Solana Derivatives Landscape: OPOS Perps Mechanisms

State of the perps and options markets on Solana ft. Drift, Jupiter, Zeta, Mango, Flash and more.

$600 trillion! Yes, that’s the market size of the whole world’s derivatives i.e. the notional amount of contracts outstanding in 2021. Crypto derivatives are still a tiny portion, and on-chain derivatives are almost negligible.

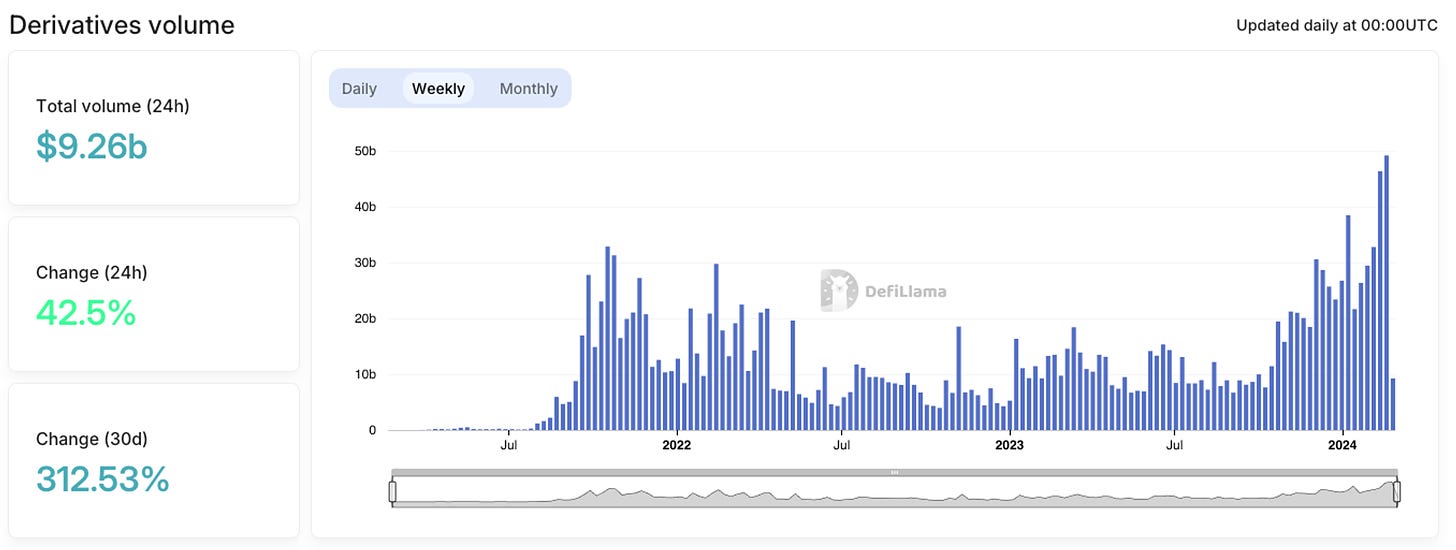

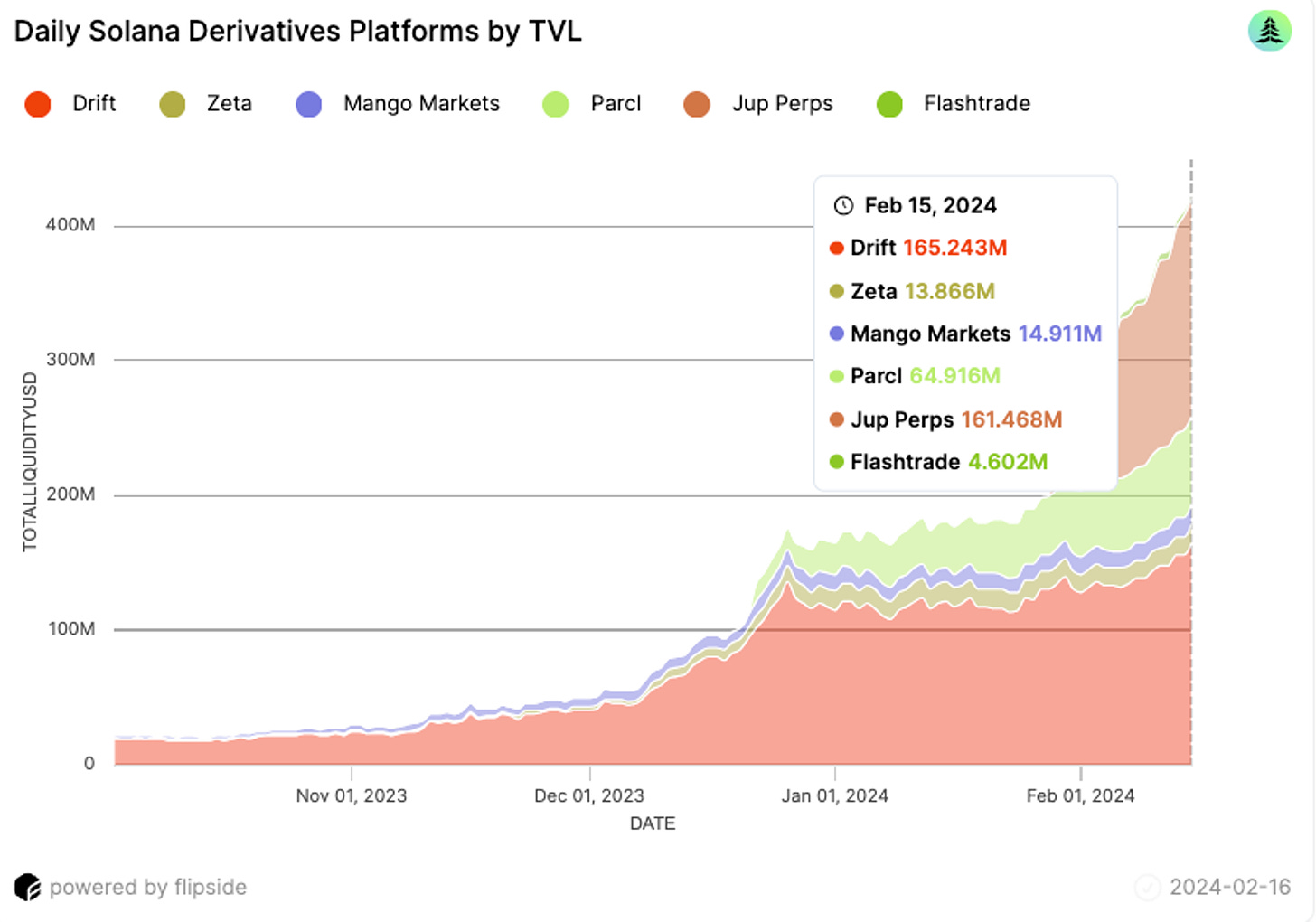

Despite that, the on-chain derivatives volume just hit an all-time high recently. Showing us what true traction and the early stages of adoption look like.

Derivatives can be primarily of two types: Futures and Options.

In Crypto, futures are primarily perpetual futures or futures which don’t expire. The most popular derivative contract within crypto is the perpetual swap or perpetual future. If you’ve been in crypto for more than a few months, you’ve definitely at least heard of “perps. Perps are essentially futures without any expiry date. Perpetual swaps (aka perps) are the lifeblood of crypto trading. Perps are ~2/3rds of trading volumes compared to only ~1/3rds for spot volumes. While CeFi perps are doing >$200 billion in volumes, DeFi perps are doing <$2 billion in daily volumes!

For the uninitiated; perpetual contracts are derivatives that constantly settle and have no expiration, hence the name perpetuals. This contract allows users to go long or short assets with significant leverage (upto 100x). They are tied to the underlying asset’s market price through a funding rate mechanism. When the price of the perpetual contract is higher than the underlying’s spot price, the funding rate is positive – meaning longs pay the funding rate to shorts. The opposite occurs when the perp contract trades lower than the underlying spot price.

In this essay, we will focus primarily on the perps, while also looking at the rising option protocols.

Why Solana for Perps:

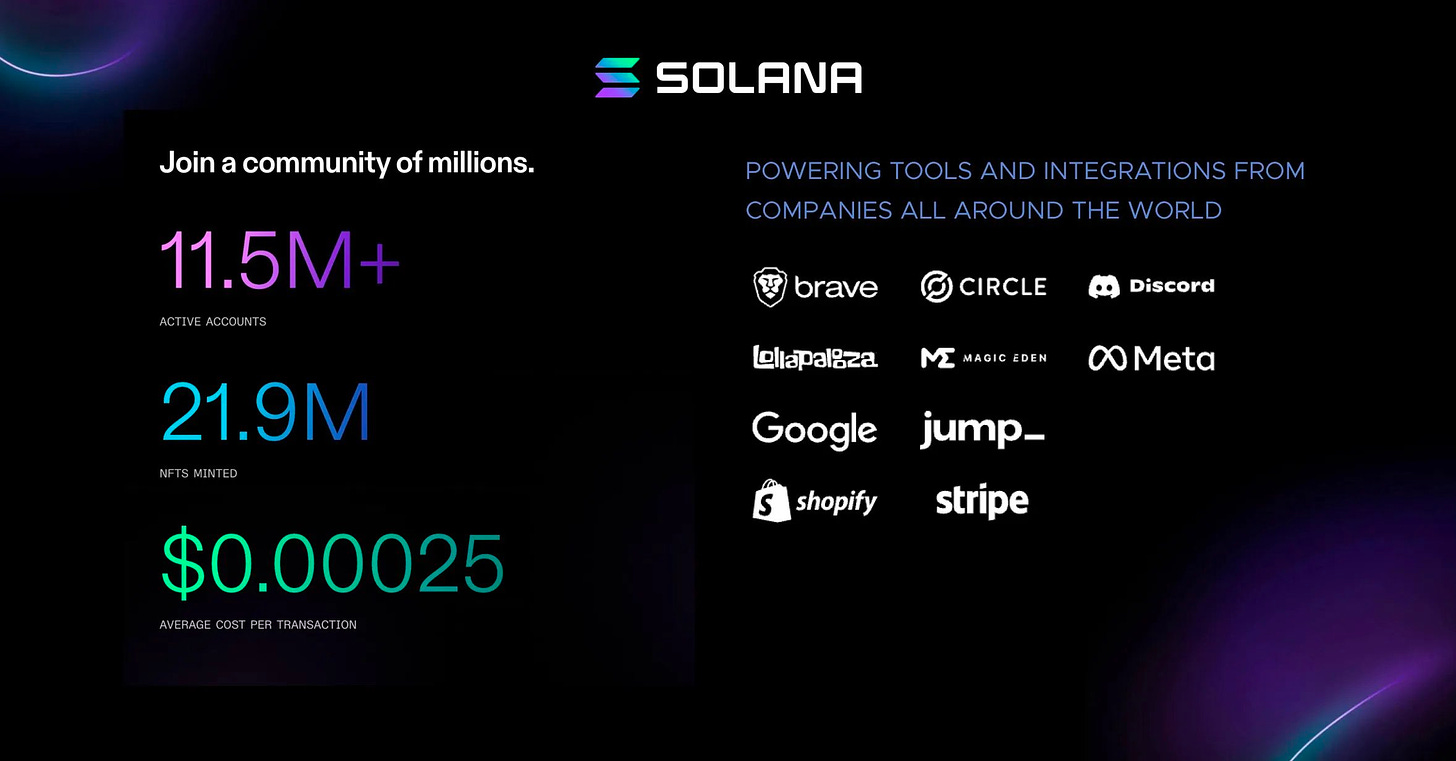

Given deep roots with FTX, Solana has always been a hotbed for derivatives. Famous for giving birth to multiple structured products in peak bull run of 2021, it has a vibrant derivative landscape.

Low fees: This enables trading at very low fees

High TPS: This is particularly critical for order book-based perp DEXs.

Liquidity and Ecosystem: This enhances market stability and trading opportunities as the increasing user base contributes to perpetual swap liquidity.

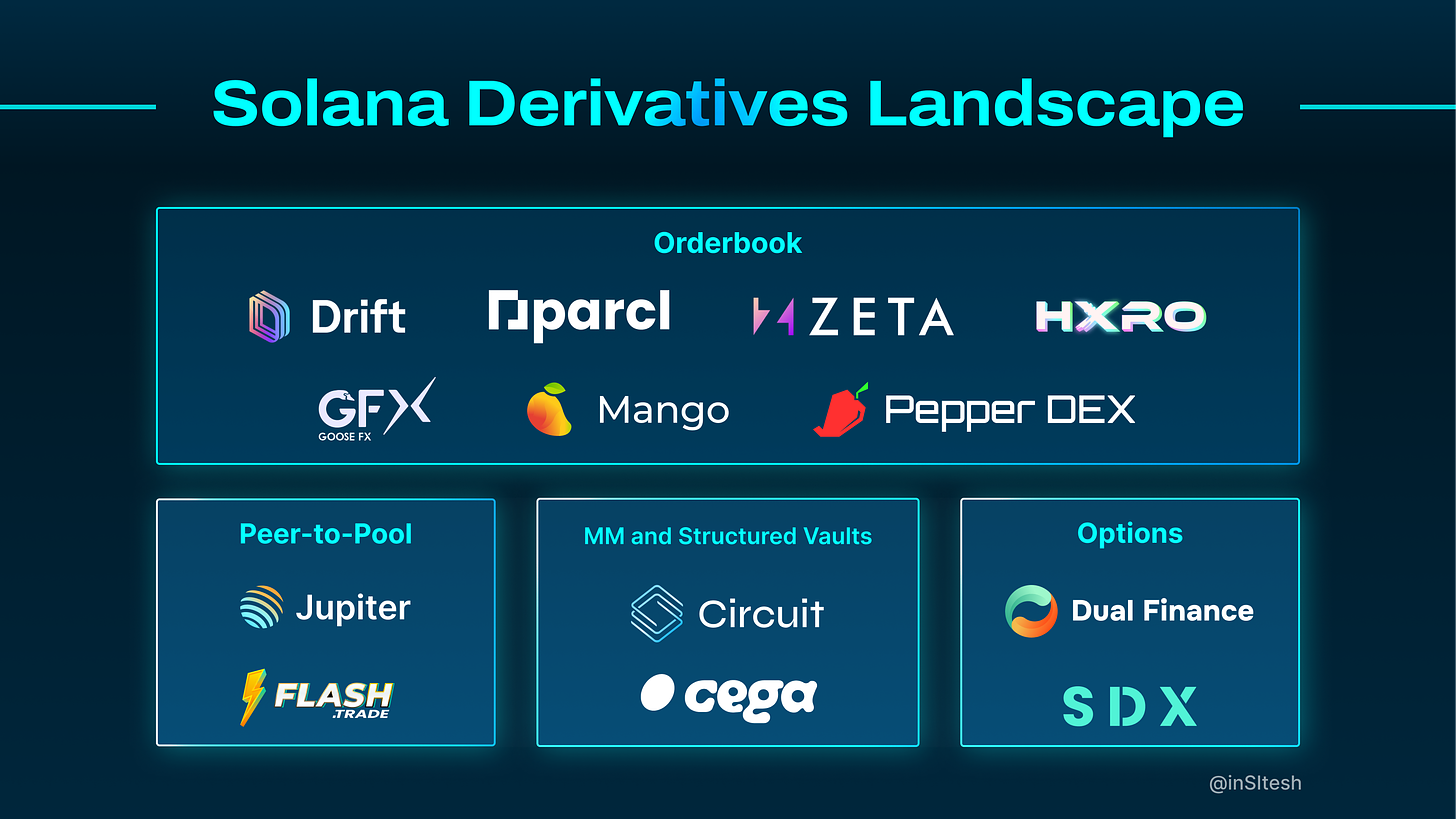

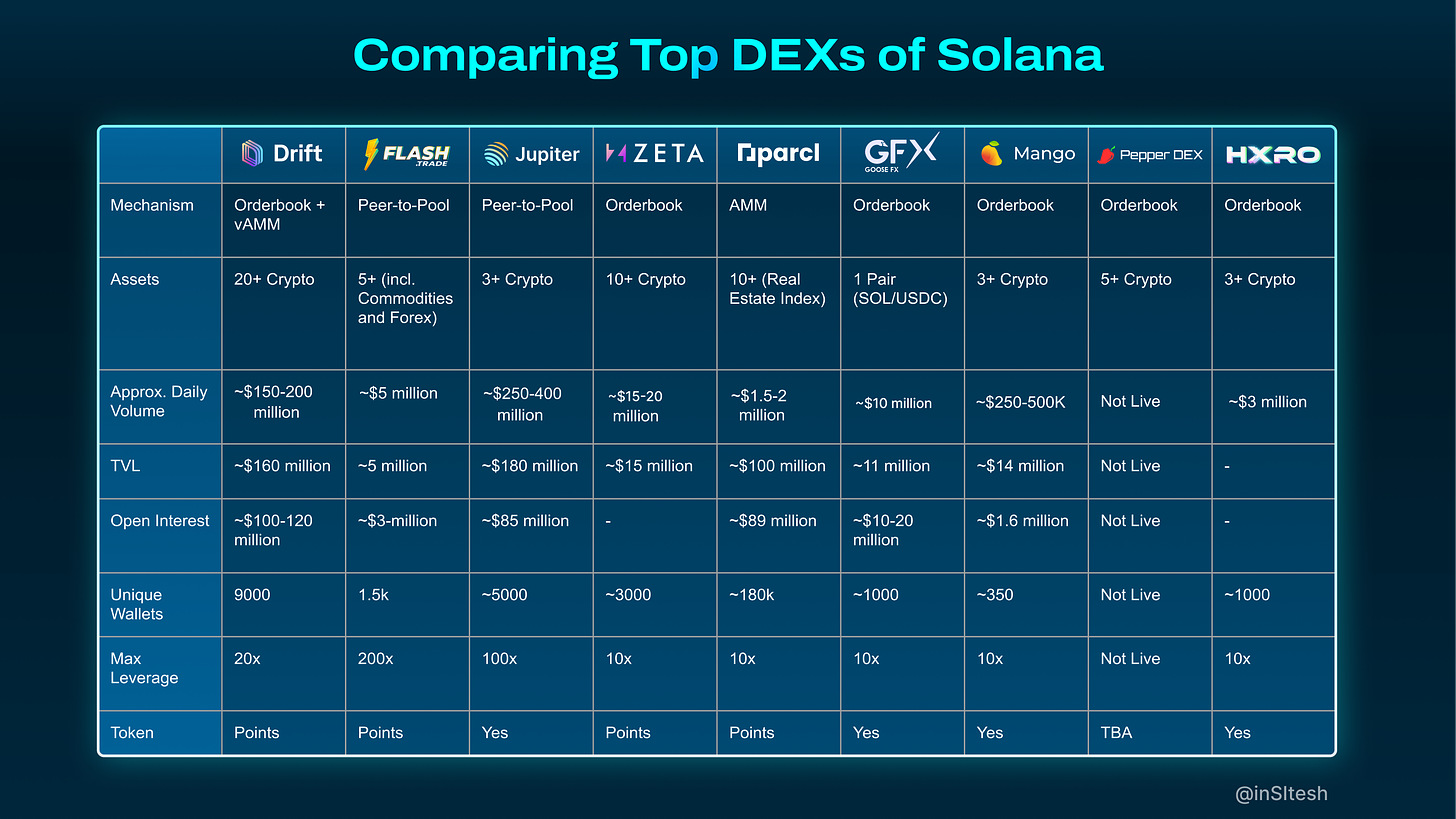

We can broadly categorize Solana derivatives into:

Peer-to-Pool Perp DEXs: Jupiter, Flash Trade

Orderbook-based Perp DEXs: Drift, GooseFX, Zeta, HXRO, Pepper, Mango

Market Making Vaults and Structured Products: Cega, Circuit Trade

Options: SDX Markets, Dual Finance

1. Drift Protocol:

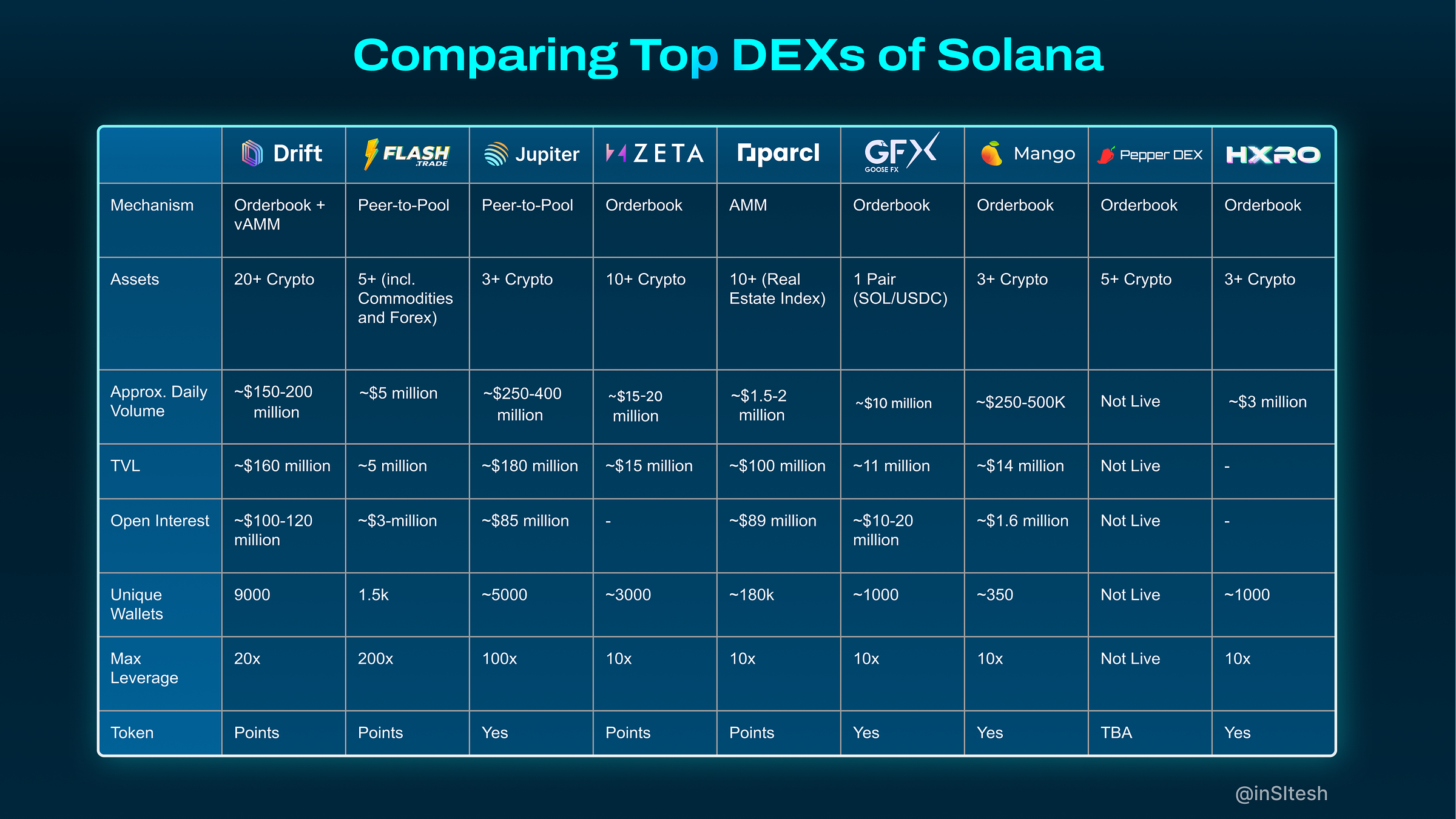

Drift v1 was launched at the peak of a bull market (November 2021) after raising a seed round from top-tier investors. It was built upon the virtual automated market maker (vAMM) model, pioneered by Perp Protocol. In under 6 months, Drift v1 saw rapid success with > 15,000 cumulative users and $10 billion+ in trading volume, driven by high market activity.

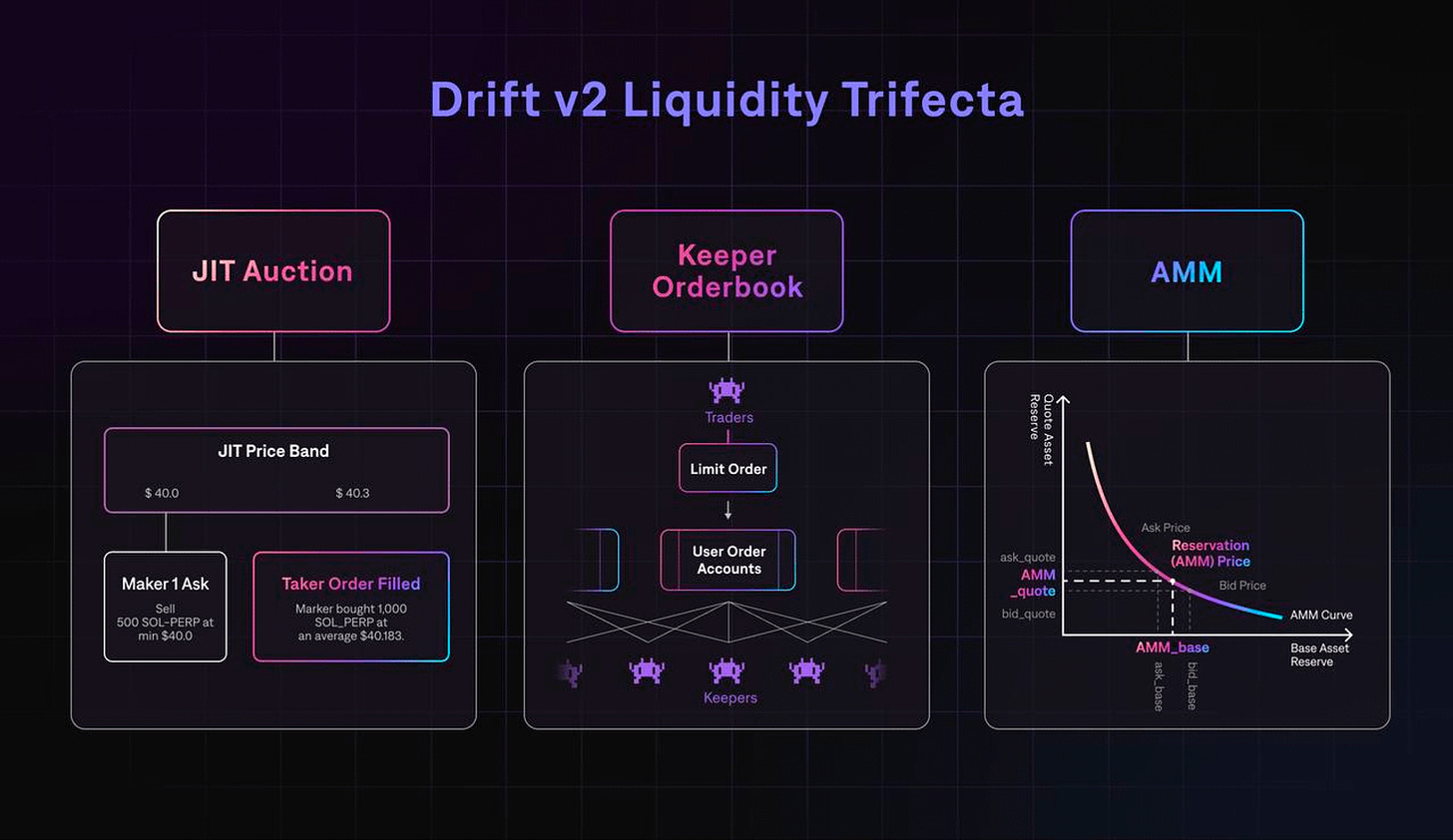

This early success led them to iterate and release Drift v2 with a pioneering liquidity mechanism to solve liquidity challenges. Enter Drift’s liquidity Trifecta, composed of 3 liquidity mechanisms:

Just-In-Time (JIT) Auction (The first layer): When a user creates an order, it is first routed through the JIT mechanism – a 5-second Dutch auction (price starts from best which is closer to Oracle price via Pyth network). The market makers compete to submit quotes within 5 seconds.

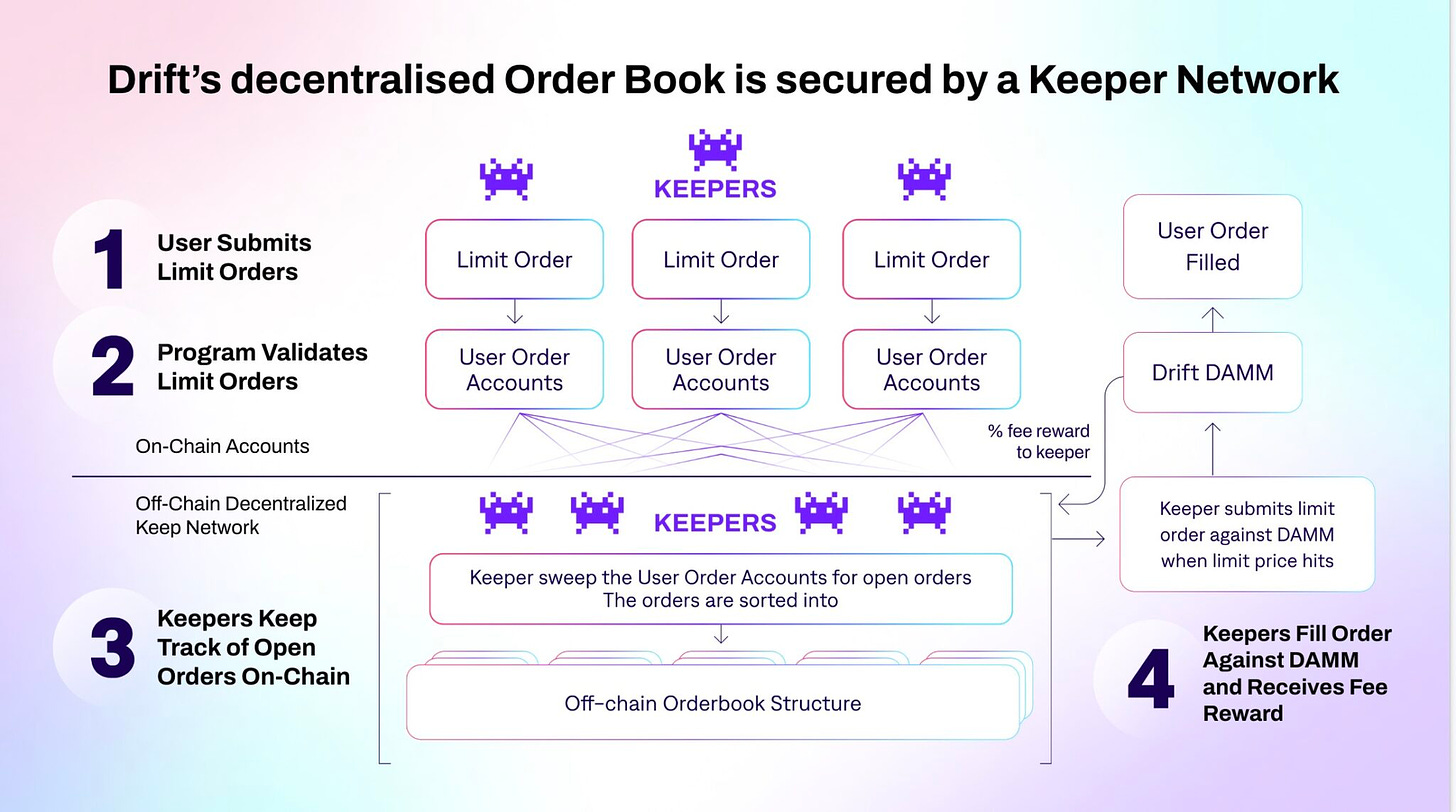

Orderbook: When on-chain limit orders (Buy or sell at a specific price) are placed, a network of keeper bots sort them from oldest to newest into an off-chain order book and start filling them to earn trading fees.

AMM: What happens if no market maker steps in the Just-in-Time auction? AMM pool acts as a backstop liquidity provider; if market orders aren't filled (partially or wholly). AMM allows Drift to launch new markets without market makers, with just a reliable oracle price.

These mechanisms work sequentially to ensure orders of any size are filled with minimal slippage. Drift isn't just focussing on Solana users: To attract EVM users; it also has in-app bridging via Mayan Finance.

Using Drift, one can also: Borrow and Lend for trading, Swapping, and Spot Margin Trading and provide passive Liquidity via Drift Liquidity Provider (DLP).

Drift has a market making vaults product — Circuit Trade

2. Jupiter Perps:

It’s a GMX-type implementation based on a novel LP-to-trader, offering up to 100x leverage. It utilizes LP pool liquidity and oracles, which ensures zero price impact, zero slippage, and deep liquidity. Oracles enable stable market operations during liquidations and stop-loss events, removing risks of position bankruptcy and LP pool fund loss. Users can open and close positions in one simple step, eliminating the need for additional accounts or deposits. With the Jupiter Swap integration, any Solana token can be used to open positions.

It has JLP (Jupiter Liquidity Pool), which consists of 5 tokens, SOL, ETH, WBTC, USDC, and USDT. Users can acquire JLP by swapping on Jupiter Swap. Using JLP, traders open leveraged positions by putting up collateral and borrowing the rest of the position from the pool. The pool has generated over $22 million in fees with 70% of it going to the JLP holders and the rest going to the platform.

3. Zeta Markets:

Zeta Markets started in 2021, has emerged as a prominent player in the Solana derivatives market. It offers a robust platform catering to both individual and institutional investors. Currently, with around 3k average daily users, it stands at ~$15 million TVL with an average of $15-20 Million daily volume happening through the platform.

Unlike Automated Market Makers (AMMs), Zeta Markets utilizes a CLOB model for efficient price discovery and order matching, potentially leading to better pricing and trade execution compared to AMMs. All trading is USDC-margined, ensuring stability and transparency. It allows 20x leverage on select assets (currently including BTC, ETH, SOL, APT, and ARB) and leverages cross-margining to further optimize capital usage.

Zeta Market offers programmatic connectivity via SDKs and CPI programs. With SDKs for Python and TypeScript, developers can build custom trading apps and bots easily. It also allows users to stake their SOL through Zeta's node for additional rewards.

Read our deep dive on Zeta Markets here (it's written 2 years back, but most fundamentals stay the same)

4. Mango Markets:

Mango Markets, like Zeta, is one of the first derivatives protocols on Solana that gained popularity during the 2021 DeFi summer wave. Although Mango Markets has had some achievements and setbacks, it remains open-source and aligned with the community via governance forums and grants to enhance its product and ecosystem.

Spot margin trading is done through Openbook DEX, while perpetual futures are traded on Mango Markets' own order book. Mango Markets is governed by MNGO token holders via the Mango DAO. Currently, with around 200 average daily users, it stands at ~$14 million TVL with an average of $113-15 Million daily volume happening through the platform.

It allows up to 10x leverage on supported assets. With cross-margining/cross-collateralization, users can efficiently use their entire portfolio as collateral, maximizing capital usage.

Hacking Incident:

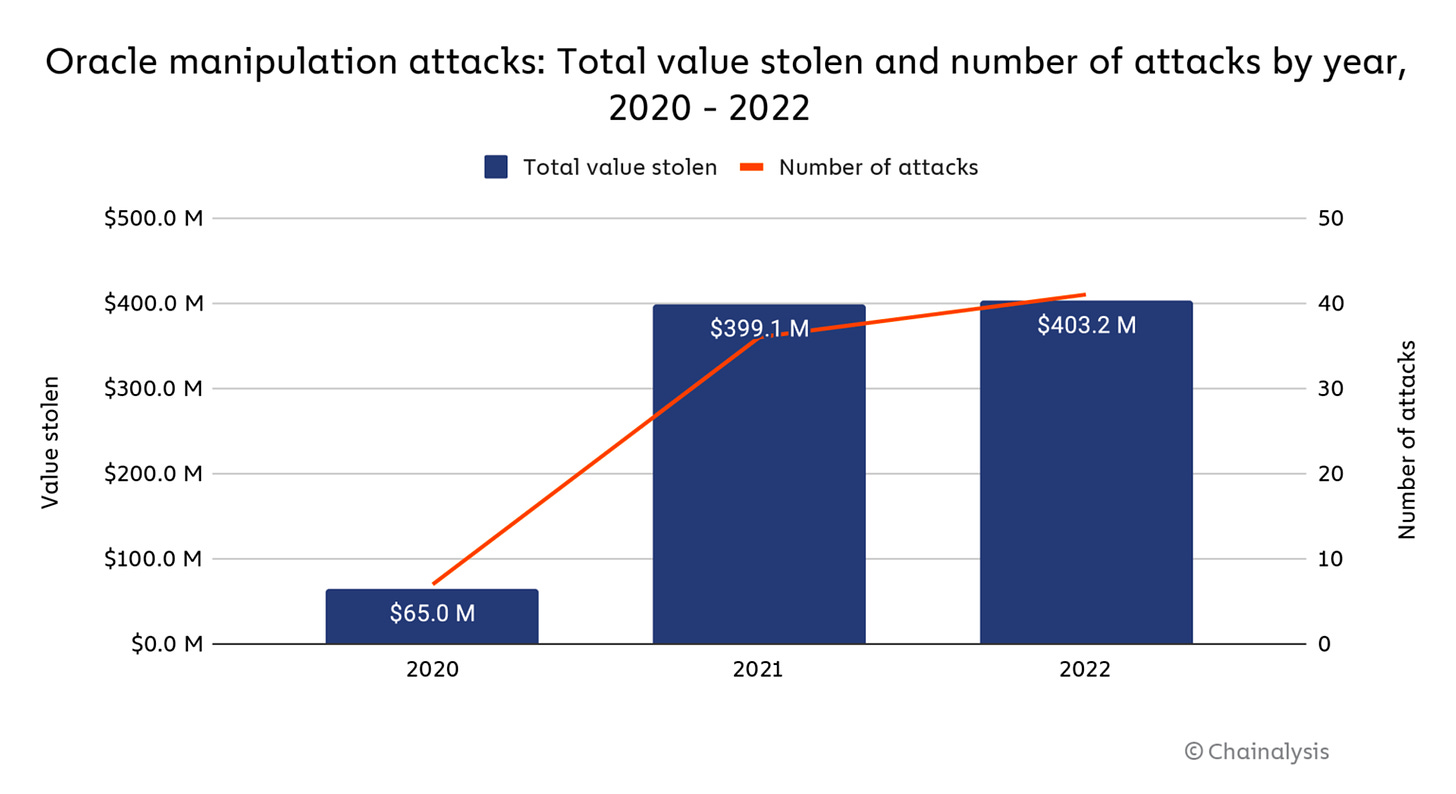

In October 2022, a hacker manipulated Mango Markets' price oracle system, causing the value of Mango's native token (MNGO) to fluctuate artificially. The hacker borrowed assets with minimal collateral and made significant profits.

The Mango DAO offered a $47 million bug bounty for the stolen funds and promised not to press charges if the remaining assets were returned. The hacker returned most of the stolen funds but left behind $67 million.

He publicly defended his actions, claiming they were a "highly profitable trading strategy," which sparked debates about DeFi ethics and regulatory frameworks. The hacker was arrested in December 2022 on charges of commodities fraud and market manipulation.

Despite the setbacks, Mango Markets remains committed to:

Open-source development: Encouraging transparency and community involvement to enhance the platform's security and functionality with its DAO.

Community grants: Empowering developers through grants to contribute to the platform's growth and innovation.

Accessibility and ease of use: Providing various API and developer tools for seamless integration with external platforms and trading systems.

5. Flash Trade

Similar to Jupiter Perps, Flash Trade is a decentralized perpetual swap exchange built on the Solana blockchain. Flash has already achieved more than $300M in trading volume without any token launch or incentive programs. Flash Trade aims to differentiate itself by offering a unique blend of features focused on user experience (UX), deep liquidity, and innovative DeFi integration.

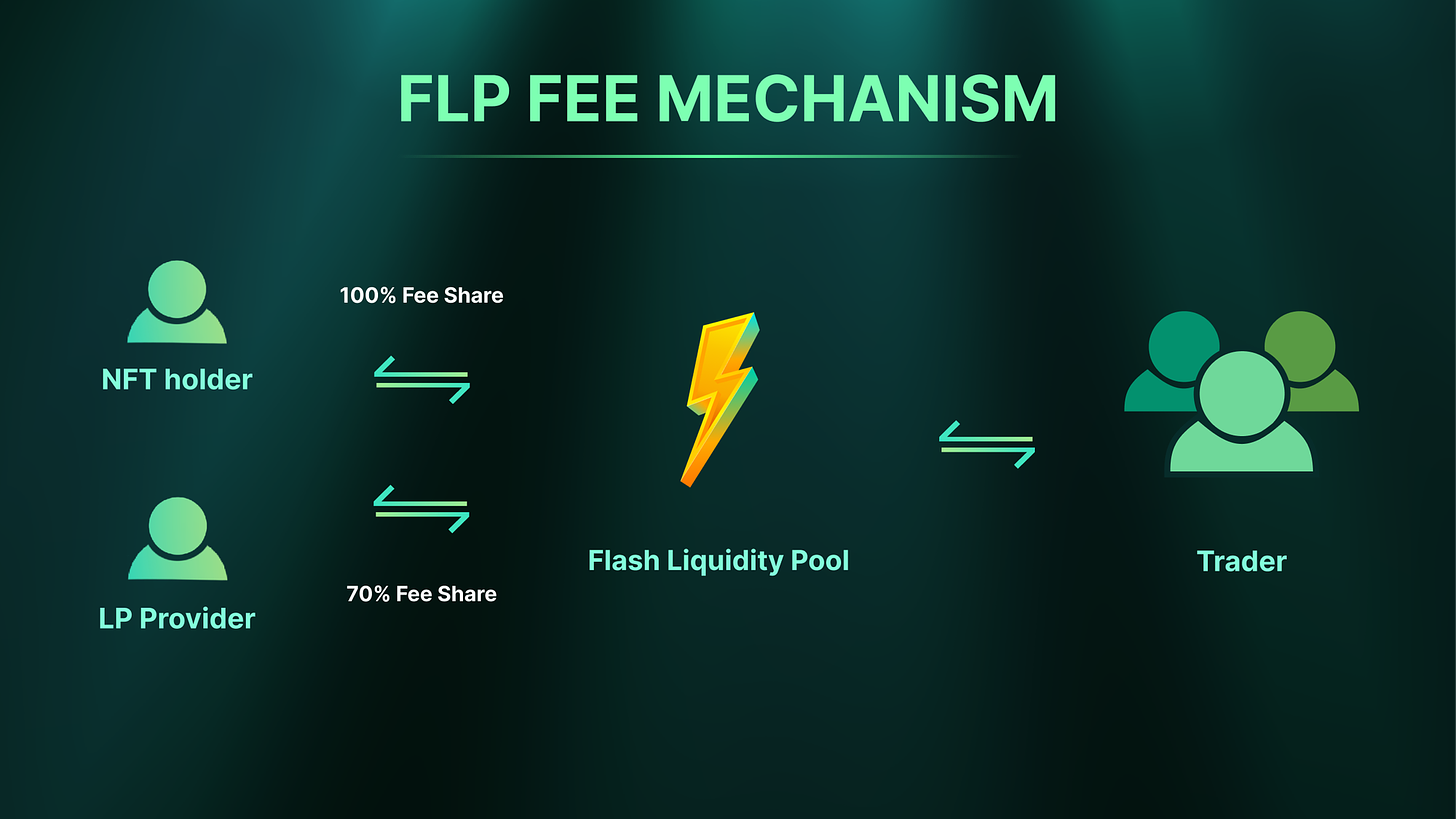

Deep Liquidity through Flash Liquidity Pool (FLP): Unlike traditional order book models, Flash Trade utilizes a single, unified FLP. This pool acts as an index holding top assets like BTC, ETH, SOL, and USDC, ensuring deep liquidity for all perpetual swaps. Making it compatible with all kinds of traders, you can take up to 100x leverage while trading (NFA, too risky). It also allows trading Forex and metals like gold and silver.

Liquidity providers (LPs) depositing assets into the FLP earn attractive yields generated from trading fees and margin interest. It also has an interesting DeFi x NFT integration (similar to Lifinity Flares) where the holders get a rebate in fees, 100% of the fee generated from the platform gets distributed to the holders, and their dynamic NFT can level up through various DeFi activities like trading and providing liquidity.

6. GooseFX:

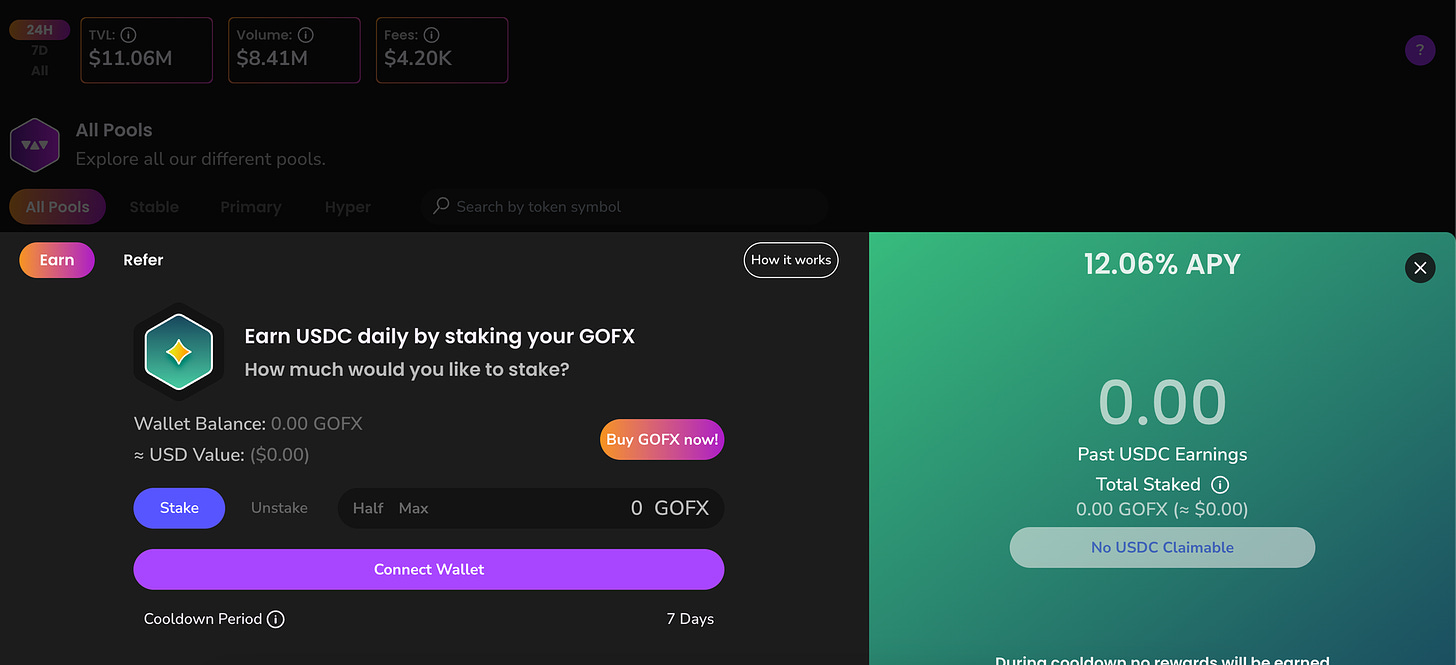

GooseFX Perps Dex is another CLOB-baed DEX, which also offers leverage up to 10x. It’s one of the few perp DEXs with live tokens, and staking GOFX tokens not only provides users with potential rewards but also grants access to lower trading fees.

Holding GOFX tokens gives users reduced trading fees and potential additional rewards. The cumulative volume on the platform has been $550 Million+, but recently the TVL has reduced a bit to ~$12 Million, likely due to better incentives/rewards at other platforms due to airdrop hype/point programs. The platform also offers a software development kit (SDK) allowing users to integrate perpetual futures trading functionalities into their applications or build trading bots.

7. Parcl:

Parcl could be a key example of how tokenization can have a huge upside and we are just getting started in the RWA space.

Parcl offers a novel approach to investing in real estate, aiming to democratize access for individuals with minimal capital. Here's a breakdown of its key features:

1. Fractionalized Real Estate Exposure:

Unlike traditional real estate investment, requiring significant capital, Parcl allows users to invest in fractions of real estate assets, potentially starting with as little as $1.

This fractionalization is facilitated through REIT-like indexes, similar to how traditional REITs pool investor funds and invest in real estate portfolios.

2. Global Reach:

Parcl provides exposure to real estate markets in various cities worldwide, expanding investment options beyond local markets. Currently operational in major US cities and with plans for expansion to London, Jakarta, and Hong Kong, Parcl offers investors a diverse selection.

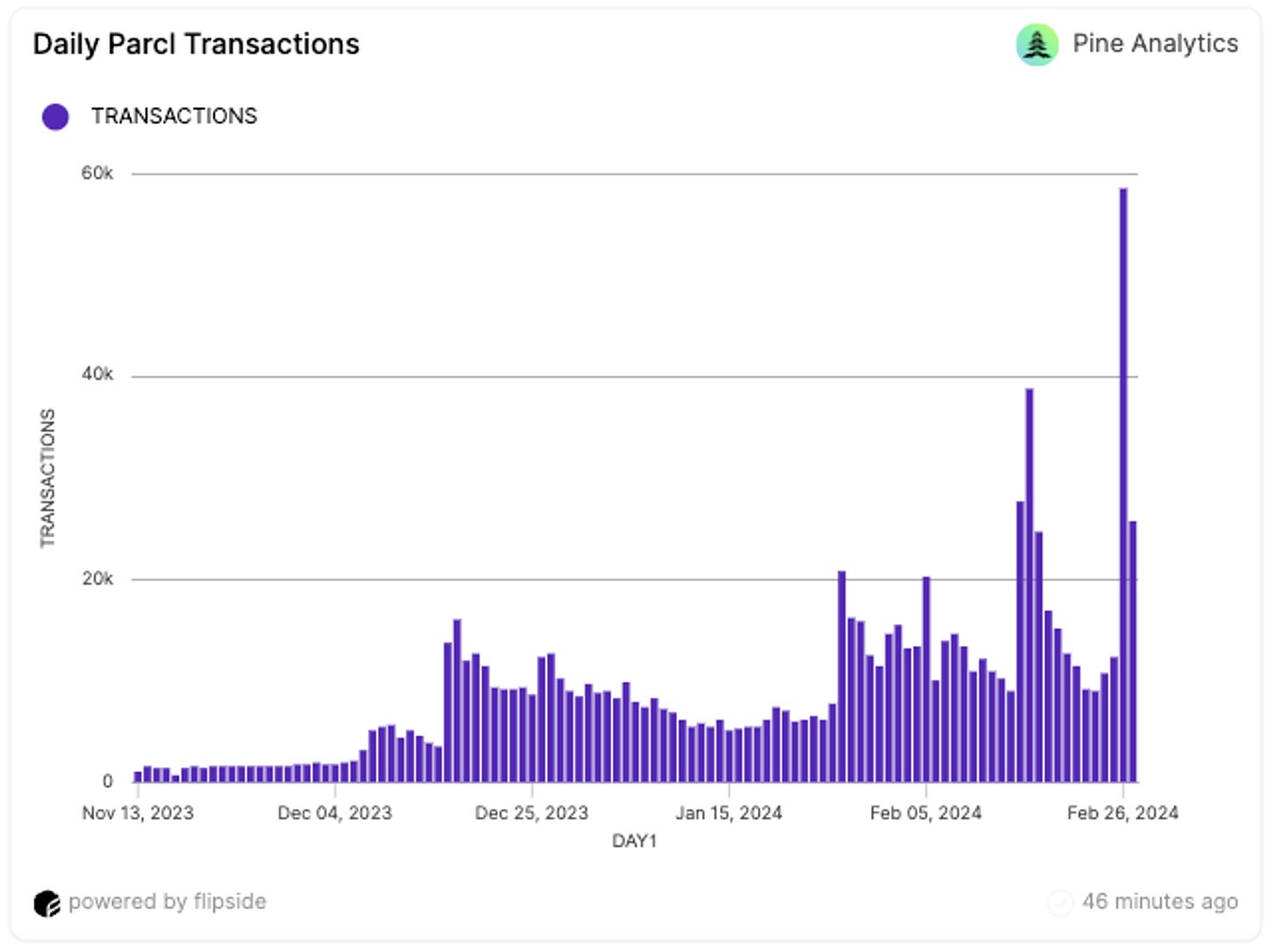

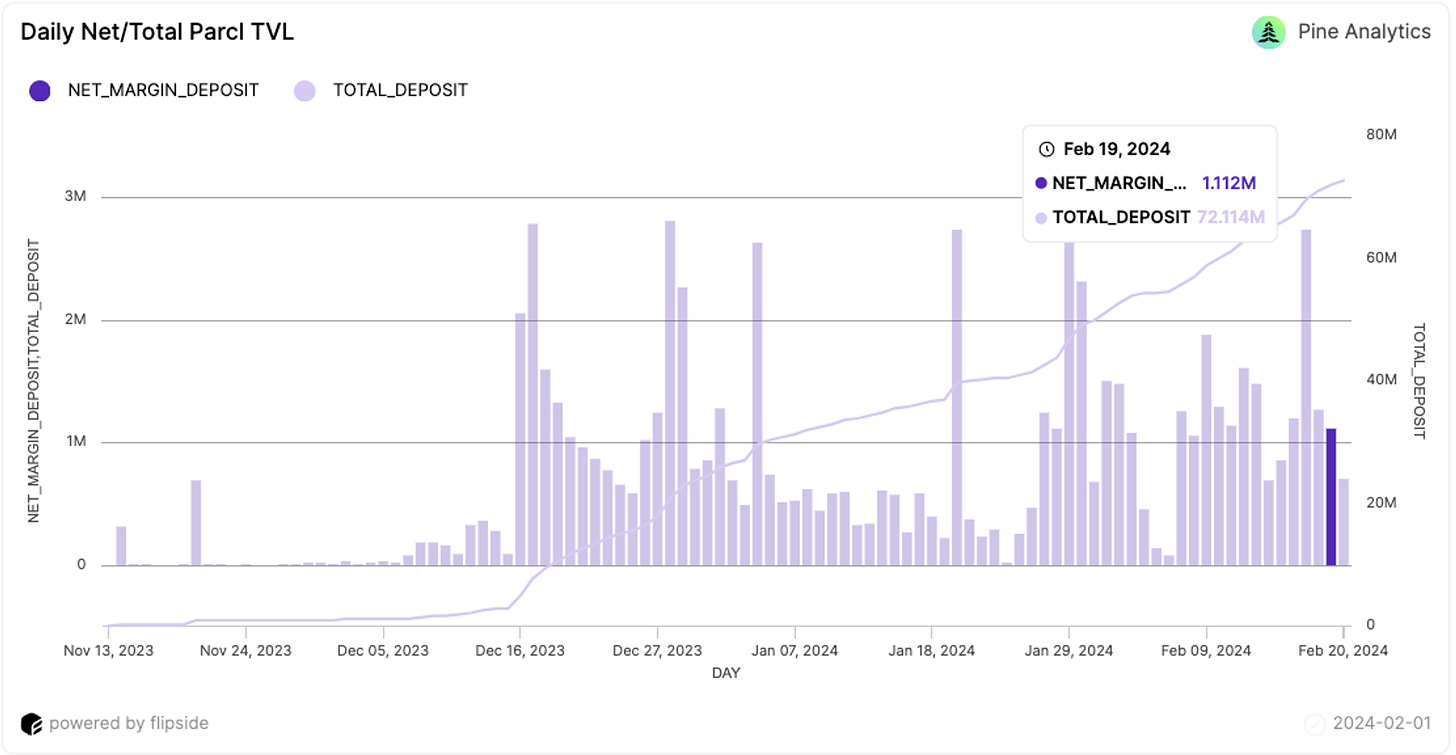

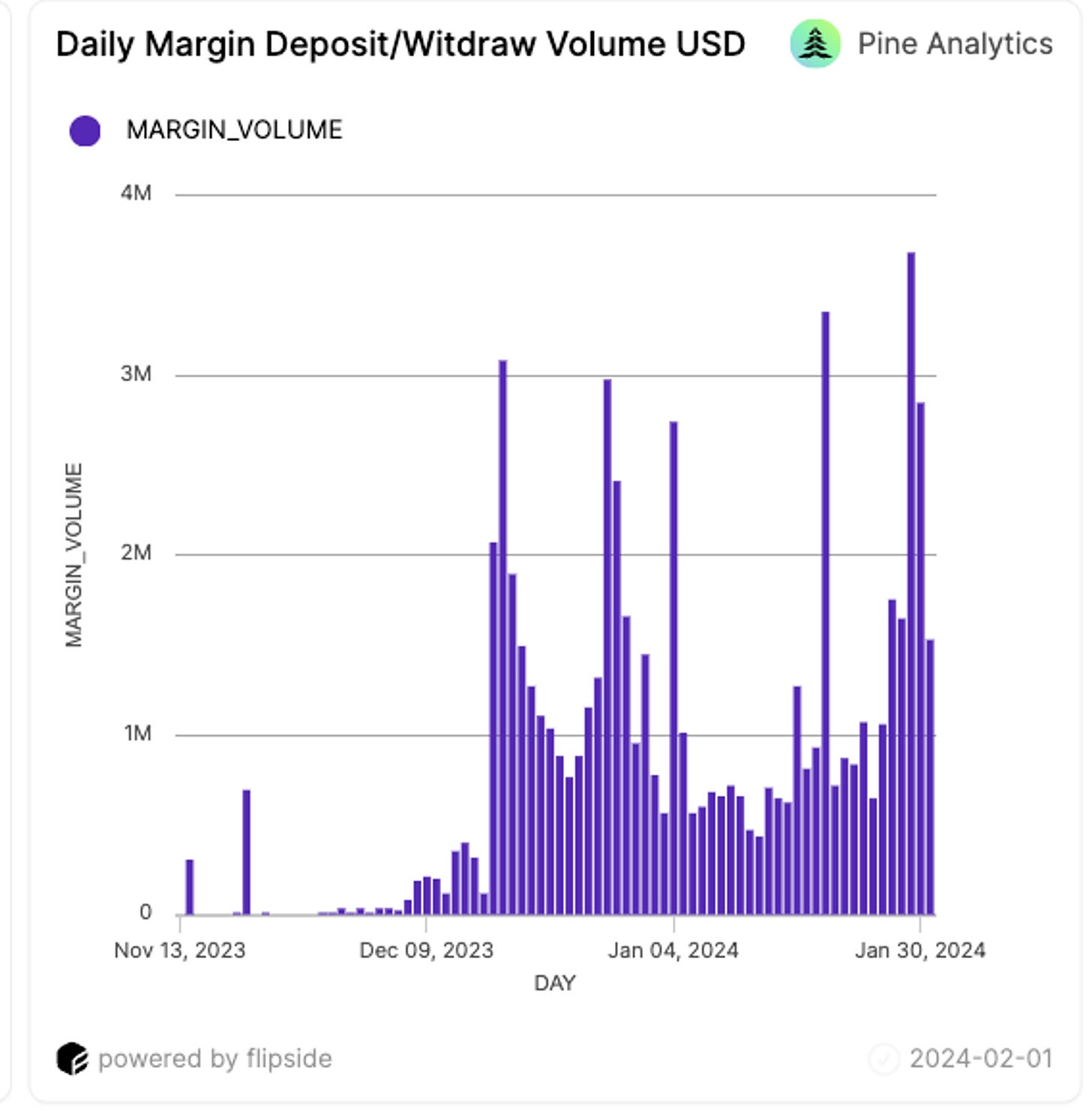

The transactions on Parcl recently hit an ATH and have been on a rally since December. It is likely due to their points program which played out pretty well. Parcl V3 has already accumulated over $72.8 million in total value locked (TVL) and across all versions ~$100 million, with more than 183K+ users using the platform.

Strangely, the average daily volume lies around 1-2million (1-2% of TVL), which feels suspicious, to say the least.

The possible reason could be people are just providing liquidity and not participating much trading activities.

8. Pepper DEX:

PepperDEX is an upcoming perp protocol on Solana, designed to enable spot market, order-book-based perpetual, and expiring futures trading. It’s powered by Hxro Network, which has a derivatives protocol — Dexterity, a global order book for derivatives that allows all Hxro Network dApps to share the same shared global liquidity. It will launch soon along with their PEP token launch.

PepperDEX aims to address the weaknesses of existing DEXs with:

Deep Orderbook Liquidity: PepperDEX leverages Hxro Network's global order book, Dexterity, to ensure liquidity and efficient trade execution.

Extreme Capital Efficiency: Dynamic margining and risk assessments through SPANDEX allow users to maximize their trading power with lower capital requirements.

It also promotes democratized market-making and permissionless vaults for advanced trading strategies. With associations with Hxro Network applications and its ecosystem, Pepperdex can create a powerful network of users and developers building on them.

9. SDX Market:

SDX Markets, is an Option Automated Market Maker (AMM), offers a seamless and accessible platform for trading crypto options. Users can engage in buying and selling fully-collateralized, cash-settled European options including calls, puts, and vertical spread strategies. Arbitrageurs can exploit price discrepancies between SDX and other DeFi option platforms like PsyFinance.

Users can participate as liquidity providers (LPs) by supplying assets to AMM pools and earning passive yield from bid-ask spreads and capital utilization fees.

Addressing DeFi Option Challenges: SDX tackles key challenges in the DeFi options space, including:

By utilizing an AMM architecture, SDX eliminates the need for traditional market makers, lowering the cost of entry for option markets. LPs benefit from better risk-adjusted yields due to options being sold at a premium.

SDX provides quotes across various volatility levels and option tenors, offering a broader range of options compared to traditional CLOB models. It caters to alt-coin option markets through its unique dual asset pool design, allowing users to gain exposure to assets like BONK and GMT.

All options on SDX are fully collateralized, eliminating bad debt and counterparty risks. And facilitates capital-efficient spread strategies by requiring only the maximum potential loss as collateral. The platform automatically adjusts bid-ask spreads to incentivize trades that maintain optimal liquidity pool composition.

10. Dual Finance:

Dual Finance, launched in 2023, distinguished itself in the crypto space by offering on-chain options as a novel tool for incentivizing and driving sustainable growth within DeFi projects. Currently, it is at ~$30 million TVL (incl. $19 million staking TVL)

Through Staking Options it enables projects to offer lockup rewards in the form of options, incentivizing long-term token holding and community engagement. Dual Finance allows projects to reward participation in their ecosystem (e.g., using their protocols or providing liquidity) by granting users options on their native tokens.

Dual Finance aims to generate self-reinforcing liquidity for partner projects, growing organically over time without external interventions. It simplifies the user experience by displaying normalized annual percentage yield (APY) while facilitating deposits based on fixed stablecoin premiums.

They also implemented Staking Options for the BONK token, resulting in significant user growth and community engagement for the project. Collaborated with Mango DAO to utilize Staking Options for writing puts, facilitating a year-long buyback program and treasury management strategies.

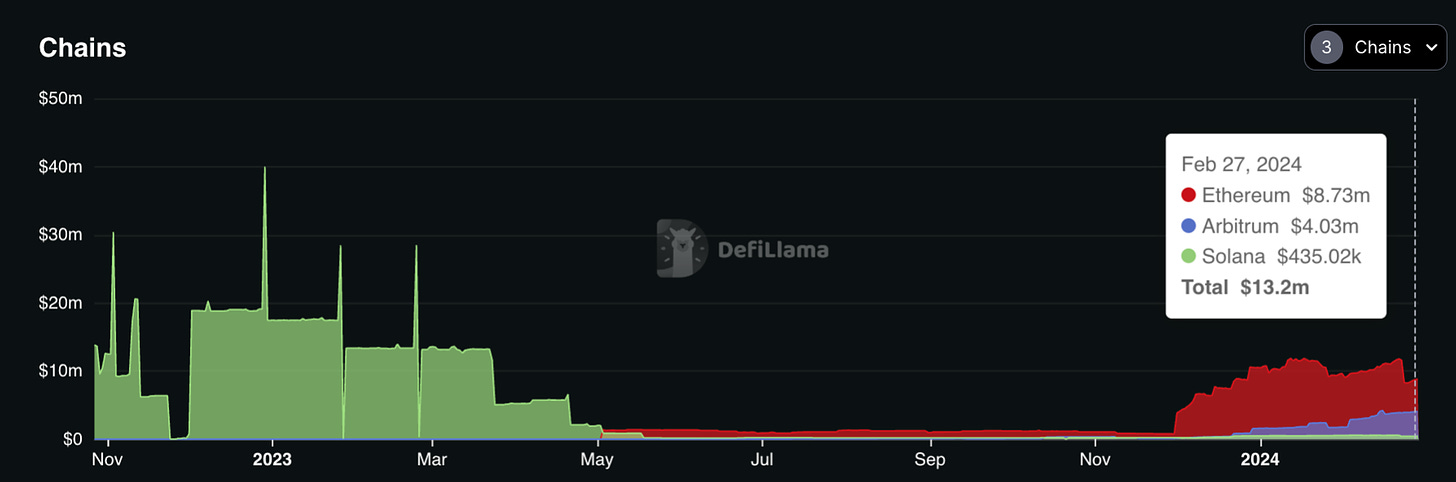

11. Cega:

Cega is a DeFi platform that offers structured products and exotic options on Solana. Through structured products, users can combine multiple options contracts to create a tailored risk-return profile. Cega has transacted more than $380 million to date. Users can earn high fixed yields ranging between 12% to 60% APY on their stablecoins, ETH, stETH, WBTC, and other assets.

It was one of the first to launch on-chain derivatives strategies that are commonly used in traditional finance, adding yield enhancement, principal protection, and diversification to investor portfolios. Backed by Dragonfly Capital and Pantera Capital and can be accessed on Ethereum Mainnet, Arbitrum, or Solana. Currently, it has a total value locked (TVL) of approximately $13 million.

Going beyond the traditional options, Cega offers structured products and exotic options on Solana. It offers structured products, which combine multiple options contracts to create tailored risk-return profiles for users.

12. Circuit Trade:

Circuit Trade are vaults that allow anyone to deposit in market-making strategies in perp DEXs (currently only Drift). It helps contribute passive liquidity and take advantage of high-yield MM strategies transparently. Supercharger Vault is a fully on-chain delta-neutral market-making strategy.

What's Next for Solana Derivatives?

Solana Derivatives would be the biggest leader of Solana DeFi 2.0 and beyond increasing volumes, here are some of the predictions:

1. Perps as Solana Appchains:

In the EVM world, most perp DEXs, particularly orderbook-based like Aevo, and Hyperliquid are shifting to their appchain. In the future, Solana perp DEXs can also build their chain, which can give the following benefits:

Free from any mainnet congestion

Better trading experience for users (trades can be gas-free for traders)

2. Continued traction on the back of points and token airdrop hype:

Most of the current perps volume on Solana is due to perp DEXs launching tokens and this will continue throughout 2024. Except for Mango and HXRO, every perp DEX will have a token airdrop as the incentive.

3. More Design Experimentations:

Derivatives are one of the few sectors, where the perp DEXs on Solana not just compete with each other, but directly compete with perp DEXs on other chains too. Hence, the Solana perp DEXs should continue optimizing their designs and experiment with more on-chain designs, which are only possible on Solana.

4. Perp Aggregator:

There has been the rise of perp aggregators like Rage Trade and MUX, we could see a similar trend coming up on Solana as well as all perp DEXs are on-chain. For instance, building an aggregator between Flash and Jupiter is low-hanging, as they both share the common Solana labs implementation with similar mechanics i.e. asset-backed Peer-to-pool model.

5. Pre-token launch Perps:

Ironically, Solana is the hottest chain with upcoming token launches, however all of these tokens before the token launch trade on other chain DEXs like Aevo or Hyperliquid. Solana Perp DEXs can also start having pre-listing markets, which can ride on the hype of token launches and serve as an effective marketing play!

Closing Thoughts: Derivatives at the Speed of Light

Solana’s original vision was to create a global state with the speed of NASDAQ. The derivatives are an important part of that vision, accounting for a majority of trading volumes. Solana is currently one of the only chains, where the orderbook-based perp DEXs are completely on-chain. We are seeing orderbook as a design being the dominant design and well understood by market makers.

The first step for Solana DEXs is to compete against the likes of hybrid DEXs i.e. dYdX, Hyperliquid, and Aevo, and then later compete against complete fully off-chain centralized exchanges like Binance and Bybit. The path is long, however, non-custodial fully on-chain DEXs are the way to go, which are Only Possible on Solana!

Stats Reference:

Jupiter | Drift | Parcl | Flashtrade 1 , Flashtrade 2 | Mango Markets

Flash Liquidity Pool (Flash Trade Blog)

Information related to the projects has been taken docs of the respective projects.

Disclaimer: This essay is meant for educational purposes only and has no intention to promote or advise to trade of digital currencies. Trading derivatives is extremely risky, NFA DYOR!