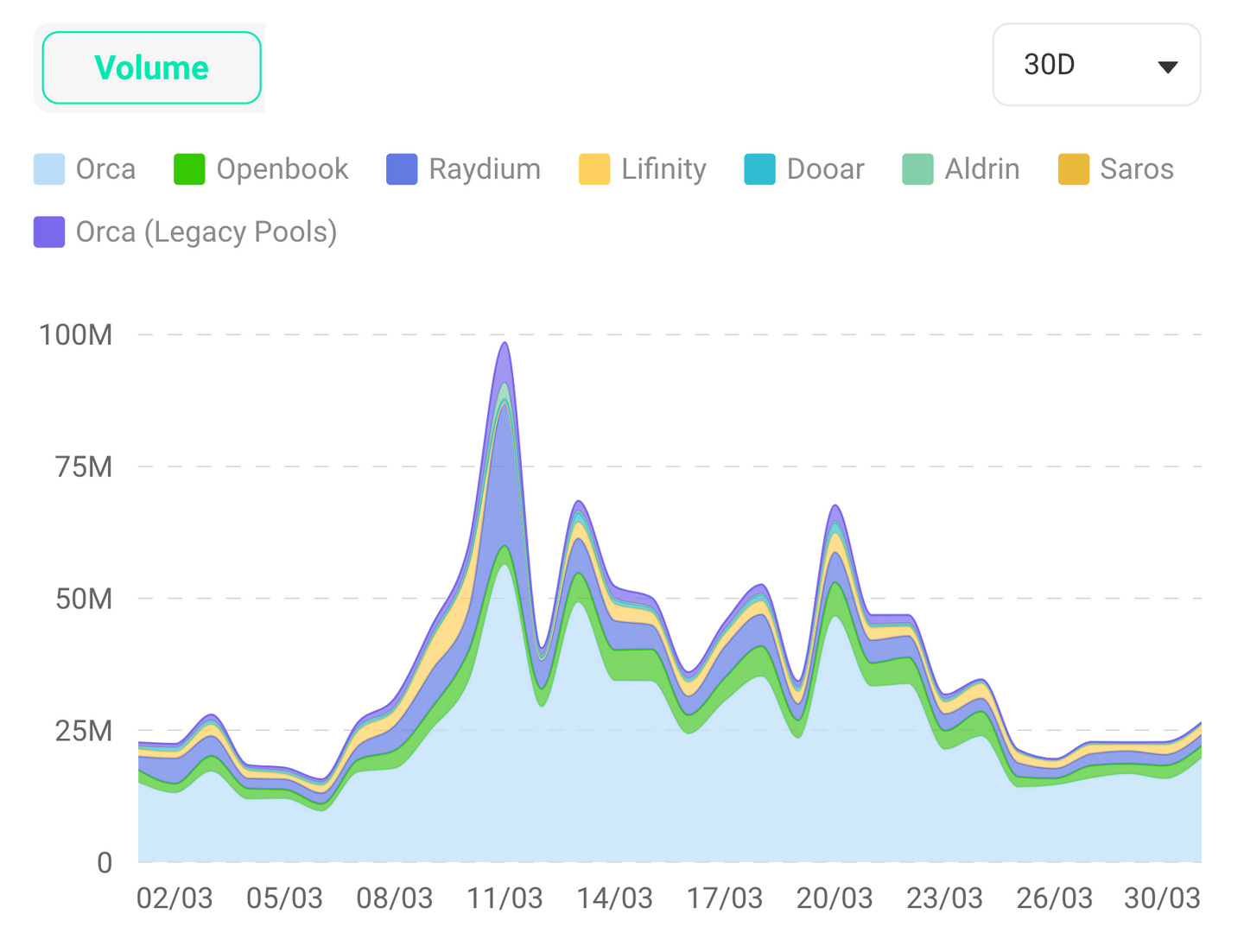

Orca has become the most dominant DEX for Solana, taking in over 74% of the total swap volume, followed by OpenBook, Raydium, Lifinity, and Aldrin. However, we are still seeing innovation with projects like Root Protocol, building a hybrid DEX that combines the efficiency of AMMs with the flexibility of order books.

More crypto native users may switch from CEXs to self-custodied trading on DEXs. However, a big obstacle to widespread adoption is the stark contrast in user experience. Although a few EVM DEXs have significant trading volume, many drew volume through additional token incentives. Without a dramatic reduction in the UX gap, it will be challenging for DEXs to overtake CEXs in volume and liquidity.

The state of CLOBs

First, a short bit of web3 history. In the early days of FTX, SBF talked to every major L1 on the market, searching for a blockchain that could power his vision of an on-chain CLOB. After stress testing the then-unknown newcomer Solana in 2020 and 3 am phone calls with Anatoly, Project Serum was born.

Serum was one of the earliest on-chain CLOBs and drove growth on Solana DeFi. Traders can experience a decentralized version of the order book they’re familiar with in TradFi. After FTX collapsed, the DeFi community forked the Serum code to become a public good and named it OpenBook.

Now, there are two live CLOBs on Solana: The widely-adopted OpenBook, and a crankless alternative, Phoenix by Ellipsis Labs. See this Superteam post for a detailed analysis of OpenBook. Note that both projects are open-sourced.

OpenBook employs cranking, an operationally intensive and centralized process to ensure that orders are matched properly. Transactions are processed in batches at regular intervals. A crankless solution enables transactions to be processed instantly and reduces the likelihood of front-running and other forms of market manipulation. While the original design of Phoenix would require institutional market makers to reveal their identity or be whitelisted, their v2 will enable permissionless and anonymous liquidity provision.

Some opportunities for builders to consider:

Design choices: One way to design order books is as separate app chains, though with the tradeoff of atomic composability. This can be just like dYdX v4 or Sei. Doing so can achieve customizability without compromising the speed and low cost of Solana through the Solana Virtual Machine (SVM). Running an off-chain order book like dYdX v3 or 0x exchange can be another example of a different design approach.

Scalability: The launch of Jump Crypto’s second validator client, Firedancer, on Solana will be interesting to watch as it may further increase Solana’s performance by 10x or more. With over 1 million in TPS in a testing environment, Firedancer opens up new possibilities for HFT and derivatives trading on-chain.

New markets: Markets can be made with new applications and asset classes, from running a permissioned order book for import/export commodity cargo to trading collectibles such as rare spirits; the opportunities are endless.

The case for an on-chain Foreign Exchange (FX) Market

FX is a huge market with over $6 trillion daily volume, and many web3 players are eyeing this opportunity. Uniswap, along with Circle, published a research report where they described different models and roles of “Exchanges” and “Tokenized Cash Issuers” to facilitate an on-chain FX market. The paper argues that AMMs will reduce the likelihood of flash crashes during high market volatility.

We respectfully disagree: CLOBs are a better market structure than AMMs for the FX market due to lesser price impact and better trade execution. FX markets are a key piece to bringing global economic activity on-chain. As the most liquid market in the world, Forex markets have microstructures on order books that AMMs simply cannot rival. Ask any large market maker in this space, and they would rather provide liquidity on a LOB (Limit Order Books) than an AMM.

EVM-based chains have synthetic FX markets based on oracles, but fiat-backed stablecoins are still limited to major currencies such as USD, EUR, and JPY. However, with more local stablecoins launching on Solana, we hope to see more sophisticated Forex trading between stablecoin pairs.

2. Lending and Borrowing: Going Beyond Speculation

Decentralized lending and borrowing provide users with access to capital without intermediaries. We can classify lending activity by collateral type: crypto-backed and real-world asset (RWA) backed.

Collateralized by Cryptoassets

Solana has seen the emergence of various decentralized lending and borrowing protocols that operate on a collateralized basis. The most notable ones are Solend, Port Finance, Francium, Tulip, Hubble Protocol (effectively the only player left in the overcollateralized stablecoin market), Jet Protocol, marginfi, Ratio Finance, and Larix.

The bull market built a lot of lending & borrowing infrastructure, while the bear market enabled us to stress test various models. A well-designed infrastructure should allow users to quickly and easily access loans with minimal friction, and Solana does this pretty well. This efficiency refers to the speed and ease of the borrowing and lending process.

Despite that, leading protocols like Solend are struggling due to a lack of liquidity, but they are coming up with potential solutions in their v2. Collateralized lending does not solve many real-world problems and is primarily used for speculative purposes like leveraged trading. This is why the FTX fiasco heavily impacted this sub-sector, as oracles were fetching FTX prices that were out of whack with actual prices.

If we look at EVM chains, they have strong collateralized lending projects like AAVE with a TVL of $4.8 billion (Feb 2023). AAVE, for instance, has been robustly liquidating all its loans while innovating on multiple fronts, like the yield-generating GHO stablecoin, cross-chain lending, RWA initiatives with Centrifuge, and flash loans. Ethereum’s first-mover advantage and large whales who cannot cash out into TradFi systems are contributing factors to its TVL.

We are particularly excited about the following opportunities:

On-chain businesses: Bringing more businesses on-chain and collaborating with multi-sig providers like Squads to power loans with lesser collateral ratio (~100-150%) or even under-collateralized (collateral ratio <100%) use cases with a decentralized set of institutional underwriters acting like validators of the protocol. This is just like multi-sig guardians, who will approve the loans for on-chain entities. The best part would be that the loan details can be all on-chain and encrypted to the necessary extent.

Another huge opportunity in collateralized lending is tokenizing RWA and bringing debt on-chain. Projects like Centrifuge, Figure, and the recent Apollo deal are exploring this. By tokenizing assets such as real estate, invoices, and royalties, these projects aim to create new investment opportunities and enable easier access to capital for businesses. If successful, this could lead to a significant expansion of the collateralized lending market and bring more real-world use cases to DeFi.

Aave’s GHO stablecoin provides an ideal case study for the possibilities on top of lending protocols, which can also be built on Solana.

Some of the exciting projects to look out for in the coming months on Solana will be:

marginFi: marginfi launched and bootstrapped over $1.5 million on their first day. The marginfi architecture is also evolving towards a prime brokerage model, where assets on marginfi can be used to go long on Zeta or Drift, or Cypher.

Solend v2: Solend, one of the biggest lending and borrowing projects on Solana, has now been battle-tested a few times since launch, from network outages to spectacular blowups. These have led to learnings that have been combined to produce an improved lending protocol, Solend V2. Check out their latest whitepaper.

Collateralized by Real-World Assets:

Issuing loans against verified on-chain holdings and keeping track of an entity's balance can help mitigate risk by guiding lenders' decision-making. Finding the ideal business model and regulatory framework is extremely challenging. Previously there have been setbacks for institutional lenders like Celsius, BlockFi, and Hodlnaut. Because of how these traditional lenders operate, there is no transparency regarding the borrowers, and money lent.

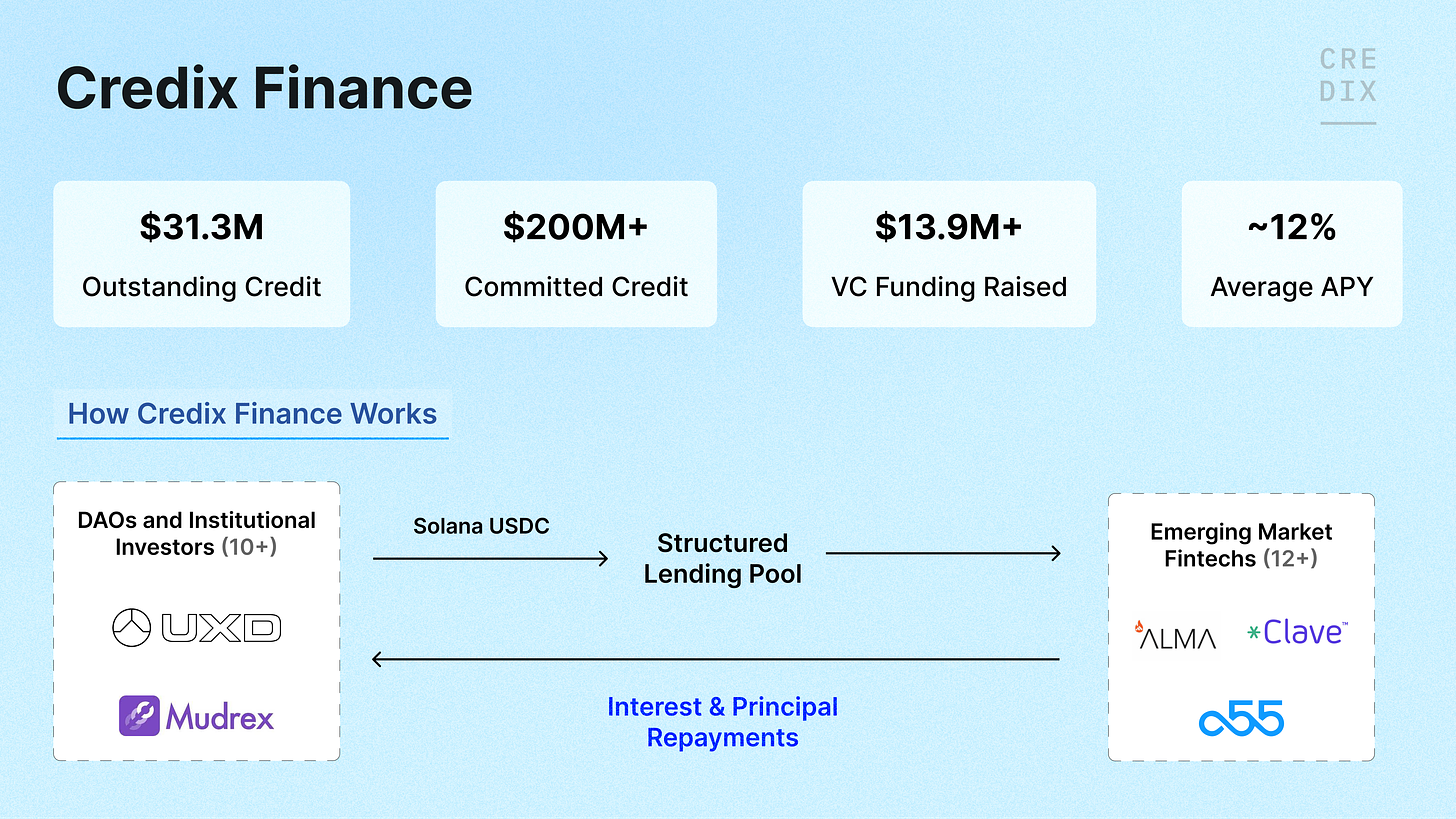

The Case for Real World Assets: Credix Finance

Credix Finance has been proliferating, with over $200 million in committed credit. Credix Finance is building a credit ecosystem that aims to bridge the gap between institutional borrowers and investors by enabling access to liquidity and creating attractive risk-adjusted investment opportunities. Credix uses consumer loans, such as auto loans and invoices, and invoice receivables as collateral in their loan pools. Additionally, some of these loans are insured by established reinsurers such as MunichRE.

RWA projects also attract capital from other ecosystems, as done by Credix Finance, where they aggregate USDC from both Solana and Ethereum but build the execution layer on Solana.

Credix is built on two major ideas:

Interesting investment opportunities are present in emerging markets that are accessible to investors, as institutional borrowers in these markets frequently encounter geographical or capacity restrictions when looking for funding. Credix addresses this issue by giving these borrowers access to capital and credit they would not otherwise have. So fintechs and non-bank loan originators in emerging markets can raise debt funding internationally with less friction and at lower rates.

Investment options offered by DeFi will be based on tangible assets rather than the volatility of cryptocurrencies. Credix intends to provide investors with a more stable and predictable investing environment by tying DeFi investments to tangible assets with a low beta to cryptocurrency assets.

Read the Solana Foundation’s case study on Credix here.

Some of the exciting opportunities in the RWA space are:

The need for an RWA token standard: Standards align different entities on a common set of rules. For instance, the standard for packaging and shipping physical goods in the form of a shipping container reduced transportation costs and drove a surge in global trade. Similarly, establishing a standard for RWA on how assets can be originated, ledgered, packaged, and distributed is essential for driving more market efficiency and better price discovery.

A robust identity protocol: Decentralized IDs and verifiable credentials that can be used across protocols are essential components to seamless UX. Although several on-chain implementations (mostly centered around DAOs and governance) have been built, these tools have not successfully attracted users. The opportunity to address accountability for anonymous users and loans is, therefore, huge. The adoption of these projects might be sped up by combining these identity techniques into a universal multifactor authentication system such as the Gitcoin passport or having an encrypted soul-bound NFT.

3. Subpar Derivatives Traction — Need for the 2.0

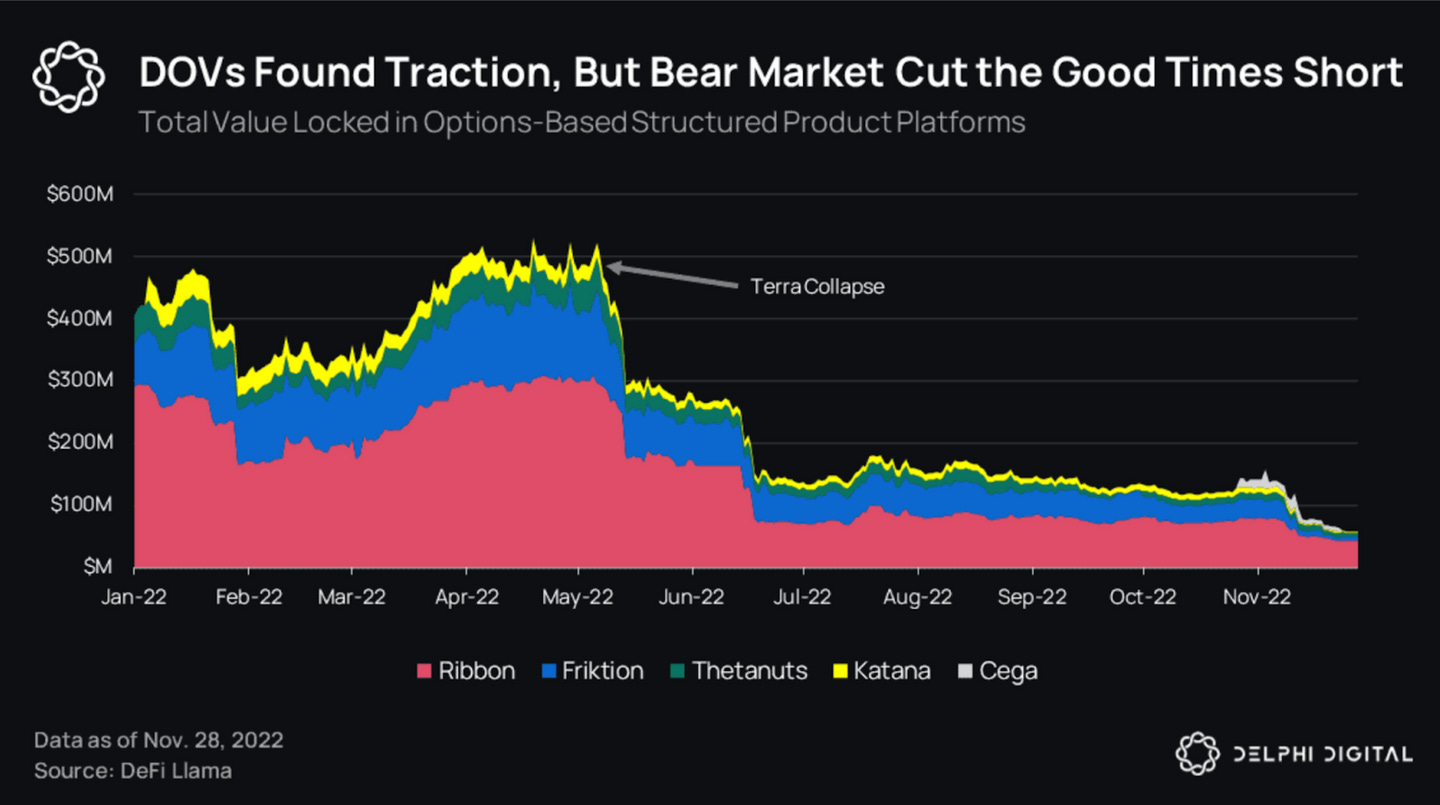

Solana experienced a surge of over $500 million in TVL in DeFi Option Vaults (DOVs) in the bull run until the bear market took hold. Solana-based derivatives platforms like Zeta offered flexible liquidity and fair value pricing by leveraging Project Serum, unlike the forced pricing of AMMs. However, DOVs like Ribbon, Katana (not actively building), and Friktion (sunsetting) added some saturation to the structured products market in 2022. While these DOVs initially attracted liquidity providers with high advertised yields and low perceived risks, their weaknesses grew increasingly apparent over time.

DeFi options markets were relatively strong before FTX collapsed. As an on-chain primitive, Ribbon introduced systematic option-selling vaults. The model was straightforward: motivate market makers to provide users with the necessary liquidity and profit handsomely from management or performance fees. To hedge their positions and earn spreads, marker makers were encouraged to purchase calls from Ribbon's users and sell calls on a centralized derivatives exchange like Deribit.

In the aftermath of FTX, many market makers took a risk-off approach and withdrew liquidity from the ecosystem. Rebuilding liquidity and faith in the Solana ecosystem and options market is a necessary step before complex structured option products can be offered at scale. The market for structured products remains much smaller than anticipated, and there is a need for products with better risk-reward structures catered to retail investors.

While options-based derivatives are struggling with protocols like Friktion shutting down, infrastructure for the next wave of derivatives on Solana is getting built as we speak; one of the innovative use cases for derivatives is Fusion - airdropping options by PsyFinance. Instead of the traditional protocol token airdrop, options airdrop gives communities more flexibility on how they contribute and protects the token against instant dumpers.

Here is an overview of some protocols that are actively building:

Drift Protocol: Drift Protocol is a decentralized exchange built to minimize slippage, fees, and price impact for all trades. It was designed to address the inefficiencies of bringing centralized liquidity engines on-chain. Drift Protocol has three sources of liquidity:

Constant Liquidity, which is Drift's virtual AMM designated as a backstop liquidity source that adjusts its bid-ask spread based on inventory held.

JIT-liquidity, which is a short-term Dutch auction competed for by market makers at or better than the auction price.

Decentralized limit order book (DLOB) matches with off-chain order monitors by Keeper Bots to provide traders with low slippage and deep liquidity.

Cypher: Cypher is an on-chain trading platform and margining engine built on Solana. It enables users to trade spot, futures, perps, and options markets from isolated or cross-margined trading accounts. It also offers a mobile trading experience optimized for convenience and time efficiency.

With native borrowing and lending pools, Cypher enables margin trading, allowing users to launch any derivative with a specified payoff function.

It has two types of clearing houses, public and private, that share the same liquidity and order books. The public clearing house is a general permissionless margin layer for anyone to trade on. In contrast, the private clearing house is reserved for institutional partners, enabling lower margin requirements for increased capital efficiency.

Hxro allows users to trade futures, options, and parimutuel contracts on Solana. It uses its protocols to create a decentralized exchange for these financial contracts.

As of April 3rd, the lifetime network volume is $232.83M, and the 30-day average daily volume stands at $3M (includes both derivatives and parimutuel volume)

With several community initiatives such as OpenHxro and partnerships like Convergence RFQ and Degen Ape already in progress, we could potentially see a more integrated ecosystem.

Vyper Protocol is another platform (currently in public beta and unaudited) that allows users to create, trade, and settle on-chain derivatives in a permissionless and decentralized fashion.

It enables the trading of any asset or data feed supported by oracles like Pyth and Switchboard.

Users can build customized derivatives tailored to their specific needs, or they can choose from a variety of pre-existing options.

Ribbon Finance, PsyFinance, Mango Markets, Cega, Zeta Markets, and Dual Finance are some of the other protocols that operate in the derivatives and structured products space. Recently Mango Markets has also launched its V4, which will be an interesting watch. Another project, Devol Network (currently in beta and launching mainnet in June), will allow on-chain options trading with full collateralization and deep liquidity across all strikes.

The case for a Robust Perpetuals Exchange on Solana

Solana requires a reliable perpetuals exchange that can offer a CEX-like experience to attract active traders to the ecosystem. A potential solution is establishing a derivatives trading platform on Solana, providing products such as perpetuals, options, and synthetic assets. This platform should offer top-notch user experience, high leverage, and competitive fees to attract traders. A hybrid liquidity model, combining an AMM and an order book, as well as cross-margining, could be explored. Other crucial features include mobile-friendly interfaces and advanced APIs for traders and liquidity providers.

In an attempt to solve this, Solana Labs put out a reference implementation for a novel perpetuals marketplace.

To distinguish itself from other platforms, it can offer cross-chain derivatives using Wormhole on Solana and leverage CLOBs to draw liquidity and capital from other chains. The development of the derivatives market on Solana could take inspiration from other chains such as GMX, dYdX, and Gains Network.

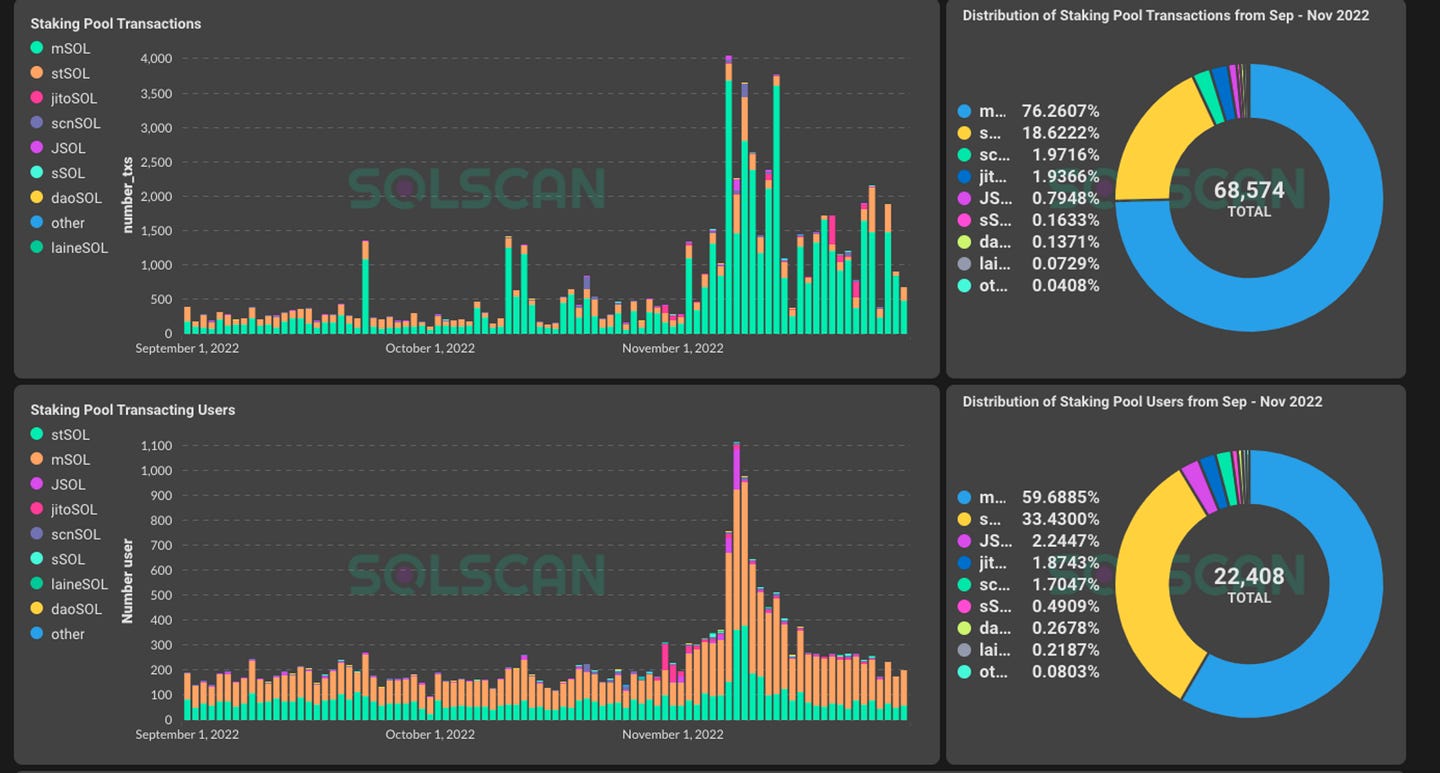

4. Liquid Staking Getting Hotter

Liquid staking is a capital-efficient option that utilizes staked assets as collateral, providing greater participation and capital flow across the market than traditional finance systems.

Lido, in December 2020, made it simple for anyone to earn Ethereum staking income without maintaining a validator node. The choice between DeFi yield and staking yield was eliminated for Ethereum users using Lido. By staking on Lido and afterward using the stETH they got in DeFi, they could now have both streams of yield. Currently, Lido is multi-chain, supporting many chains including Solana, and leads the chart regarding TVL across other liquid staking protocols. The rush for liquid staking on Solana might start again due to Jito Labs’ MEV redistribution through their validator client. Maximum Extractable Value, or MEV, refers to on-chain activities that generate economic gains by capitalizing on market inefficiencies. With additional rewards for individuals operating jitoSOL clients, the jitoSOL staking pool enables distributed value capture among many validators. On the other hand, over time, this can result in a situation with a risk of centralization.

As of 30th March, JitoSOL offers a staking APY of around 6.80%, comparable to other leading staking pools like Marinade (6.84%) and Lido (6.7%) on Solana. It's important to note that each provider calculates their APY differently. For example, Marinade displays APY based on the past 14 days, while Lido shows the highest APY from the past 14, 30, or 90 days or since launch. Some other players in liquid staking on Solana include Quarry protocol, which was once the #1 Solana protocol by TVL in early ‘22. Still, soon as the rewards started drying up, it started to lose its craze. Their Twitter and community are currently inactive.

5. Untapped Synthetic Assets and Prediction Markets

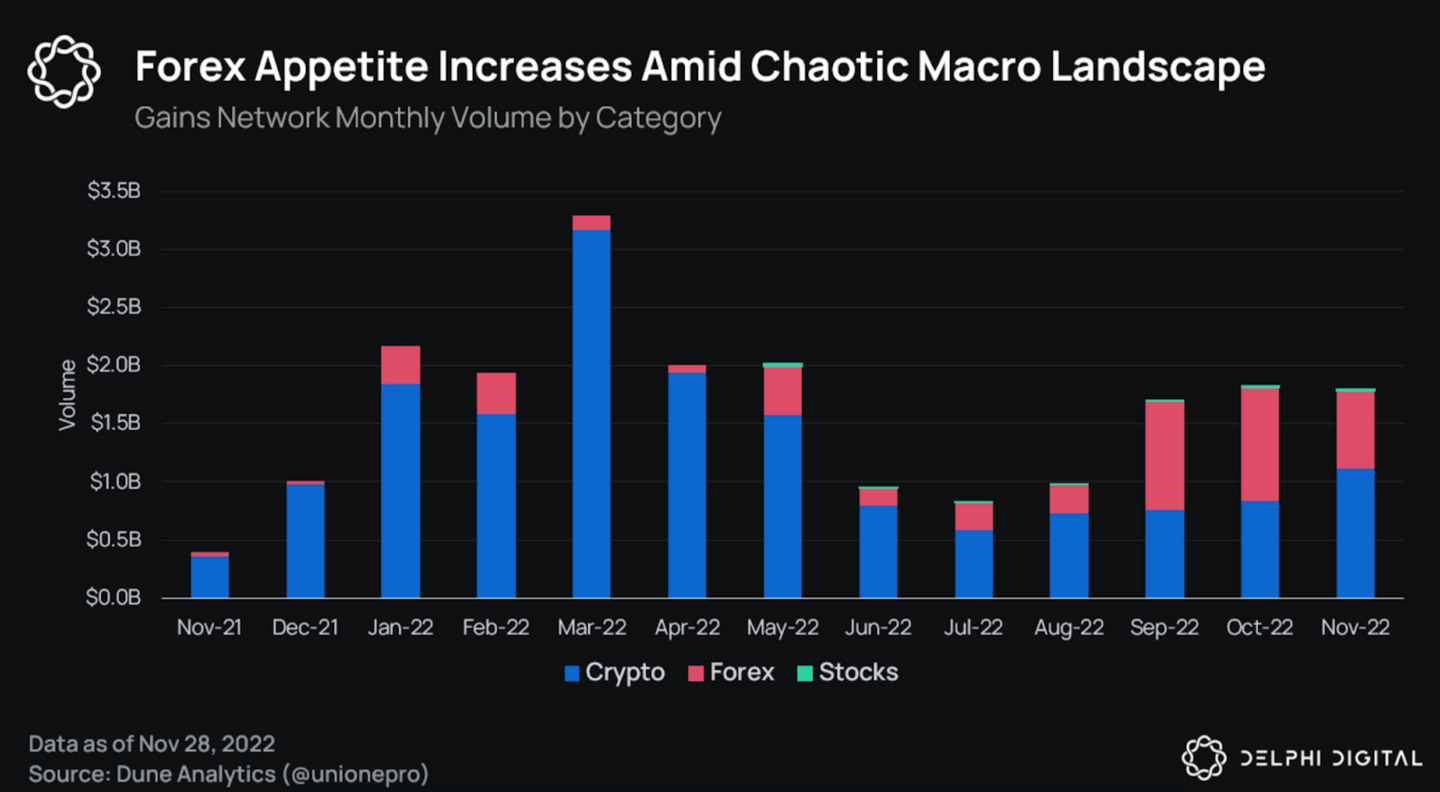

The simplest approach to use oracles to gain leveraged exposure to synthetic assets is through GMX and Gains Network. In September and October, the majority of Gains Network volume was made up of forex trades. With GMX's significantly larger user base and the upcoming introduction of synthetic assets, FX volume for EVM-based chains may skyrocket in 2023. A robust synthetic protocol leveraging oracles like Switchboard and Pyth is inevitable.

Prediction markets or betting platforms offer users the opportunity to bet on the outcome of future events. Solana, being a high-throughput blockchain, provides a fast and scalable infrastructure for prediction markets to handle a large number of trades. Aver exchange is a peer-to-peer betting and prediction platform on Solana that eliminates the traditional concept of "the house" in sportsbook betting. Hedgehog is another prediction market on Solana that generates passive yield for liquidity providers. Apart from these, Monaco Protocol provides open-source infrastructure for prediction markets on the Solana network. On Vyper protocol one can trade event/prediction markets structured as digital options.

Despite the advantages of Solana, some weaknesses may limit its growth in the prediction market space. One of these weaknesses is a lack of user adoption; Solana is a relatively new blockchain platform, and its prediction markets may not have as much user adoption and enough liquidity as Ethereum. There will be limited options for prediction markets currently available on Solana compared to other networks. For users unfamiliar with the concept of prediction markets, the process of understanding and participating in these markets can be complex and intimidating. This could deter potential users from engaging with the market, limiting its overall adoption and potential impact. However, these markets have the potential to attract non-crypto native users, who can learn about tokens through gaming and then potentially participate in the DeFi ecosystem.

One of the main threats to Solana-based prediction markets is competition from other platforms, such as Polymarket on Polygon. These platforms already have a significant user base and a larger selection of prediction markets due to the size of their respective ecosystems. Another threat is regulatory challenges, as the prediction market industry is still largely unregulated, and adding a crypto layer could pose challenges in the future as governments move to regulate it.

6. Improving the DeFi Experience with UX Aggregators

As the main point of the user interface, liquidity aggregators sit on top of the liquidity aggregation layer and own the consumers. Due to this, they are well-positioned to take over as DeFi's main user-facing layer. Although users own their information through their on-chain addresses and switching costs are low, it is not straightforward to monetize in the DeFi space. Wallet-native swaps currently take ~85 bps, whereas centralized exchange fees are much lower. UX aggregators should develop creative monetization strategies that don't compromise usability.

UX aggregators give considerable advantages to newbie crypto users even though they are primarily geared toward crypto native users. UX aggregators should give a degree of freedom while still delivering an efficient user experience by restricting access to safety protocols and issuing alerts for high-risk tokens.

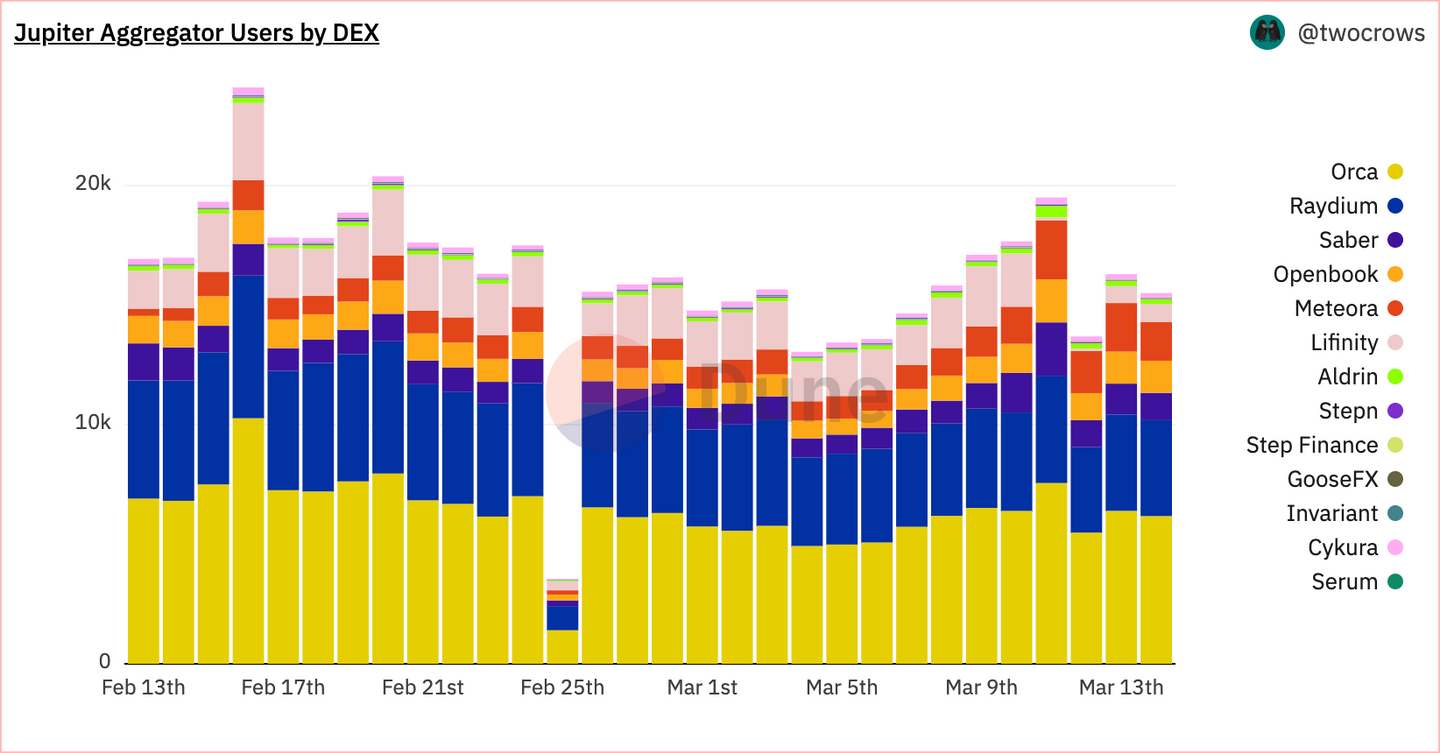

There are currently hundreds of DEXs with liquidity to trade. Here liquidity aggregators like Jupiter on Solana, as well as 1inch and Paraswap on other chains, fetch quotes from various DEXs to find users the best execution price. This spares users the hassle of having to visit various DEXs to find the best rate or sticking with a single DEX. Liquidity aggregation will likely move beyond DEXs as the DeFi ecosystem develops. It will accommodate the different protocols supporting these operations, and aggregators for other DeFi products will inevitably emerge.

Jupiter is one of the most innovative liquidity aggregators on Solana (launched in November 2021) and has quickly become the dominant liquidity aggregator on Solana, with over $27 billion in trade volume and half a million users. Jupiter's platform allows users to find the best prices and execute trades across multiple DEXs on the Solana network. While many major chains have DEX aggregators, few offers features like limit orders.

Jupiter has continued to experience high trading volumes, making it the most widely used project on Solana. In fact, Jupiter has been responsible for as much as 41% of Solana's daily non-voting transaction volume. One notable aspect of Jupiter's recent success has been its involvement in the $BONK craze, which has driven significant trading activity on the platform.

Jupiter's success is proof of the growing popularity of DeFi applications and liquidity aggregators' role in facilitating trades across multiple DEXs. As more users enter the DeFi space and seek out the best prices and execution, liquidity aggregators like Jupiter will likely continue to play an essential role in the DeFi ecosystem.

Some of the exciting opportunities for builders in the aggregator space are:

Build a complete DeFi UX aggregator where users can access multiple opportunities like swaps, yield-bearing opportunities, borrowing rates, execution for perpetual futures, the cheapest/most expensive option premiums, etc. This can be similar to Step Finance but with a more friendly UX and a mobile-first approach, like a super Backpack app for Solana.

Jupiter-like aggregator for on/off-ramps: It will help in concentrating liquidity and helping users find the most optimal route with the lowest fees and a unified KYC to abstract away onboarding for each platform and have better fraud detection engines, significantly increasing UX for consumer apps. On top of that, attract more non-custodial on/off-ramping solutions and partner with local fintech companies to support non-card-based local payment methods to provide comprehensive options to the users.

7. Enhancing Portfolio Management and Analytics

Symmetry, Step Finance, and Sonar Watch are all portfolio management and analytics tools for the Solana ecosystem. These platforms help users to track the real-time performance and value of their positions on the Solana, including farming, staking, and other yield strategies. One differentiating feature of Symmetry is that it allows anyone to create or purchase an index. Sonar watch also has sophisticated tools such as DEX manager and IL calculator.

However, Solana-based portfolio management apps have limited features compared to more comprehensive, multi-chain platforms like Zapper; it may become less appealing for users who want a more comprehensive portfolio management and analytics solution. The competition is also high as there are many well-established, multi-chain platforms such as DeFiYield, CoinStats, and Starlight. This can potentially lead to limited adoption of these platforms as the switching cost of these apps is not high.

Apart from these, there are also a few things that can hinder mass consumer adoption of DeFi, this includes but not limited to:

Missing localization: Every DeFi product has the same story to sell to users, highlighting APYs, low fees, and rewards. However, those products are challenging to access by non-English speakers or those with banking or crypto restrictions in their locality. This is a problem, as these users are the ones who could benefit from DeFi the most.

Onboarding new users is a clunky process: the on/off-ramp hasn’t been solved extensively, and self-custody requires more education.

The case for a mobile-friendly dashboard app

There is a lack in terms of sticky consumer apps, especially mobile apps. We need products so good that people will learn self custody to use them. Projects that have seen traction are mostly speculation-based products that are not yet focused on providing more practical use cases like lending, insurance, and other financial services. Rather, they are designed to cater to traders and investors seeking to make a profit through trading and investing in different DeFi tokens.

Though this is true of all crypto apps, it is especially important for portfolio management projects to have a mobile app. For the majority of users, opening their computer only to check their portfolio involves too much work and needless friction.

As the DeFi market continues to grow, portfolio management and analytics platforms on Solana can play an important role in helping users navigate and make the most of the ecosystem by providing rich data insights and analytics that can assist users in making more informed investment decisions.

It would be a game changer to have mobile apps that instantly display all information about your portfolio at your fingertips. With the launch of Solana’s Saga, there is a good opportunity for projects to build that for the Saga dApp store.

Insurance

As more users enter the space, users will need to manage their risks and protect their investments. This presents a vast market for insurance providers to offer coverage and protection against potential losses. The development of open risk protection models, like the one created by Amulet, is an exciting opportunity to create a new model for the entire risk protection sector. The traditional insurance industry is built on a centralized model, often leading to high costs, slow processing times, and limited coverage options.

Decentralized insurance protocols can offer more affordable and efficient solutions. These protocols can eliminate intermediaries and administrative costs, enabling them to provide more comprehensive and affordable coverage options to users.

NFT Finance

Solana is the second-largest chain for NFTs by volume and hosts one of the most active NFT communities. The NFT Finance or NFT-Fi landscape is also heating up with Frakt, Rain, and Sharky, allowing for NFT Lending and Borrowing, while Decalls allows for trading NFT Options. We will see more co-mingling of Solana DeFi and NFTs going forward.

8. Expanding Bridges and Oracles: Infrastructure Connecting DeFi

Wormhole and Pyth lead the bridging and oracle space in Solana DeFi, respectively. However, we see a lot of advancements in this space.

Interoperability protocol and cross-chain bridges:

Cross-chain interoperability is a critical aspect of the DeFi ecosystem. Wormhole is a message-passing and interoperability protocol that connects multiple blockchain networks to provide cross-chain compatibility. For context, $25 billion of capital flowed through during its peak in the month of March 2022. Wormhole has an expanding ecosystem of protocols that are leveraging its capabilities.

Another much anticipated cross-chain protocol is Circle’s Cross-Chain Transfer Protocol, which enables the bridging of USDC by burning and minting the token on the source and destination chains. The Portal Token Bridge (Wormhole itself), Atlas, Allbridge, and Mayan Finance (using Solana as the omni-chain layer for cross-chain trades) are other protocols that offer cross-chain transfers and swaps. While these bridges offer many benefits, such as permissionless transactions and smart contract composability, they also present some challenges like security.

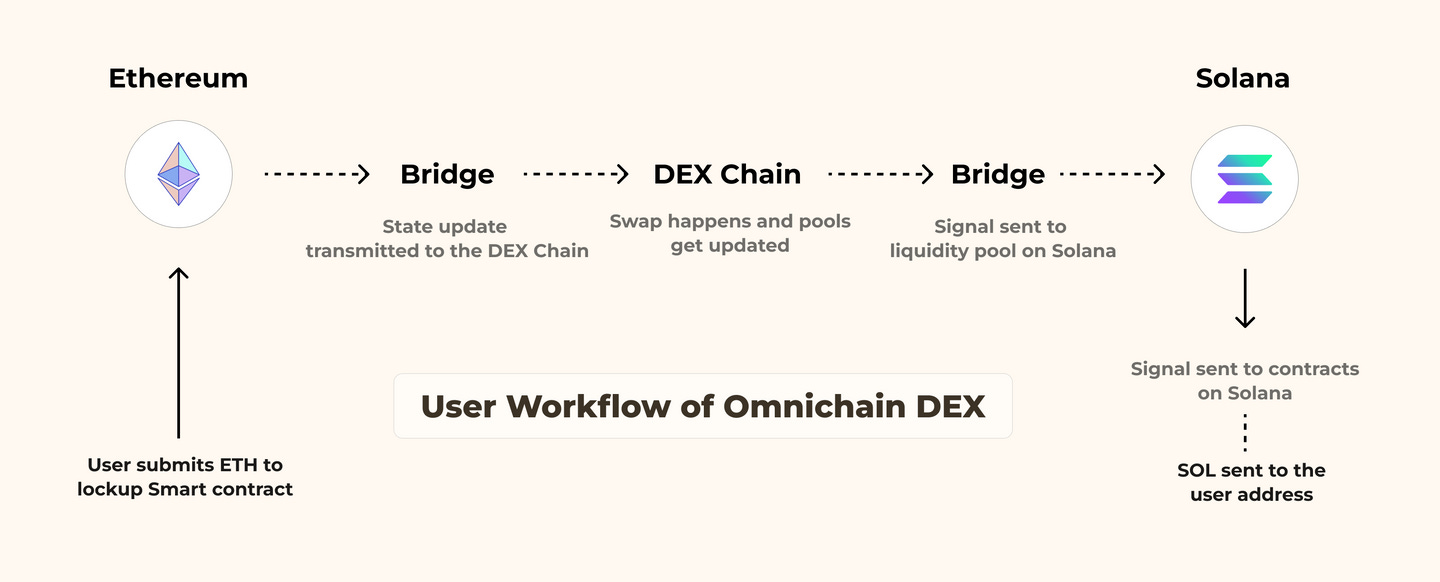

An alternative solution to such token bridges is “omni-chain DEX,” which combines both CEX and token bridges. Think of them as Uniswap, but for bridges. Just like Uniswap, anyone can add liquidity to any asset. Instead of wrapping, the sender converts the token to a native bridge token, then the receiver gets the bridge token through the DEX’s native chain and converts it back to the desired token. However, the middle chain induces its own vulnerabilities, and with extra swaps comes an additional layer of fees and slippage.

Solana has over-dependence on Wormhole as the only cross-chain liquidity, and all the bridges are built on Wormhole as the core messaging layer. Currently, most other bridges are focused on EVM and Cosmos-based chains. For them, adding Solana would require extra development effort due to different runtimes. However, we are seeing bridges adding support for Solana in the coming months.

Some of the exciting opportunities in the cross-chain interoperability space can be:

Native asset swapping: it is a major headache to unwrap wrapped assets on the destination chain and have a total bridge time of 10–20 minutes (or days). "Native asset swapping" may be the answer in this situation. In this process, a USDC on the destination chain, let's say Ethereum, is created when a source chain, let's say Solana, burns a USDC. With assets like USDC being really interoperable between chains, Circle’s Cross-Chain Transfer Protocol can provide a wide range of seamless applications in payments and lending.

Cross-chain identity: As the on-chain identity market gains traction, interoperability between chains will be a huge opportunity, and it will enable developers to request user information from other networks. One of the largest identity ecosystems is ENS (Ethereum Name Service). What if developers can build a "Login with ENS" system even on Solana or Sui by accessing users' cross-chain data (xData).

In essence, the end user's avatar, name, wallet address, and other details can be read by applications on other chains without the user having to re-upload that information on a different blockchain. Another significant opportunity in this direction is cross-chain reputation.

Good UX and trusted cross-chain dApps: We need to produce a user experience comparable to what we have with Web2 applications, where you don't feel like crazy things are happening in the background. We must ensure that nothing is lost in transit and that everything is fully secured as the blockchain's isolated states come together over bridges. Because at the end of the day, if users lose money, that’s the ultimate bad user experience. Just like globalization in the 1990s gave rise to multinational corporations, with cross-chain interoperability, cross-chain applications will enable anyone to experience the ascending web3 world seamlessly with 100x better UX.

Oracles:

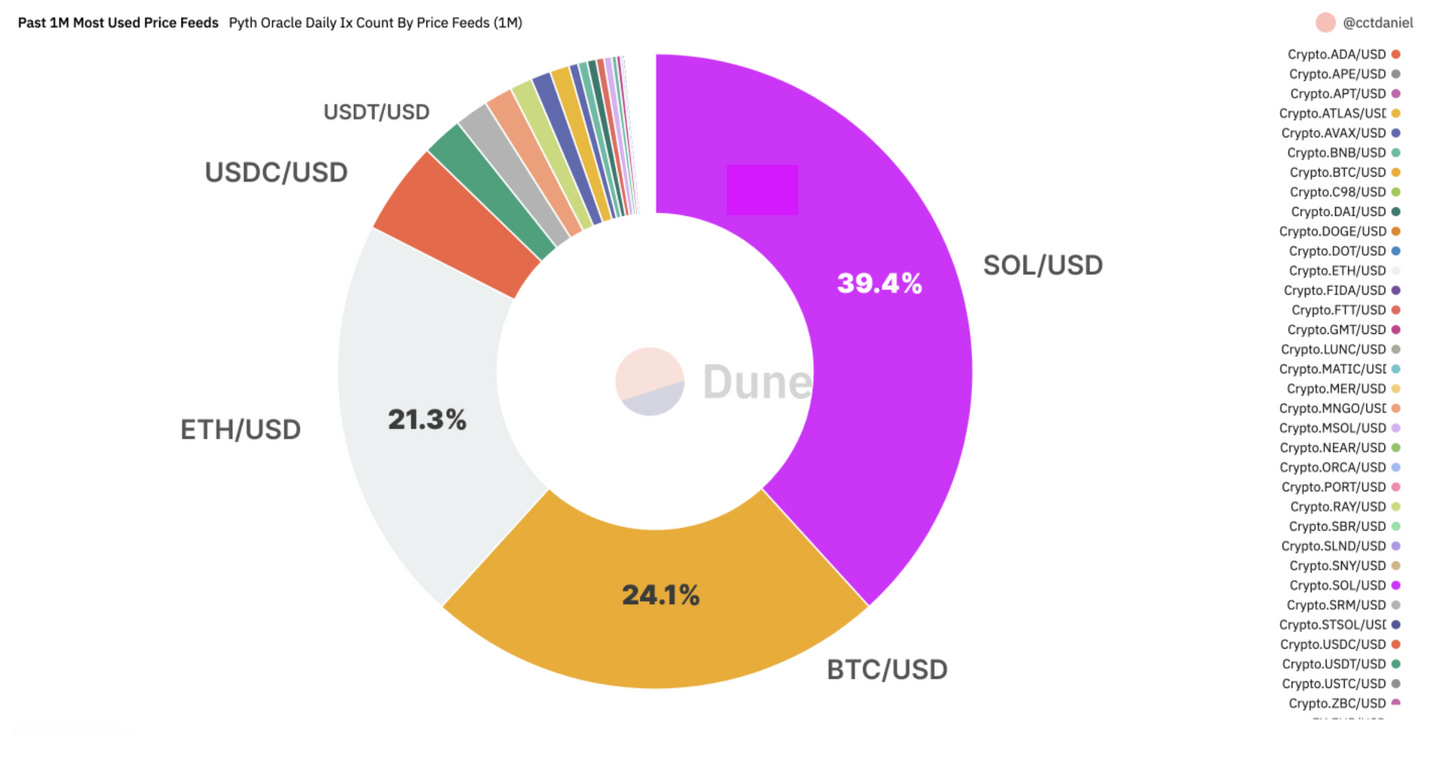

To access off-chain data, “oracles” are needed. Think of oracles as bridges to the external world. Pyth launched on Solana mainnet in August 2021, after launching on devnet in April 2021. In just over a year, it had secured over 90% TVS (Total Value Secured) of Solana’s addressable market, 550K+ client downloads, and half a billion value secured.

While Pyth is a dominant player on Solana (>90% market share), Switchboard is another emerging player on Solana. In the Ethereum ecosystem, there are established players like ChainLink that pose a serious threat to oracles on Solana in the multi-chain future. In comparison, ChainLink has 1000+ data consumers, with 12+ blockchains supported and a $75 billion total value secured at its peak in December 2021, with a cumulative transaction value enabled of $6+ trillion. Currently, the data feeds are dominated by crypto-USD pairs; however, as we take more and more applications and financial assets on-chain, the need for reliable external data will only increase exponentially.

RWA on-chain: with more and more real-world assets like trade finance, revenue-based finance, carbon credits, and real estate coming on-chain, there will be an immense need for reliable data for these external assets. For instance, if someone wants real estate in New York to be tradable on-chain, they would need a price oracle for real estate through which they can get reliable and robust prices. One project in this space is Parcl. It enables users to trade the global price movement of real estate assets by giving them permanent exposure to synthetic assets through an AMM. Apart from this, Homebase on Solana is already building a platform that enables users to invest in tokenized residential real estate for as little as $100 with fractional ownership represented via NFTs.

Weather, politics, and sports: With these oracles focussing primarily on “financial markets” data right now, there lies a ton of opportunity to build for non-financial sectors. An obvious use case here is prediction markets, where smart contracts require reliable data sources for settling bets related to topics like sports. Finding reliable data publishers would be the key.

9. Formation of DeFi Organizations:

Enabling coordination between Solana DeFi players is more critical than ever.

A risk management organization: this can be structured as a Risk DAO or an advisory board, which does research and risk analysis for DeFi protocols. These entities can publish public “Risk Analysis Dashboards” with key metrics for the Solana ecosystem and offer paid research, risk assessment frameworks, and risk rating services to DeFi projects.

A proximity labs-like R&D organization focusing on providing DeFi-related research and development services to DeFi projects and Web2 enterprises. Proximity has been a major driver of DeFi in the NEAR ecosystem and has recently launched a $10 million dedicated order book fund, one of the main reasons why NEAR already has 3 major order books.

Another idea can be to have a consortium of DeFi projects which manages critical public DeFi goods like OpenBook, Wrapped BTC/ETH, and so on, with key stakeholders being incentive aligned.

10. More Secure and Stable DeFi on Solana

The importance of security in DeFi cannot be overstated. There have been exploits of various DeFi protocols like Wormhole, Nirvana Finance, Crema Finance, Mango Markets, etc. This resulted in significant losses of funds, which clearly indicates the need for increased attention to security measures. The truth is real people and institutions are losing real money due to these exploits. In all these cases, hackers managed to take advantage of code-level flaws and platform-level (i.e., oracle) flaws which could have been avoided by getting the code base audited by a credible third party and also by giving attention to each product decision that could lead to anything suspicious.

As more sophisticated hackers attack DeFi, protocols must have the foresight and a deep understanding of their product. Having a standard security measure for anyone building a DeFi protocol is necessary to ensure that the ecosystem as a whole is protected. This could include requirements for security audits, open-sourcing the codebase, and frequent code reviews to fix potential vulnerabilities.

Lastly, Solana cannot have anymore downtime, which affect the DeFi ecosystem more than any other sector due to stale asset prices, halted trading activity, etc. Maintaining 100% uptime is critical for the long-term success of Solana DeFi.

Closing Thoughts: Solana DeFi 2.0

While Solana DeFi has a fair share of its problems, we believe 2023 will be the year when many of these problems will be solved. Broadly, we will see Solana DeFi play the themes of:

Going Mobile: Solana’s flagship mobile phone, SAGA, along with mobile-friendly standards like Solana Mobile Stack, Solana Pay, and xNFTs, will propel Solana DeFi to go mobile, leading to the rise of SuperApps and UX aggregators.

Asset Tokenization: Credit markets have already started getting tokenized on Solana, and we will see more credits like personal loans, trade financing, revenue-based financing, carbon credits, and so on getting tokenized. However, given Solana’s high performance, tokenizing high-frequency traded assets like forex, stocks, and so on would be interesting to watch out for.

Cheers for staying with us — We are excited for what’s next in Solana DeFi!

Feel free to contact us at Sitesh, Anna, and Yash for any suggestions or if you have any opinions. If you find this even slightly insightful, please share it — it justifies our weeks of effort and gets us more eyeballs :)

Special thanks to all the DeFi projects, who have reviewed and provided insights at different stages of the draft (the list is too long!)

Further Readings:

Disclaimer: This essay is completely our personal perspective and thoughts on the Solana DeFi Ecosystem and in no way represents any organization we might be associated with. Given the comprehensive and informal nature of the essay, some amazing projects might have been missed or received lesser attention as compared to other projects. None of this is financial advice or any recommendation towards a particular project.

Incredible work!

Brilliant article. I have one concern though. Velocity has an inverse relationship with TVL. Is it fair to compare TVL of 253M vs with 5B on Velocity? I understand the relevance of the metric when two chains with comparable TVL are being evaluated. This might not work in this case.