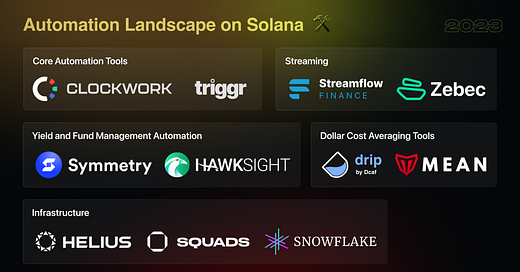

Automation Landscape on Solana • A Deep Dive

An overview of the current automation tools on Solana, highlighting key players, trends, and gaps in the ecosystem!

Automations are of the utmost importance, be it any industry, as it results in time as well as cost efficiency. In web2, Zapier has grown incredibly fast to become the go-to tool for software process automation, being valued last at $5 billion and over $140 million ARR! Not just that, we have other amazing tools like IFTTT, Alloy, Zapup, Whatifi, and so on, which are solving automation in unique ways.

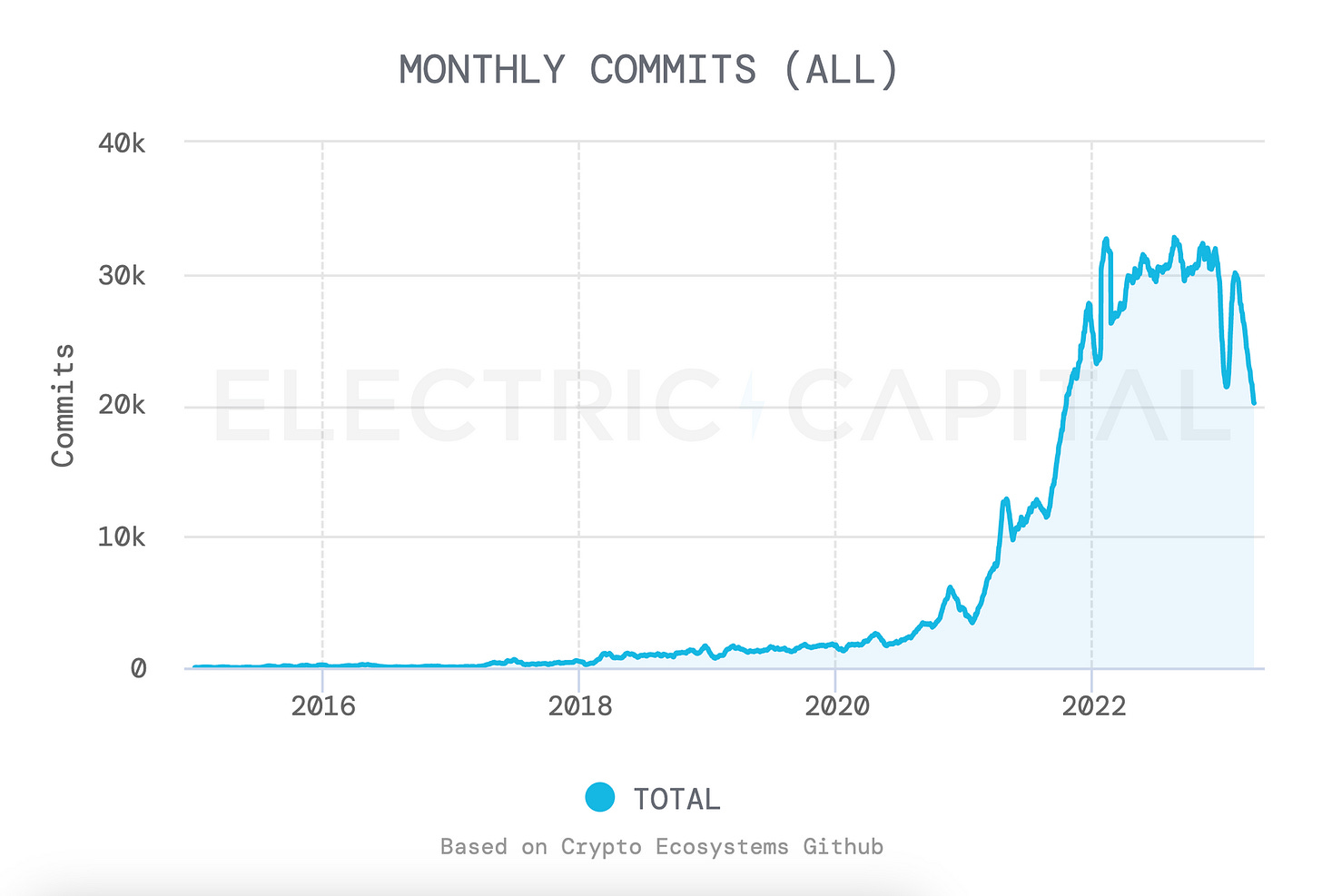

We are now seeing a similar explosion in Web3 as well. In this essay, we will put the spotlight on automation tools on Solana and, most importantly, what are interesting ideas to explore!

Web2 vs Web3 Automation

Web3 or on-chain automation refers to the use of smart contracts, which are self-executing programs to automate tasks on a blockchain network by automatically triggering actions based on predetermined conditions. Compared to traditional web2 automation tools, on-chain automation is decentralized and, unlike web2 automation tools, such as Zapier, it doesn't rely on centralized servers to perform actions across different web applications.

If you were using a web2 automation tool like Zapier, you would need to connect different web applications and use APIs to trigger the payment process. This process is centralized and reliant on the availability of servers. For example, let's say you want to automate a payment process between two parties on a blockchain network. With on-chain automation, you can create a smart contract that automatically releases the payment to the second party once certain conditions, such as the completion of a task or the receipt of goods, are met. It can be used to automate the execution of smart contract-based financial transactions, such as lending and borrowing protocols. This eliminates the need for intermediaries and allows for a more streamlined and secure payment process, and enables more complex and customizable automation processes, as smart contracts can be programmed with specific conditions and logic.

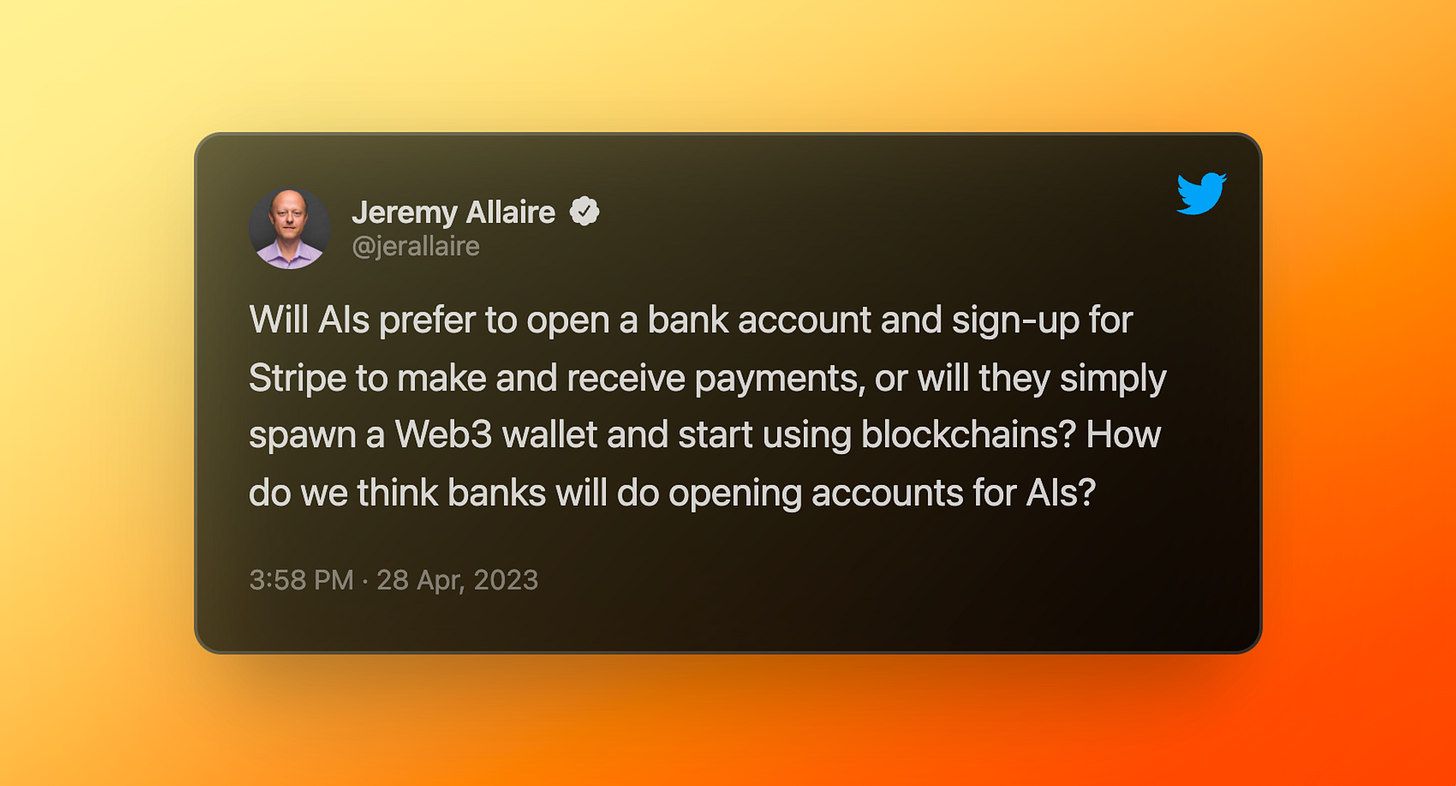

On-chain automation is cool, as it truly enables leveraging the most powerful concept of crypto - “Programmable Money.” Imagine AI agents in the future, not just talking to each other but also transacting with each other using internet-native money, i.e., Crypto. Why crypto here is simple here — it’s programmable, while traditional fiat money like paper cash or commercial bank deposits isn’t.

Before we have a look at what are the different automation tools on Solana, let’s understand why Solana at the first place!

Why Solana is best Suited for On-chain Automation

Solana is one of the highest-performant blockchains and offers the following advantages.

High speed and low fees: High Throughput (up to 64k TPS), Fast finality (1-2 seconds), and low transaction fees (<$0.0001) make it perfect for on-chain automation, where anyone running this automation doesn’t have to worry about high gas fees or even care about waiting for their on-chain tasks to be executed. This also enables high-frequency use cases like trading to be automated and executed completely on-chain.

Scalability: Solana's architecture is designed to be highly scalable, allowing for the creation of complex applications and automation platforms with ease. This is especially important in the context of on-chain automation, where large volumes of transactions need to be processed in a short amount of time.

Smart contract capabilities: Solana supports smart contract development through the programming language Rust and its Web3.js library. Using highly performant languages like Rust, developers can easily design sophisticated automation logic.

Strong developer and community support: Solana has a strong and active community of developers, investors, and users who are committed to building and improving the network. This support provides a solid foundation for the development of on-chain automation tools and platforms.

Let’s now look at different projects working on on-chain automation for Solana:

The projects working on on-chain automation on Solana

While the automation landscape on Solana is still nascent, it’s growing insanely and is led by projects like Clockwork, Triggr, Helius, and many more. For a better understanding, let’s divide the automation tools into a few major categories:

Core Automation Tools

These are straightaway “Zapier for Solana”, which help anyone automate on-chain workflows:

Clockwork is an automation suite designed for Solana developers to solve the issue of decentralization in blockchain automation. It enables developers to create and operate decentralized lambdas, which are programs that can run independently without dedicated servers or human supervision.

The decentralized lambdas in Clockwork are powered by a network of Solana validators and RPC nodes, ensuring high performance and decentralization. With Clockwork, developers can schedule recurring tasks and automate on-chain workflows while preserving decentralization.

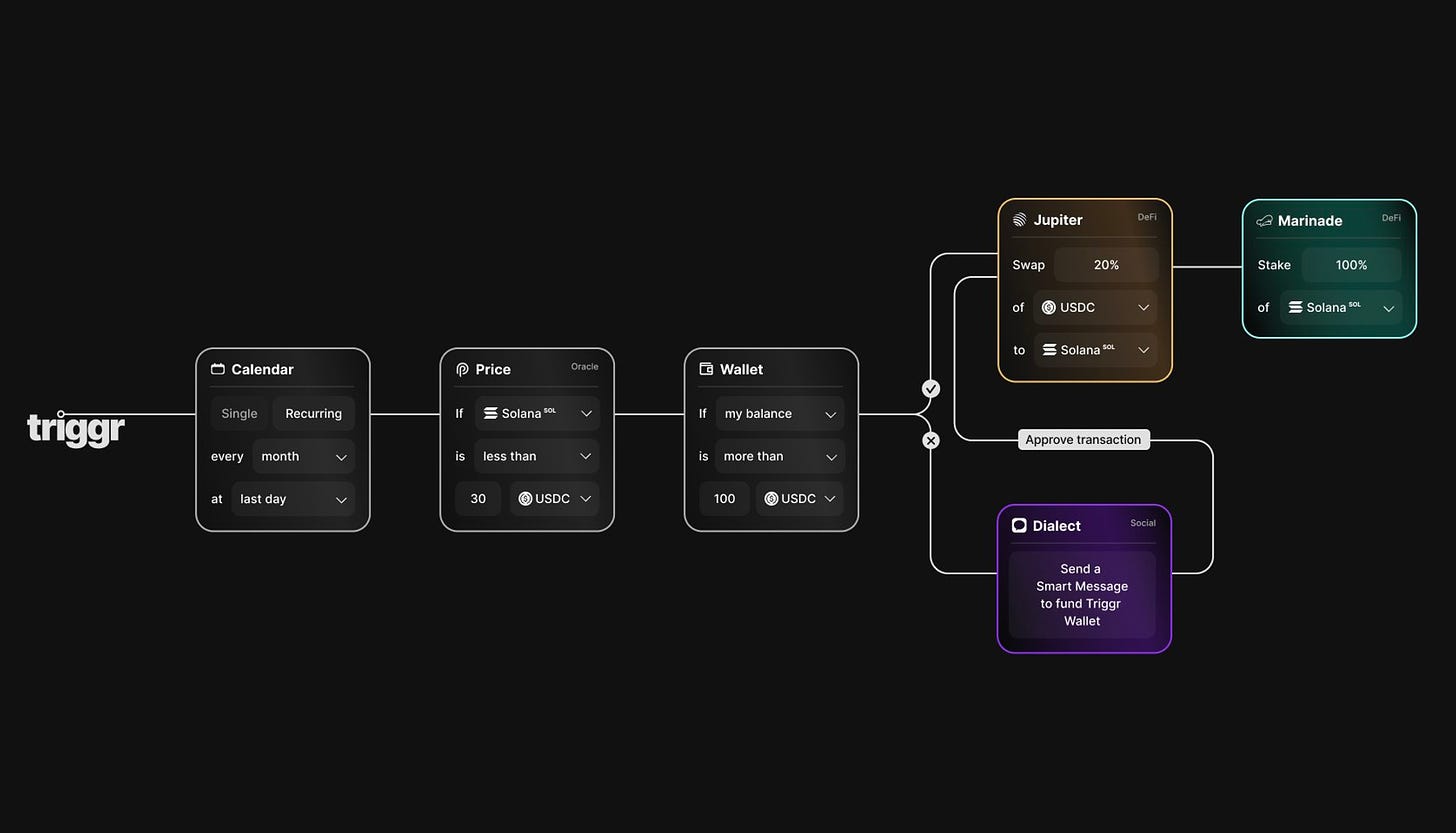

Using Clockwork, developers can create autonomous decentralized applications that can be trusted to execute without human interference or central control. Therefore, Clockwork is the most comprehensive automation suite for Solana developers to build decentralized applications. Clockwork's incentivizing infrastructure ensures that the network of workers is incentivized to provide reliable and efficient automation services. This ensures that the automation provided by Clockwork is not only decentralized but also reliable and scalable. For instance, one of the biggest projects on Solana, Helium, uses clockwork to automate network epoch transitions & token issuance.Triggr is a no-code automation platform that utilizes the power of Solana to connect decentralized applications, automate daily workflows, and simplify the process of executing tasks asynchronously. Its three pillars, composability, simplicity, and asynchronicity, empower users to automate tasks such as DCA strategies, limit orders, NFT collection, and recurring actions for DAOs.

Solana's low fees, high composability, and fast speed make it the perfect fit for Triggr's ambition. With some of its recent Ws, including first prize at LamportDAO's Sandstorm hackathon automation track, second place at the Berlin Build Station Demo Day, and fifth prize in the Grizzlython Web3 consumer track, Trigger has become a promising tool. It aims to revolutionize the future of automation by scaling up, adding more protocols, creating more workflows, and turning the Solana ecosystem into an accessible, automated world.

Streaming:

These enable real-time automatic streaming of payments -

Streamflow is a token distribution platform that provides teams with the necessary tools to manage their treasury and distribute value (Streaming payments and on-chain salaries) with ease.

With Streamflow's suite of payment tools, employers and project developers can set up automated payroll systems, real-time issue payments, and create customizable vesting contracts, all in a trust-minimized, decentralized environment.

One of the key features of Streamflow is its Streams functionality, which provides a highly customizable solution for both vesting contracts and payroll streams. This enables organizations to create affordable and automated payroll systems, reducing payroll expenses and increasing employee satisfaction.

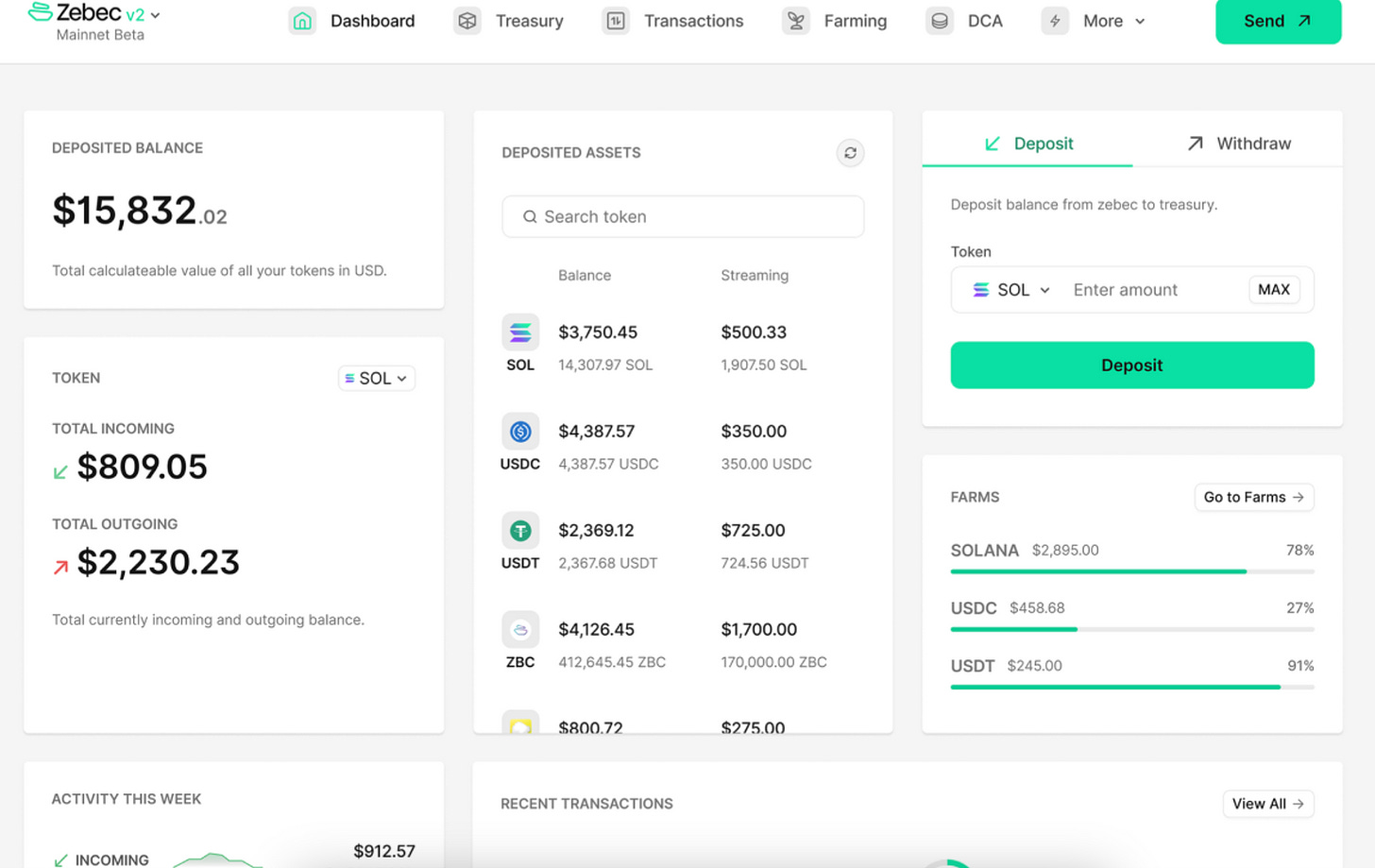

Streamflow's automation tools also allow for real-time payments to distributed teams, which can be processed in batches to save time and increase efficiency. And with the ability to set up payment streams for services billed per time unit, such as consulting or content creation, organizations can ensure that they are only paying for the time spent consuming the content.Another player working in the space of DeFi payment streams is Zebec. Zebec Protocol is a platform that offers real-time payroll, treasury, token management, and Web3 banking solutions, which are multi-chain compatible. By building on top of Stream, Zebec enables users to seamlessly manage payments, vesting, and more.

Zebec Pay enables users to leverage the power of payments on a per-second basis, allowing for frictionless and continuous streams of payments. Its automatic money streams offer a new way of getting paid and investing in products and services. With its focus on continuous payments and its multi-chain compatibility, Zebec is a promising player in the world of DeFi payment streams and automation.

Infrastructure for Automation:

These enable automation at the infrastructure level via their webhooks and so on.

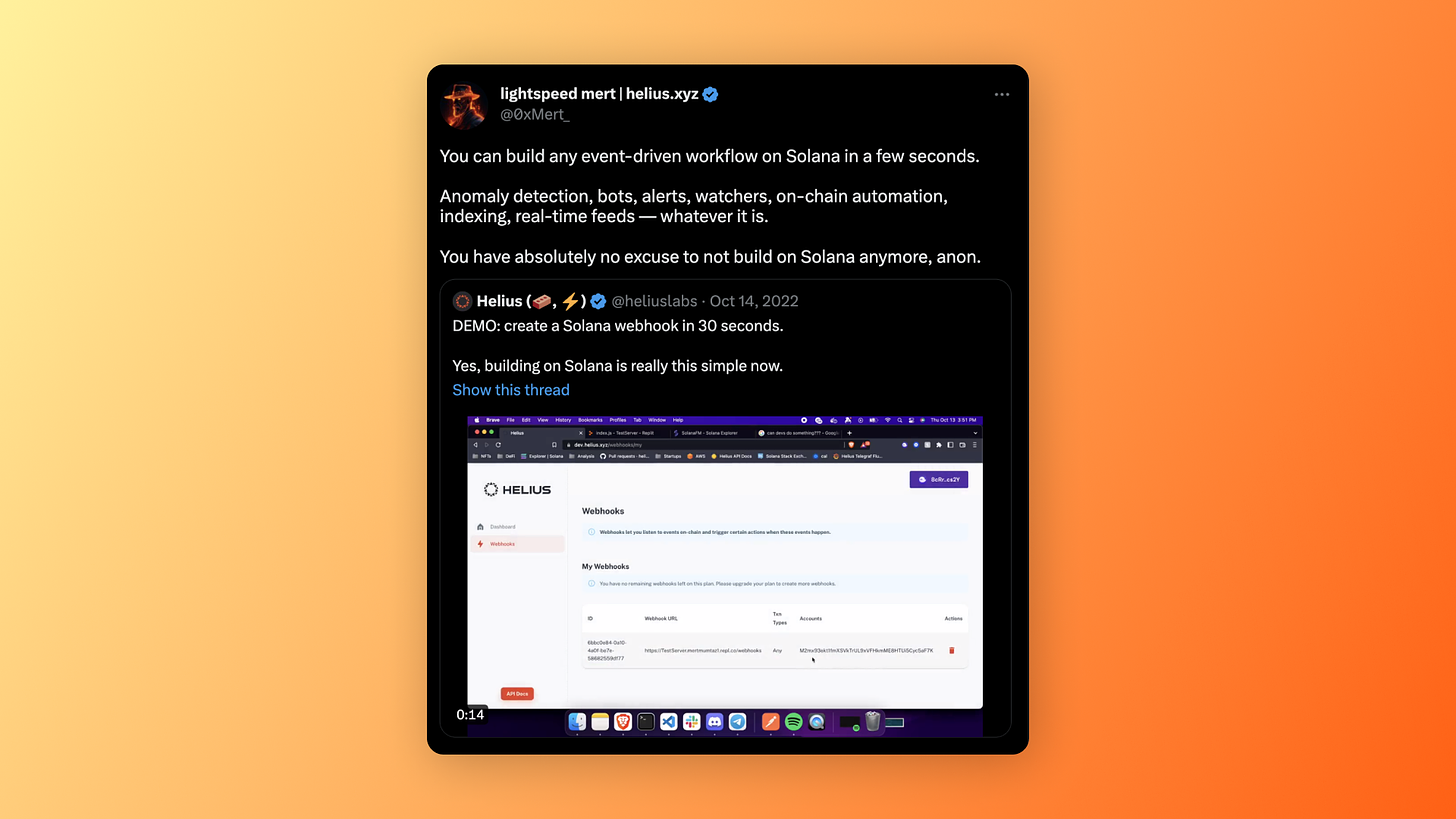

Helius aims to simplify the process of developing on Solana by providing a suite of intuitive tools, including enhanced APIs, webhooks, RPC nodes, and cutting-edge data infrastructure like Geyser and Datalakes.

With Helius, developers can quickly and easily build any event-driven workflow on Solana, such as anomaly detection systems, bots, alerts, watchers, on-chain automation, indexing, and real-time feeds. The goal of Helius is to create a seamless and enjoyable experience for developers who want to build on Solana, without having to deal with the complexities of blockchain technology.

In the last Sandstrom Hackathon, there was also a Helius Automation Track where a bunch of projects showcased some amazing automation projects they had built using Helius Webhooks. Check out this thread to know more.

Squads Protocol is an open-source, secure, and robust smart contract wallet standard for Solana Virtual Machine (SVM) that simplifies the management of developer and treasury assets for teams building on Solana. It provides an innovative solution for the next generation of SVM builders and operators, where intuitive UX, slick design, security, and self-custody meet the speed and performance of the blockchain built for mass adoption.

One of the notable features of Squads Protocol is its Transaction Builder, which allows developers to prepare and execute internal instructions as a MsTransaction (multi-sig transaction) via Cross-Program Invocation (CPI). This is particularly useful for automation purposes as it simplifies the process of executing transactions involving multiple instructions, such as adding or removing members from a multisig account, changing the threshold, or executing a transaction.

The Transaction Builder works by creating a MsTransaction and adding the appropriate MsInstructions, such as addMember, changeThreshold, or removeMember, to it. The resulting MsTransaction can then be executed via CPI, which allows for the seamless execution of cross-program transactions. Additionally, Squads Protocol provides a simple instruction, checkGetTopUpInstruction, that developers can attach or execute whenever needed to reallocate space and fund the multisig account when adding new members.

This makes Squads Protocol's Transaction Builder a powerful and flexible tool for developers building on Solana, allowing for the automation of complex transactions involving multiple instructions.

Snowflake aims to make web3 more decentralized by removing the burden of maintaining off-chain services from project teams and giving them more time to build what really matters to their end-users.

Snowflake is built for two types of users: developers and end-users of web3. For developers, Snowflake provides a dedicated and purpose-built automation platform that allows them to trigger, schedule, and execute simple to complex automation and jobs. The platform features a built-in cron time scheduler, price oracle trigger, and custom condition trigger, and allows developers to compose pre-built and custom actions to set up sophisticated automations in minutes without writing a single line of code. Snowflake also offers a best-in-class UI that makes it super easy to configure, authorize, and monitor job executions. On top of that, it consists of a decentralized network of independent operators that work together to ensure every job gets executed at the exact scheduled time or as soon as the defined trigger conditions are met.

For end-users of web3, Snowflake is designed to be simple and effortless to use. Using Snowflake, web3 users will be able to compose all kinds of automation like recurring payments, limit orders, dollar cost average investments, impermanent loss protection, liquidation protection, and more.

Snowflake is composed of four components:

the Snowflake smart contract, which stores all automation configurations and orchestrates execution requests;

the Snowflake UI, which allows developers and users to compose, authorize, and monitor conditions and executions;

the Snowflake node operator, which is a network of bots that work together to ensure jobs get executed at the right time or when the right conditions are met;

the Snowflake SDK, which will allow app developers to easily interact with Snowflake contracts in a programmatic fashion in the future.

Dollar Cost Averaging Tools:

Dollar-cost averaging refers to the practice of regularly purchasing a particular asset in small amounts to obtain an average price over time. For years, centralized exchanges such as Coinbase or Binance have offered the convenience of investing in cryptocurrency. However, these applications are custodial entities that are centralized, meaning that users have no control over their funds. As a result, users have been vulnerable to various security breaches that can result in funds being frozen or lost entirely, as seen in the MtGox, Coinbase, and many more hacks.

Here are the tools that enable you to do DCA in a more decentralized and permissionless way.

Dcaf:

Drip by Dcaf Labs is a protocol that enables dollar cost averaging through an on-chain, permission-less mechanism. Drip's unique feature is its incentivized drip mechanism, which rewards users with a small fee for successfully triggering a swap for a token pair at a specified frequency.

This incentivization encourages users to participate in the protocol and potentially earn additional income. Dcaf Labs provides a bot to perform these swaps for users, but community members are also encouraged to create their own bots and take advantage of the fee structure.

The decentralized nature of Drip's DCA experience sets it apart from other DeFi products, providing a reliable and trustless mechanism for users to regularly invest in their chosen asset.

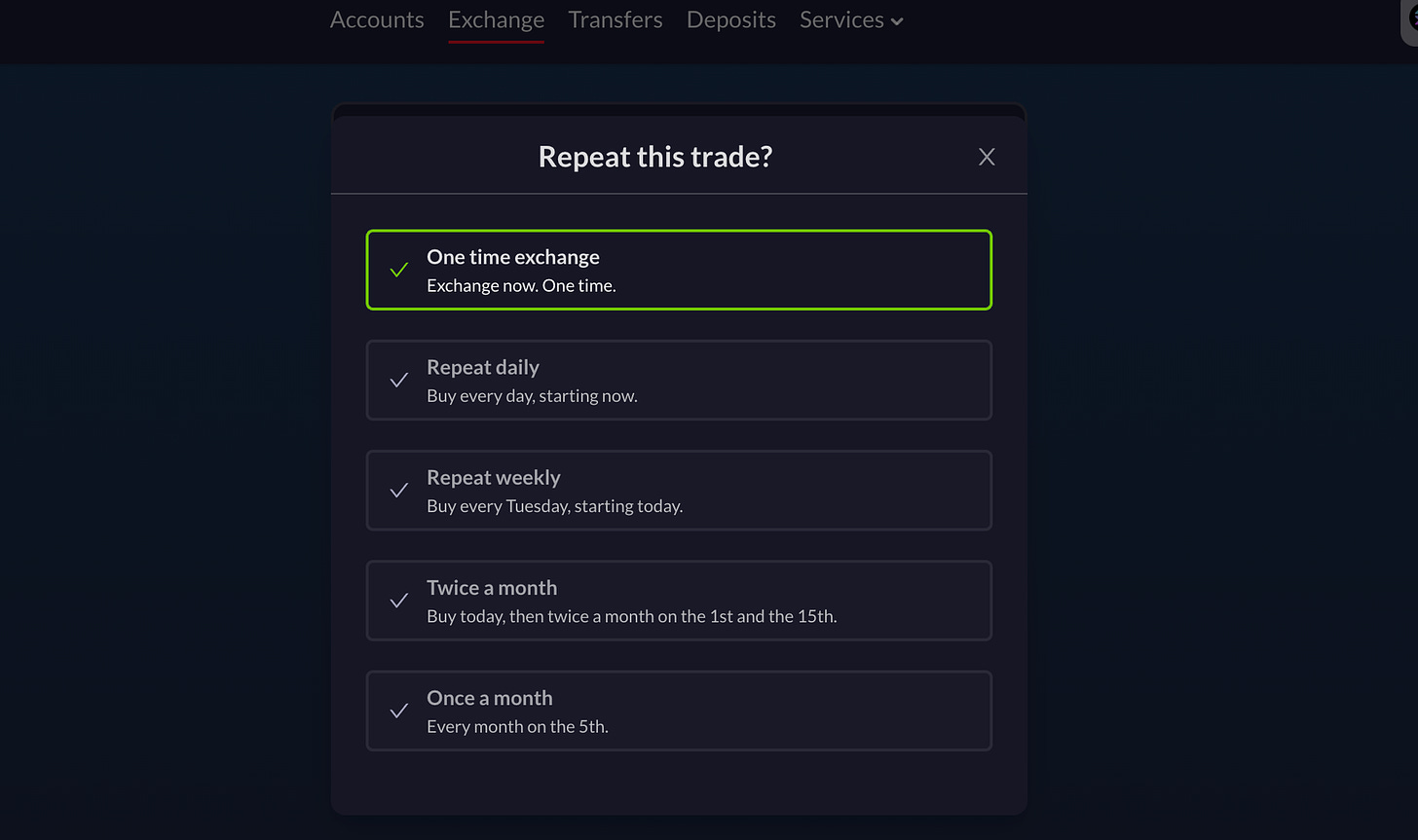

Meanfi (DCA)

MeanFi also does DCA in a decentralized, trustless, and permissionless manner. This means that you always have control over your funds, and you can leverage the Mean Protocol's DDCA contract to schedule recurring swaps for buying, selling, or exchanging crypto to stables and vice versa.

Yield and Fund Management Automation:

Symmetry primarily enables the Automation of Fund Management. It’s an all-in-one infrastructure designed to simplify the process of creating, automating, managing, and tracking on-chain funds. Symmetry provides a unique way of creating on-chain funds using single tokens that represent ready-made portfolio strategies and index funds. These tokens can passively earn and rebalance to earn fees for index holders. Symmetry is deeply integrated with all major protocols in the DeFi ecosystem, offering an all-in-one functionality when it comes to all things DeFi.

Hawksight is a DeFi super-app that aims to simplify the process of earning yield from popular DeFi protocols on Solana. With just one click, users can maximize their gains through 40+ self-custodial and yield-optimized strategies across four protocols - Solend, Francium, Port Finance, and Marinade.

One of the key features of Hawksight is its automated yield strategies, which allow users to earn the best APY yield opportunities to grow their SOL and USDC without the need for swapping, staking, pairing, bridging, or pooling. This means less time and gas fees spent on executing complex DeFi strategies, as Hawksight automates the processes needed to execute them.

There are a few other automation tools that may or may not be active on Solana but were good attempts. Do check out them: Airdrop automation from Skeleton Crew, Autonomy Network, Minting Labs, Execute.dev, Space operator, and Mintoor Bot.

Gaps in Automation:

Let’s look at some of the gaps and opportunities that lie ahead in the pursuit of making the Solana ecosystem’s automation tooling more comprehensive:

DeFi: While there are many automation tools for DCA, yield optimizing, and so on, there is still room for tooling like:

No-code Keeper Bot Maker: While protocols like Jupiter and Drift use Keeper bots, having no-code tools, which enables anyone to deploy keeper bots to place orders on certain triggers, can be helpful. Further, Market-Making bot building tools can not only enable retail traders to arbitrage but also deepen liquidity in Solana DeFi.

Anomaly Detection: Just like TradFi, AI bots can be employed, which can detect patterns in real-time and flag those issues!

Cross-chain Applications: We still lack cross-chain applications which can automate cross-chain actions with a scheduler app, i.e., automated contracts with triggers involving multiple chains. For instance, a trigger condition can be to buy 10 SOLs at market price on Openbook (Solana’s Order book DEX); if the price of ETH falls below $1500, with USDC stored in the escrow contract on ETH with an expiry date of 21st May 2023.

More automation solutions, like Gelato Network on Solana, also enable relaying of gasless transactions.

Applications of Automation:

Let’s now look at what problems such automation tools like Clockwork can solve and what are the different applications:

Payments: Despite the lack of truly programmable money, we already have a plethora of automation on payments; web3 can take it a step further. Some of them are:

Scheduled Payouts – Schedule token transfers and automate payouts or subscription payments via projects like Streamflow.

Dollar-cost averaging – Run an automated dollar-cost averaging program on-chain to ease into an investment position without hassle or stress.

Pre-funding wallets automatically for new wallets.

Rebasing of Algorithmic Stablecoins

DeFi: Automation can give traders as well as investors a massive edge in the market. Some of the applications can be:

Preventing user liquidations – Enable Automatic repayment of debt on a lending market like Solend or Jet when collateral prices approach liquidation levels.

Trading bots – ****Execute trades on order books like Openbook or Phoenix based on price feeds and technical indicators.

LP rebalancing – Automatically rebalance liquidity on AMMs like Orca whenever the market price moves out of a specified range.

Keeper bots for executing Limit Orders on AMMs and Order books.

Automated yield harvesting, which claims yield generated from a pool and re-deposits them back into the pool.

Gaming: To enable a superior UX, just like DeFi, automation can also be applied to gaming to make gamers’ experience hassle-free. For instance, gamers can set up automated schedules for idle game worlds, such as automatically regrowing trees, building construction times, and dinner visitors.

AI x Crypto: One of the most interesting trends to watch in the next 2-3 years will be the convergence of AI and Web3, and automation will be one of the most outcomes of that:

AI-Augmented Workflow Tools: AI tools can significantly enhance projects by building on Solana’s workflows, streamlining processes, and boosting efficiency. An example can be an AI agent using AutoGPT to automatically create and execute complex perpetual trade strategies and balance margins whenever it detects any patterns in the market.

NFT Automation: AI can be used to automatically generate not just art but also corresponding texts and metadata related to each NFT of a collection. Running the entire process, which requires artists, developers, and marketers, which requires several months - all by AI would be the end game!

AI supercharged Super wallets: Wallets are a critical piece of user flows, and enabling users to automate their wallet interactions all from their wallet can be a game-changer.

Supply Chain: On-chain automation can also be used to automate the execution of supply chain management processes, such as tracking and tracing the movement of goods, ensuring product quality and safety, and preventing counterfeiting. This improves the transparency and efficiency of the supply chain and reduces the risk of fraud.

Closing Thoughts:

Crypto presents us with a unique concept of “Programmable” or “Internet-native” money, and automation tools can help individuals, as well as businesses, truly leverage that to the fullest. Unlike EVM, Solana enables automation which is fast as well as cheap, removing any constraints for developers and giving a web2-like playground. We are still at the tip of the iceberg, and will be exciting to see the next set of automation tools, which are uniquely “Only possible on Solana!”

Cheers for staying with us!

Found it insightful? Share it with your friends! If you have any suggestions or want us to deep dive into your project, we would love to connect — Sitesh Sahoo and Yash Agarwal

References:

All info and related images are taken from the respective projects and hyperlinked at those places. If we missed any - do let us know :)